FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

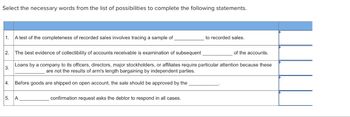

Transcribed Image Text:Select the necessary words from the list of possibilities to complete the following statements.

1. A test of the completeness of recorded sales involves tracing a sample of _

2. The best evidence of collectibility of accounts receivable is examination of subsequent

3.

4.

to recorded sales.

of the accounts.

Loans by a company to its officers, directors, major stockholders, or affiliates require particular attention because these

are not the results of arm's length bargaining by independent parties.

Before goods are shipped on open account, the sale should be approved by the

5. A

confirmation request asks the debtor to respond in all cases.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vendor invoices are recorded for items that were never ordered by the company. Which of the following controls can best address this issue? O Procedures for rejected inputs O Reconcile bank account O Independent authorization to make payment Independent validation of vendor invoicesarrow_forwardThe descriptive sections of the annual report that provides insight into what the company does and the types of risks it lates is felt Select one: OA management discussion and analysis. B. the industry overview. OC. the audit opinion. D. notes to the financial statements. To best interpret the accounts receivable turnover ratio, the days in accounts receivable should be compared to the company's Select one: A sales revenue. B. credit terms. OC. inventory turnover. D. accounts receivable balance. Two companies have an identical amount of current assets and current liabilities Donald Inc. has 40% of its current assets invested in whereas Mickey Corp. has 30% of its current assets invested in inventory Which of the following statements is true? Select one: OA. Donald will have the higher quick ratio. OB. Donald will have the higher current ratio. OC. The companies are equally liquid because their current ratios are the same OD. Donald is less liquid than Mickarrow_forwardWhich of the following is most likely to be detected by an auditor's review of an entity's sales cutoff? Multiple Choice lapping of year-end accounts receivable unrecorded sales for the year excessive sales discounts unauthorized goods returned for credit 3 Multiple Choice Which of the following is most likely to be detected by an auditor's review of an entity's sales cutoff? C lapping of year-end accounts receivable unrecorded sales for the year excessive sales discounts unauthorized goods returned for creditarrow_forward

- The expense cycle offers employees many opportunities to commit fraudin processing cash purchases and cash disbursements. Buyers usually becomeeasy targets for suppliers who offer large returns if willing to transactmore. Analytical procedures are a cost-effective means of identifying accounts in the expense cycle that are misstated.a. Please list some of the analytical procedures the auditor may use forestimate the likelihood of misstatement and explain the significance of the audit?b. Why a trade payable turnover day analysis provides a more precise analysis of debteffort rather than current ratio?c. Why do auditors pay more attention to debt understatement than debt overstatement?d. Please identify the elements of environmental control that are relevant toinitiation and recording of purchases?arrow_forwardDescribe one specific substantive audit procedure you would use to test the financial statement assertion you are most concerned with based on your analysis of inventory in the bakeryarrow_forwardQuestion 29 Which of the following is the best reason for pre-numbering in numerical sequence documents sucj as sales orders, shipping documents and sales invoices? Enables company personnel to determine accuracy of each document Enables personnel to determine the proper period recording of sales revenue and receivables Enables personnel to check numerical sequence for missing documents and unrecorded transactions Enables personnel to determine the validity of recorded transactionsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education