FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Estimating Doubtful Accounts

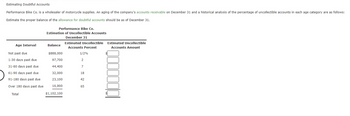

Performance Bike Co. is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31 and a historical analysis of the percentage of uncollectible accounts in each age category are as follows:

Estimate the proper balance of the allowance for doubtful accounts should be as of December 31.

Performance Bike Co.

Estimation of Uncollectible Accounts

December 31

Estimated Uncollectible

Age Interval

Balance

Accounts Percent

Not past due

$888,000

1/2%

1-30 days past due

97,700

2

31-60 days past due

44,400

7

61-90 days past due

32,000

18

91-180 days past due

23,100

42

Over 180 days past due

16,900

65

Total

$1,102,100

Estimated Uncollectible

Accounts Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Providing for Doubtful Accounts At the end of the current year, the accounts receivable account has a debit balance of $992,000 and sales for the year total $11,240,000. a. The allowance account before adjustment has a credit balance of $13,400, Bad debt expense is estimated at 1/4 of 1% of sales. b. The allowance account before adjustment has a credit balance of $13,400. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $42,900. c. The allowance account before adjustment has a debit balance of $8,300. Bad debt expense is estimated at 1/2 of 1% of sales. d. The allowance account before adjustment has a debit balance of $8,300. An aging of the account in the customer lodger indicates estimated doubtful accounts of $68,900. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above. b. S C. d.arrow_forwardAging of Receivables; Estimating Allowance for Doubtful Accounts Wig Creations Company supplies wigs and hair care products to beauty salons throughout Texas and the Southwest. The accounts receivable clerk for Wig Creations prepared the following partially completed aging of receivables schedule as of the end of business on December 31, 20Y7: Not Days Past Due Past Customer Balance Due 1-30 31-60 61-90 91-120 Over 120 АВС Веauty 19,000 19,000 Angel Wigs 7,100 7,100 Zodiac Beauty 3,500 3,500 Subtotals 1,316,900 752,700 299,000 128,300 39,800 16,400 80,700 The following accounts were unintentionally omitted from the aging schedule. Assume all due dates are for the current year except for Visions Hair & Nail, which is due in the next year. Customer Due Date Balance Arcade Beauty Aug. 17 $5,300 Creative Images Oct. 30 4,700 Excel Hair Products July 3 8,500 First Class Hair Care Sept. 8 6,700 Golden Images Nov. 23 3,300 Ob That Eair Nov 2Oarrow_forwardOutlaw Bike Co. is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31 and a historical analysis of the percentage of uncollectible accounts in each age category are given below. Estimated Uncollectible Estimated Uncollectible Age Interval Balance Accounts Percent Accounts Amount Not past due $500,000 3/4 % $3,750 1-30 days past due 55,000 4 2,200 31-60 days past due 25,000 6 1,500 61-90 days past due 18,000 14 2,520 91-180 days past due 13,000 42 5,460 Over 180 days past due 9,500 70 6,650 Total $620,500 $22,080 Assume that the allowance for doubtful accounts for Outlaw Bike Co. had a debit balance of $3,975 as of December 31. Journalize the adjusting entry for uncollectible accounts as of December 31.arrow_forward

- Vaibhav Subject: acountingarrow_forwardEstimating Doubtful Accounts Outlaw Bike Co. is a wholesaler of motorcycle supplies. An aging of the company’s accounts receivable on December 31, and a historical analysis of the percentage of uncollectible accounts in each age category are as follows: Age Class Balance Percent Uncollectible Not past due $532,000 1/2 % 1–30 days past due 58,500 4 31-60 days past due 26,600 6 61–90 days past due 19,200 14 91–180 days past due 13,800 41 Over 180 days past due 10,100 80 $660,200 Estimate what the proper balance of the allowance for doubtful accounts should be as of December 31. Age Class Balance PercentUncollectible Estimated UncollectibleAccounts Amount Not past due $532,000 1/2% $fill in the blank 1 1-30 days past due 58,500 4 fill in the blank 2 31-60 days past due 26,600 6 fill in the blank 3 61-90 days past due 19,200 14 fill in the blank 4 91-180 days past due 13,800 41 fill in the blank 5 Over 180…arrow_forwardDaley Company prepared the following aging of receivables analysis at December 31. Total Days Past Due 0 1 to 30 31 to 60 61 to 90 Over 90 Accounts receivable $ 575,000 $ 397,000 $ 91,000 $ 37,000 $ 19,000 $ 31,000 Percent uncollectible 2% 3% 6% 8% 11% Complete the table below to calculate the estimated balance of Allowance for Doubtful Accounts using aging of accounts receivable. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $3,700 credit. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $200 debit. Complete the table below to calculate the estimated balance of Allowance for Doubtful Accounts using aging of accounts receivable. Accounts Receivable x Percent Uncollectible (%) = Estimated…arrow_forward

- Estimating Doubtful Accounts Performance Bike Co. is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31 and a historical analysis of the percentage of uncollectible accounts in each age category are as follows: Estimate the proper balance of the allowance for doubtful accounts should be as of December 31. Performance Bike Co. Estimation of Uncollectible Accounts December 31 Age Interval Balance Estimated UncollectibleAccounts Percent Estimated UncollectibleAccounts Amount Not past due $530,000 3/4% $fill in the blank 1 1-30 days past due 58,300 2 fill in the blank 2 31-60 days past due 26,500 6 fill in the blank 3 61-90 days past due 19,100 16 fill in the blank 4 91-180 days past due 13,800 38 fill in the blank 5 Over 180 days past due 10,100 80 fill in the blank 6 Total $657,800 $fill in the blank 7arrow_forwardment/chec Show Me How Print Item Estimating Doubtful Accounts Outlaw Bike Co. is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31, and a historical añalysis of the percentage of uncollectible accounts in each age category are as follows: Percent Age Class Balance Uncollectible Not past due $782,000 1/2 % 1-30 days past due 86,000 4 31-60 days past due 39,100 7 61-90 days past due 28,200 18 91-180 days past due 20,300 41 Over 180 days past due 14,900 80 $970,500 Estimate what the proper balance of the allowance for doubtful accounts should be as of December 31. Percent Estimated Uncollectible Age Class Balance Uncollectible Accounts Amount Not past due $782,000 1/2% 1-30 days past due 86,000 4 31-60 days past due 39,100 7arrow_forwardProviding for Doubtful Accounts At the end of the current year, the accounts receivable account has a debit balance of $1,132,000 and sales for the year total $12,840,000. The allowance account before adjustment has a credit balance of $15,300. Bad debt expense is estimated at 1/4 of 1% of sales. The allowance account before adjustment has a credit balance of $15,300. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $49,000. The allowance account before adjustment has a debit balance of $9,200. Bad debt expense is estimated at 3/4 of 1% of sales. The allowance account before adjustment has a debit balance of $9,200. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $76,400. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above.arrow_forward

- Entry for Uncollectible Accounts Outlaw Bike Co. is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31 and a historical analysis of the percentage of uncollectible accounts in each age category are given below. Age Interval Balance Estimated UncollectibleAccounts Percent Estimated UncollectibleAccounts Amount Not past due $902,000 3/4 % $6,765 1-30 days past due 99,200 2 1,984 31-60 days past due 45,100 6 2,706 61-90 days past due 32,500 18 5,850 91-180 days past due 23,500 42 9,870 Over 180 days past due 17,100 65 11,115 Total $1,119,400 $38,290 Assume that the allowance for doubtful accounts for Outlaw Bike Co. had a debit balance of $6,890 as of December 31. Journalize the adjusting entry for uncollectible accounts as of December 31. Dec. 31 - Select - - Select -arrow_forwardEntry for Uncollectible Accounts Outlaw Bike Co. is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31 and a historical analysis of the percentage of uncollectible accounts in each age category are given below. Age Interval Balance Estimated UncollectibleAccounts Percent Estimated UncollectibleAccounts Amount Not past due $878,000 3/4 % $6,585 1-30 days past due 96,600 2 1,932 31-60 days past due 43,900 8 3,512 61-90 days past due 31,600 14 4,424 91-180 days past due 22,800 38 8,664 Over 180 days past due 16,700 75 12,525 Total $1,089,600 $37,642 Assume that the allowance for doubtful accounts for Outlaw Bike Co. had a debit balance of $6,775 as of December 31. Journalize the adjusting entry for uncollectible accounts as of December 31. If an amount box does not require an entry, leave it blank. Dec. 31 - Select - - Select - - Select - - Select -arrow_forwardProviding for Doubtful Accounts At the end of the current year, the accounts receivable account has a debit balance of $1,162,000 and sales for the year total $13,170,000. The allowance account before adjustment has a credit balance of $15,700. Bad debt expense is estimated at 1/2 of 1% of sales. The allowance account before adjustment has a credit balance of $15,700. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $50,200. The allowance account before adjustment has a debit balance of $9,100. Bad debt expense is estimated at 1/4 of 1% of sales. The allowance account before adjustment has a debit balance of $9,100. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $75,500. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above. a. $ b. $ c. $ d. $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education