Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

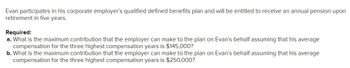

Transcribed Image Text:Evan participates in his corporate employer's qualified defined benefits plan and will be entitled to receive an annual pension upon

retirement in five years.

Required:

a. What is the maximum contribution that the employer can make to the plan on Evan's behalf assuming that his average

compensation for the three highest compensation years is $145,000?

b. What is the maximum contribution that the employer can make to the plan on Evan's behalf assuming that his average

compensation for the three highest compensation years is $250,000?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 4. Mr. Ankit retired on April 30, 2020. He will be receiving gratuity of *5.5 lakh and leave encashment of *2.20 lakh. He will also be receiving employee and employer contribution to provident fund. If he opt for the reduced rate of tax. Explain whether he will be eligible for the exemption under Income Tax Act,arrow_forwardIn 2022, when the Social Security wage base limitation was $147,000, Jacee received a $100,000 business allocation from a partnership in which Jacee was a general partner. This is Jacee's only source of income for the year. What is Jacee's self-employment tax liability? Note: Round the final answer to the nearest whole dollar amount Multiple Choice $2,900 $3.824 14,130arrow_forwardJacob is a member of his employers defined contribution pension plan. He has pensionable earnings of $110,000 and he contributes 6% of his earnings and his employers will match his 6%. What is Jacob's pension adjustment for the year? Question 5 options: $13,200 $11,000 $6,600 $19,800 Spencer has a RRSP with a balance of $600,000. Unfortunately, Spencer experienced a severe heart attack and died. Spencer was recently divorced and she had not assigned a beneficiary to her RRSP account. She also did not have a current willWhich of the following statements about her RRSP account is correct? Question 2 options: The assets in Spencer's RRSP will be fully included in her income in the year of death The assets in Spencer's RRSP will be included at a rate of 75% in her income in the year of death The assets in Spencer's RRSP will be included at a rate of 50% in her income in the year of death The assets in the RRSP will transfer to Spencer's heirs tax free.arrow_forward

- Alicia has been working for JMM Corp. for 33 years. Alicia participates in JMM's defined benefit plan. Under the plan, for every year of service for JMM, she is to receive 2 percent of the average salary of her three highest consecutive calendar years of compensation from JMM. She retired on January 1, 2020. Before retirement, her annual salary was $588,000, $618,000, and $648,000 for 2017, 2018, and 2019. What is the maximum benefit Alicia can receive in 2020? Maximum benefit in 2020 [$] *PER MCGRAW-HILL, THE ANSWER IS NOT $370, 800*arrow_forwardClayton participates in his employer's nonqualified deferred compensation plan. For 2022, he is deferring 10 percent of his $364,000 annual salary. Assuming this is his only source of income and his marginal income tax rate is 32 percent, how much does deferring Clayton's income save his employer (after taxes) in 2022? The employer's marginal tax rate is 21 percent (ignore payroll taxes).arrow_forwardAll the listed benefits paid by an employer are required to be included in an employee's income for a tax year except one. Which one? Question 4 options: a) Tuition fees for training that relates to employer's work b) Medical expenses of an employee c) Forgiveness of employee debt d) Cost of life insurancearrow_forward

- Alicia has been working for JMM Corp. for 33 years. Alicia participates in JMM’s defined benefit plan. Under the plan, for every year of service for JMM she is to receive 2 percent of the average salary of her three highest years of compensation from JMM. She retired on January 1, 2019. Before retirement, her annual salary was $609,000, $639,000, and $669,000 for 2016, 2017, and 2018. What is the maximum benefit Alicia can receive in 2019?arrow_forwardThe XYZ corporation pension plan provides a lifetime annual income to its employees upon retirement at age 65. The plan provides 4% for each year of service of the employee's salary upon retirement. Moreover, those retiring after 65 have their benefit increased by 1.1% for each year beyond 65 that they work. Caitlin retires at age 73 with 16 years of service. If her salary upon retirement is $60, 106, what is her annual pension benefit?arrow_forwardClarence is an employee at the Drake Candy Corporation, an S corporation. Clarence and other employees are covered under a disability income plan that will pay him 50% of his $96,000 salary if he becomes disabled. The company adds the pro rata cost of the plan to each employee's W-2. Clarence is in the 25% income tax bracket. What is the amount of monthly disability benefits Clarence will receive after tax if he remains in the same tax bracket when disabled? 1. $2,250. 2. $3,000. 3. $3,500. 4. $4,000. Ⓒ$4,000. $3,500. $2,250. Ⓒ$3,000.arrow_forward

- Alicia has been working for JMM Corporated for 32 years. Alicia participates in JMM’s defined benefit plan. Under the plan, for every year of service for JMM, she is to receive 2 percent of the average salary of her three highest consecutive calendar years of compensation from JMM. She retired on January 1, 2021. Before retirement, her annual salary was $570,000, $600,000, and $630,000 for 2018, 2019, and 2020. What is the maximum benefit Alicia can receive in 2021?arrow_forwardkk.18.arrow_forwardBarbara has worked for one employer her entire career. While she was working, she participated in the employer’s defined contribution plan [traditional 401(k)]. At the end of 2020, Barbara retires. The balance in her defined contribution plan is $4,000,000 at the end of 2019. Use the below provide abbreviated uniform lifetime table to answer the questions. a. What is Barbara’s required minimum distribution for 2020 that must be distributed in 2021 if she is 68 years old at the end of 2020? b. What is Barbara’s required minimum distribution for 2020 if she turns 72 during 2020? When must she receive this distribution? c. What is Barbara’s required minimum distribution for 2020 that must be distributed in 2021 if she turns 75 years old in 2020? d. Assuming that Barbara is 76 years old at the end of 2020 and her marginal tax rate is 32 percent, what amount of her distribution will she have remaining after taxes if she receives only a distribution of $50,000 for 2020?…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education