Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

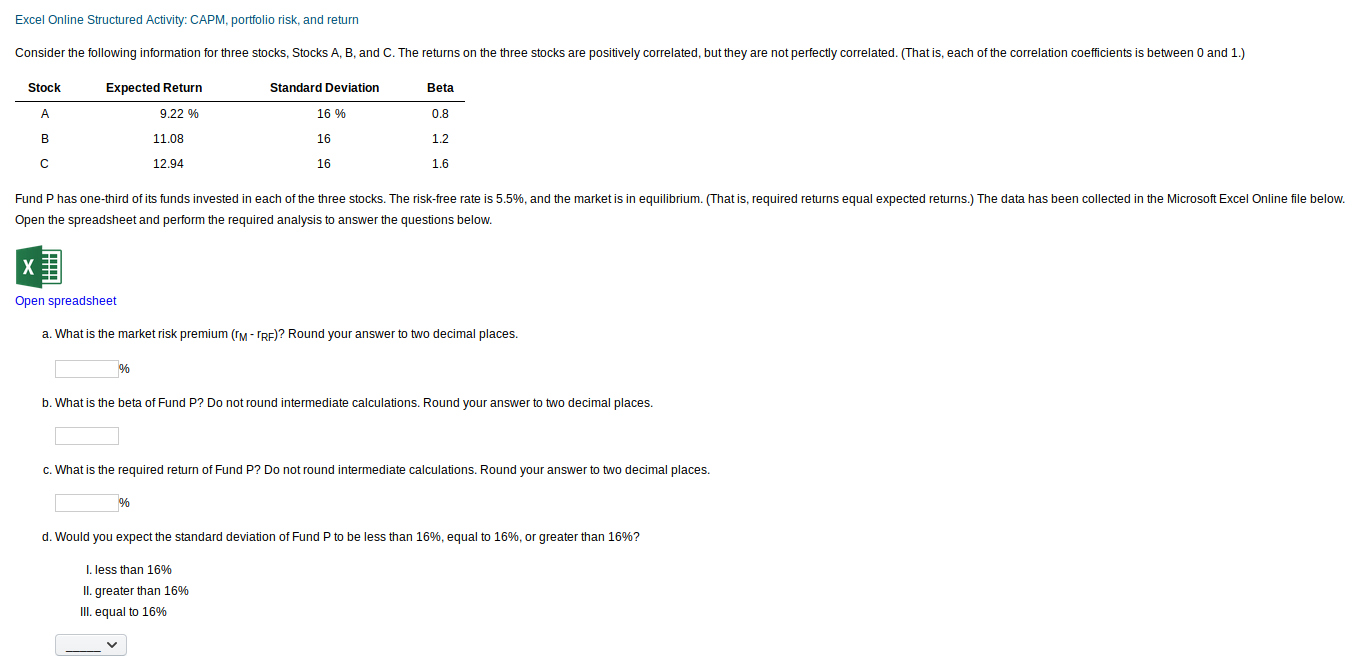

Transcribed Image Text:Excel Online Structured Activity: CAPM, portfolio risk, and return

Consider the following information for three stocks, Stocks A, B, and C. The returns on the three stocks are positively correlated, but they are not perfectly correlated. (That is, each of the correlation coefficients is between 0 and 1.)

Stock

Expected Return

Standard Deviation

Beta

9.22 %

A

16 %

0.8

11.08

16

1.2

C

12.94

16

1.6

Fund P has one-third of its funds invested in each of the three stocks. The risk-free rate is 5.5%, and the market is in equilibrium. (That is, required returns equal expected returns.) The data has been collected in the Microsoft Excel Online file below.

Open the spreadsheet and perform the required analysis to answer the questions below.

Open spreadsheet

a. What is the market risk premium (rM-rRE)? Round your answer to two decimal places

b. What is the beta of Fund P? Do not round intermediate calculations. Round your answer to two decimal places

c. What is the required return of Fund P? Do not round intermediate calculations. Round your answer to two decimal places

d. Would you expect the standard deviation of Fund P to be less than 16%, equal to 16%, or greater than 16%?

. less than 16%

lI. greater than 16%

III. equal to 16%

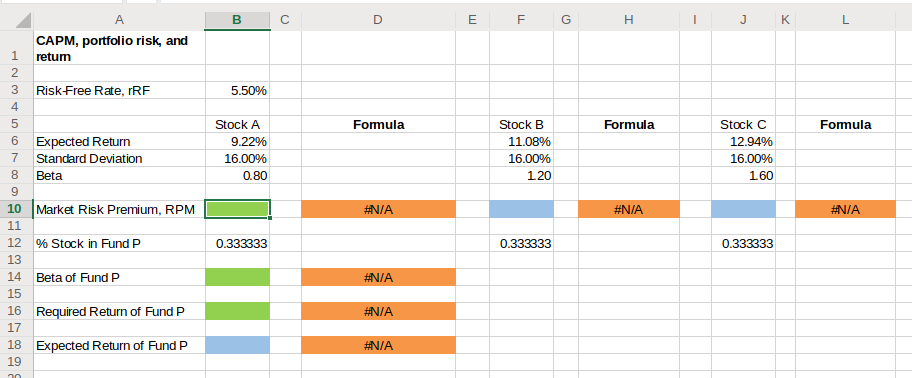

Transcribed Image Text:A

F

G

н

К

L

CAPM, portfolio risk, and

1

retum

Risk-Free Rate, rRF

5.50%

Stock A

Formula

Stock B

Formula

Stock C

Formula

Expected Return

9.22%

11.08%

12.94%

Standard Deviation

16.00%

16.00%

16,00%

Beta

0.80

120

160

Market Risk Premium, RPM

#N/A

#N/A

#N/A

11

12

0.333333

% Stock in Fund P

0.333333

0.333333

Beta of Fund P

#N /A

16 Required Return of FundP

#N/A.

17

18

Expected Return of Fund P

#N/A

19

20.

ш

B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- 2. Consider the following expected returns, volatilities, and correlations: Expected Standard Stock Return Deviation Correlation with Vital Correlation with Mital Correlation with Pital Vital 14% 6% 1.0 -1.0 0.0 Mital 44% 24% -1.0 1.0 0.7 Pital 23% 14% 0.0 0.7 1.0 a. Imagine a portfolio comprising solely of Vital and Mital. What portion of should be allocated to Vital stock to ensure a risk-free investment? your investment b. What is the portfolio's volatility when holding a $10,000 long position in Pital and a $2000 short position in Mital? wwwww c. In a market, there are two securities, Artis and Brotis. Currently, the price of Artis stands at £50. Looking ahead, the price of Artis next year will be £40 during a recession, £55 in normal economic times, and £60 in an expanding economy. The probabilities associated with recession, normal times, and expansion are 0.1, 0.8, and 0.1, respectively. Artis does not pay dividends and has a correlation of 0.8 with the market. On the other…arrow_forwardConsidering the attached set of securities and portfolio returns: Find the combination of the weights that minimizes CV of the portfolio. How does the CV of the optimal portfolio compare with the CVs of its constituents?arrow_forwardSuppose securities A, B, and C have the following expected return and risk. Stock Expected return Risk A 8% 6% B 7% 9% C 13% 9% What is the coefficient of variation for stock A?arrow_forward

- A stock has a correlation with the market of 0.4. If the Sharpe ratio of the market portfolio is 0.7, what is the Sharpe ratio of the stock? (Hint: algebraically manipulate the SML equation.) 0.28 0.75C. 0.60D. 0.55arrow_forwardConsider the following information for stocks A, B, and C. The returns on the three stocks are positively correlated, but they are not perfectly correlated. (That is, each of the correlation coefficients is between 0 and 1.) Stock Expected Return Standard Deviation Beta A B с 9.30% 10.35 12.10 14% 14 14 0.8 1.1 1.6 Fund P has one-third of its funds invested in each of the three stocks. The risk-free rate is 6.5%, and the market is in equilibrium. (That is, required returns equal expected returns.) a. What is the market risk premium (гM-TRF)? Round your answer to one decimal place. % b. What is the beta of Fund P? Do not round intermediate calculations. Round your answer to two decimal places. c. What is the required return of Fund P? Do not round intermediate calculations. Round your answer to two decimal places. % d. What would you expect the standard deviation of Fund P to be? I. Less than 14% II. Greater than 14% III. Equal to 14% -Select-arrow_forwardPlease answer all parts with explanations thxarrow_forward

- Utilizing the information below on 2 recently purchased stocks, compute the risk of the portfolio for the different levels of correlation between the 2 securities: Stock A B Expected Return 0.14 0.17 Std Dev of returns 0.11 0.11 Proportion invested 0.35 0.65 Correlation coefficient 1 0.4 0.1 0 -0.4 -1arrow_forwardStocks A and B have the following returns: (Click on the following icon in order to copy its contents into a spreadsheet.) 123 45 Stock A 0.09 0.07 0.13 -0.01 0.09 Stock B 0.05 0.01 0.06 0.02 -0.04 a. What are the expected returns of the two stocks? b. What are the standard deviations of the returns of the two stocks? c. If their correlation is 0.42, what is the expected return and standard deviation of a portfolio of 60% stock A and 40% stock B?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education