Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please give me true answer this financial accounting question

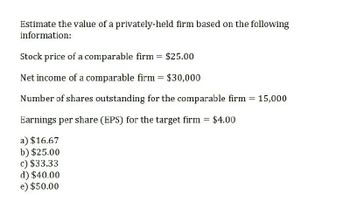

Transcribed Image Text:Estimate the value of a privately-held firm based on the following

information:

Stock price of a comparable firm = $25.00

Net income of a comparable firm = $30,000

Number of shares outstanding for the comparable firm = 15,000

Earnings per share (EPS) for the target firm = $4.00

a) $16.67

b) $25.00

c) $33.33

d) $40.00

e) $50.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the total market value of the firm's equity??arrow_forwardThe M. Smith and Family Corporation Data Shares Outstanding 25,000,000 Earnings $50,000,000 Dividends, Per Share (Just Paid) $1.25 Return on Equity 0.15 Beta 1.35 Market Data Expected Return Market Return 0.12 Risk-Free Rate 0.03 Required: Using the information in the tables above, complete the necessary steps to calculate the P/E ratio and the PEG ratio. The M. Smith and Family Corporation Calculations Capitalization Rate Earnings Per Share Plowback Rate Sustainable Growth Rate Price P/E Ratio Sustainable Growth Rate (as Percentage, use for PEG Calculation) 0 PEG Ratioarrow_forwardA firm has a total book value of equity of $300,000, a market to book ratio of .33 (one-third), and a book value per share of $8.00. What is the total market value of the firm's equity? O$ 100,000 O$ 37,500 O$ 112,500 O$ 900,000 O $1,200,000arrow_forward

- Need help with this accounting questionarrow_forwardA) For a listed company of ABC, total book value of assets is 40 million, total market value of current assets is 20 million; total market value of fixed assets is 25 million, total current & non-current liabilities is 17.5 million, & total retained earning is 4.5 million. Total number of shares of the company is 2.5 million. Determine Current Price per share. B) How should we consider investment decision by comparing between market price and hook value of the security?arrow_forwardWhat is the earnings yield of a single share on these financial accounting question?arrow_forward

- ed A company has the following balance sheet (market values): Liabilities + Equity Debt Equity Assets Cash Operating Assets 600 1000 400 1200 If the firm has 300, find its fair share price after it repurchases 100 worth of shares: (round your answer to the nearest 0.01)arrow_forwardOn the basis of this information, calculate as many liquidity, activity, leverage, profitzit and common stock measures as you can. (Note: Assume the current market price of the common stock is $75 per share.arrow_forwardGive me correct option? General accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning