Calculus: Early Transcendentals

8th Edition

ISBN: 9781285741550

Author: James Stewart

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

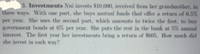

Transcribed Image Text:3. Investments Nui invests $10,000, received from her grandmother, in

three ways. With one part, she buys mutual funds that offer a return of 6.5%

per year. She uses the second part, which amounts to twice the first, to buy

government bonds at 6% per year. She puts the rest in the bank at 5% annual

interest. The first year her investments bring a return of $605. How much did

she invest in each way?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, calculus and related others by exploring similar questions and additional content below.Similar questions

- The price of a home is $220,000, financed at 7% with a 30 year fixed rate. 20% down and 3 points required by the bank at closing. What is the monthly payment? How much must be paid for the 3 points at closing?arrow_forwardA bond with face value $10,000 simple interest 6.45% and a term for 12 years is originally bought by Linda. After 33 months, she sells it to Carly for $11,400. Carly then holds on to it for 7 years, eventually selling it to Mike for $14,950. Mike keeps the bond until matures and cashes it in. What is Linda's profit?arrow_forward1 102 F Partly sunny Devon invested $7500 in three different mutual funds. A fund containing large cap stocks made a 5.4% return in 1 yr. A real estate fund lost 13.2% in 1 yr, and a bond fund made 4.2% in 1 yr. The amount invested in the large cap stock fund was three times the amount invested in the real estate fund. If Devon had a net return of $108 across all investments, how much did he invest in each fund? Devon invested S in the large cap fund, S Check 14 f5 16 4- in the real estate fund, and S Q Search f7 ♫+ fa 00 s b fg 144 liji in the bond fund. f10 DII fi Save For Later Submit Assig © 2023 McGraw Hill LLC. All Rights Reserved. Terms of Use | Privacy Center | A DDI X 112 5 deletearrow_forward

- Mark's mother is planning to borrow $25,000 to remodel the restaurant she owns. She contacted several loan companies, and she is comparing two different options. • Company 1 offers an interest rate of 5.25%. • Company 2 offers an interest rate of 8.5%. Both loan options involve simple interest and must be repaid in exactly 3 years. How much more will Mark's mother pay in interest if she chooses to borrow the money from Company 2? A $812.50 B В $3,937.50 C $2,437.50 D $6,375.00 in a sayings account that earns 3% simple interest annually. If he does not make anyarrow_forwardPart A: Cami has an unpaid balance of $1,321 on her credit card. What is the finance charge for a month if her interest rate is 1.3% per month?Part B: If her interest rate was raised to 2.8%per month, what is her new finance charge for a month with the same unpaid balance?Part C: What is the difference in the finance charge that she will pay in a month with a 2.8% interest rate compared to a 1.3% interest rate?arrow_forwardYou are considering making a movie. The movie is expected to cost $10.7 million upfront and take a year to make. After that, it is expected to make $4.4 million in the first year it is released (end of year 2) and $1.7 million for the following 4 years (end of years 3 through 6). What is the payback period of this investment? If you require a payback period of 2 years, will you make the movie? Does the movie have positive NPV if the cost of capital is 10.3%? C... The payback period is 5.70588 years. (Round up to the nearest integer.) Based on the payback period requirement, would you make this movie? No If the cost of capital is 10.3%, the NPV is $ million. (Round to three decimal places.) (Select from the drop-down menu.) ▸arrow_forward

- You bought a bond with 8% coupon rate, 10 year maturity, and $1000 par value for $1,039 one year ago. Today the bond has a price of $901. If you sell the bond today, what is your return on the investment?arrow_forwardJoel takes out a loan from his local bank at a rate of 5%. He invests 75% of that loan into common shares of ABC co (making his the owner of all of that company's shares). The other 25% he uses to make an interest free loan to ABC co. How much of the interest on the loan will be deductible? 100% 25% 75% 0%arrow_forwardSydney is saving for a down payment on a new home. Each month she deposits $150 into an accountyielding 4.5% APR. If she does this for 10 years, how much will she have saved for the down payment?arrow_forward

- Suppose a mutual fund has a portfolio of stocks that have a market value of $10.75 billion and the company has 900 million shares of stock. What is the net asset value (in dollars) of a share of the mutual fund?arrow_forwardMutual Fund X owns 0.5% of the total stock of Company Y. In one particular year, Company Y announces annual profits of $12,000,000, and decides to pay dividends to its shareholders at a rate of 15% of its annual profits. How much will Mutual Fund X receive in the form of dividends from Company Y? Give your answer in dollars.arrow_forward6 Janis wishes to invert 7500 into two accounts One account earns 41. annually while the other earns 8% annually. How much should be invested. into each account to each $400 in Foral interest after lone year? Assume simple interest.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Calculus: Early TranscendentalsCalculusISBN:9781285741550Author:James StewartPublisher:Cengage Learning

Calculus: Early TranscendentalsCalculusISBN:9781285741550Author:James StewartPublisher:Cengage Learning Thomas' Calculus (14th Edition)CalculusISBN:9780134438986Author:Joel R. Hass, Christopher E. Heil, Maurice D. WeirPublisher:PEARSON

Thomas' Calculus (14th Edition)CalculusISBN:9780134438986Author:Joel R. Hass, Christopher E. Heil, Maurice D. WeirPublisher:PEARSON Calculus: Early Transcendentals (3rd Edition)CalculusISBN:9780134763644Author:William L. Briggs, Lyle Cochran, Bernard Gillett, Eric SchulzPublisher:PEARSON

Calculus: Early Transcendentals (3rd Edition)CalculusISBN:9780134763644Author:William L. Briggs, Lyle Cochran, Bernard Gillett, Eric SchulzPublisher:PEARSON Calculus: Early TranscendentalsCalculusISBN:9781319050740Author:Jon Rogawski, Colin Adams, Robert FranzosaPublisher:W. H. Freeman

Calculus: Early TranscendentalsCalculusISBN:9781319050740Author:Jon Rogawski, Colin Adams, Robert FranzosaPublisher:W. H. Freeman

Calculus: Early Transcendental FunctionsCalculusISBN:9781337552516Author:Ron Larson, Bruce H. EdwardsPublisher:Cengage Learning

Calculus: Early Transcendental FunctionsCalculusISBN:9781337552516Author:Ron Larson, Bruce H. EdwardsPublisher:Cengage Learning

Calculus: Early Transcendentals

Calculus

ISBN:9781285741550

Author:James Stewart

Publisher:Cengage Learning

Thomas' Calculus (14th Edition)

Calculus

ISBN:9780134438986

Author:Joel R. Hass, Christopher E. Heil, Maurice D. Weir

Publisher:PEARSON

Calculus: Early Transcendentals (3rd Edition)

Calculus

ISBN:9780134763644

Author:William L. Briggs, Lyle Cochran, Bernard Gillett, Eric Schulz

Publisher:PEARSON

Calculus: Early Transcendentals

Calculus

ISBN:9781319050740

Author:Jon Rogawski, Colin Adams, Robert Franzosa

Publisher:W. H. Freeman

Calculus: Early Transcendental Functions

Calculus

ISBN:9781337552516

Author:Ron Larson, Bruce H. Edwards

Publisher:Cengage Learning