Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

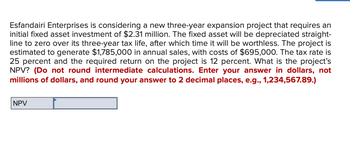

Transcribed Image Text:Esfandairi Enterprises is considering a new three-year expansion project that requires an

initial fixed asset investment of $2.31 million. The fixed asset will be depreciated straight-

line to zero over its three-year tax life, after which time it will be worthless. The project is

estimated to generate $1,785,000 in annual sales, with costs of $695,000. The tax rate is

25 percent and the required return on the project is 12 percent. What is the project's

NPV? (Do not round intermediate calculations. Enter your answer in dollars, not

millions of dollars, and round your answer to 2 decimal places, e.g., 1,234,567.89.)

NPV

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Hubrey Home Inc. is considering a new three-year expansion project that requires an initial fixed asset investment of $3.7 million. The fixed asset falls into Class 10 for tax purposes (CCA rate of 30% per year), and at the end of the three years can be sold for a salvage value equal to its UCC. The project is estimated to generate $2,630,000 in annual sales, with costs of $832,000. If the tax rate is 35%, what is the OCF for each year of this project? (Enter the answers in dollars. Do not round your intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.) OCF1 $ OCF2 $ OCF3 $arrow_forwardDDR Enterprises is analyzing an expansion project. The project's installed cost is $80,000. It is eligible for 100% bonus depreciation. The project has a $12,000 salvage value at the end of its five year expected life. The project will requie an additional $8,000 investment in net working capital. The tax rate is 25%. What is the project's initial investment? If you could show the steps in calcualtion too that would be great!arrow_forwardQuad Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.9 million. The fixed asset will be depreciated straight-line to zero over its three year tax life, after which time it will be worthless. The project is estimated to generate $2,190,000 in annual sales, with costs of $815,000. The tax rate is 35%. What is the NPV of the project if the required rate of return is 12% O $47,523 O $59,255 O $68.991 O $52.648arrow_forward

- Esfandiri Enterprises is considering a new three year expansion project that requires an initial fixed asset investment of $2.18 million. The fixed asset will be depreciated straight-line to zero over its three year tax life, after which time it will be worthless. The Project is estimated to generate $1.645 million in annual sales with costs of $610,000. If the tax rate is 27.00% what is the OCF per year (OCF will be the same for the three years) for this project? Group of answer choices $650,058.06 $715,063.86 $786,570.25 $865,227.27 $951,750.00arrow_forwardte.3arrow_forwardEsfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.18 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $1730000 million in annual sales, with costs of $640,000. The tax rate is 24 percent. If the required return is 13 percent, what is the project's NPV? please answer fast i give upvotearrow_forward

- H. Cochran, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $2.15 million. The fixed asset will be depreciated straight- line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $2.23 million in annual sales, with costs of $1.25 million. Assume the tax rate is 23 percent and the required return on the project is 14 percent. What is the project's NPV? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Net present valuearrow_forwardEsfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2,350,000. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $2,830,000 in annual sales, with costs of $1,850,000. Assume the tax rate is 25 percent and the required return on the project is 11 percent. What is the project’s NPV?arrow_forwardSummer Tyme, Inc., is considering a new 3-year expansion project that requires an initial fixed asset investment of $2,098,350. The fixed asset will be depreciated straight-line to zero over its 3-year tax life, after which time it will be worthless. The project is estimated to generate $1,814,883 in annual sales, with costs of $1,675,390. If the tax rate is 0.33 , what is the OCF for this project?arrow_forward

- Wilson, Inc., is considering a new four-year expansion project that requires an initial fixed asset investment of $1,875,000. The fixed asset will be depreciated straight-line to zero over its four-year tax life, after which time it will be worthless. The project is estimated to generate $2,040,000 in annual sales, with costs of $1,235,000. If the tax rate is 35 %, and the required return on the project is 12%, what is the project's NPV?arrow_forwardDMV, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $1.2 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which it will be worthless. The project is estimated to generate $1,40,000 in annual sales, with costs of $500,000. The tax rate is 37 percent and the required return is 12 percent. What is the project's NPV?arrow_forwardSummer Tyme, Inc., is considering a new 3-year expansion project that requires an initial fixed asset investment of $2,380,090. The fixed asset will be depreciated straight-line to zero over its 3-year tax life, after which time it will be worthless. The project is estimated to generate $1,966,851 in annual sales, with costs of $1,680,260. If the tax rate is 0.35 , what is the OCF for this project?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education