MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

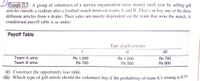

Transcribed Image Text:Example 21.3 A group of volunteers of a service organisation raise money each year by selling gift

articles outside a stadium after a football match between teams A and B. They can buy any of the three

different articles from a dealer. Their sales are mostly dependent on the team that wins the match. A

conditional payoff table is as under:

Payoff Table

Type of gift articles

II

III

Team A wins

Rs 1,500

Rs 1,000

Rs 700

Team B wins

Rs 700

Rs 500

Rs 900

(i) Construct the opportunity loss table.

(ii) Which type of gift article should the volunteers buy if the probability of team A's wining is 0.7?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- Chapter 8 Loans 75 Name • Yeser Ramirez-Mesia 7th block dent Loans Section 8.3 High-Interest Loans Patsy needs a $1,200 loan. She is considering either a title loan on her car or a pawnshop loan on her diamond bracelet. A. A local finance company offers a $1,200 loan on her car, which is worth $4,750. The fee is 23.0% of the loan amount for a 30-day term. How much will Patsy have to pay after 30 days? B. A pawnshop offers a $1,200 loan on her bracelet, which is worth $5,900. The term is 30 days, and the interest charge is 1.65% plus a 24% fee for storage and handling. How much will Patsy have to pay after 30 days? C. Why might Patsy prefer the title loan over the pawnshop loan? D. Why might Patsy prefer the pawnshop over the title loan?arrow_forward3. Investments Nui invests $10,000, received from her grandmother, in three ways. With one part, she buys mutual funds that offer a return of 6.5% per year. She uses the second part, which amounts to twice the first, to buy government bonds at 6% per year. She puts the rest in the bank at 5% annual interest. The first year her investments bring a return of $605. How much did she invest in each way?arrow_forwardA decislon maker's course of action results in a consequence or payoff. True or False True Falsearrow_forward

- Questions a. - c. refer to the following data. You estimate a 3-factor return-generating process for 5 large portfolios with the following results. a. Which two portfolios are functional equivalents according to the Arbitrage Pricing Theory? b. What is the expected return on portfolio B? c. Suppose that the market is currently pricing portfolio E so that its expected return is 8% and pricing portfolio B so that its expected return is 10%. Describe the forces that will bring about equilibrium according to the APT.arrow_forwardBoran Stockbrokers, Inc., selects four stocks for the purpose of developing its own index of stock market behavior. Prices per share for a year 1 base period, January year 3, and March year 3 follow. Base-year quantities are set on the basis of historical volumes for the four stocks. Stock A B C D Jan Mar Stock = = A - B с D Industry Oil Computer Steel Real Estate January Year 1 Quantity 100 150 75 50 Price per Share ($) March Year 1 Base 31.50 65.00 40.00 16.00 Compute the price relatives for the four stocks making up the Boran index. (Round your answers to one decimal place.) Price Relative January Year 3 22.75 49.00 32.00 6.50 March Year 3 22.50 47.50 29.50 Use the weighted average of price relatives to compute the January year 3 and March year 3 Boran indexes. (Round your answers to one decimal place.) I, 2.75arrow_forward10. Suppose a will decreed that three siblings will each receive a cash inheritance according to the following: The eldest receives 3 times as much as the youngest, and twice as much as the middle sibling. Answer the following. a. If the youngest sibling receives x dollars, how much do the other two receive? b. If the middle sibling receives y dollars, how much do the other two receive? c. If the oldest sibling receives z dollars, how much do the other two receive?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman