Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

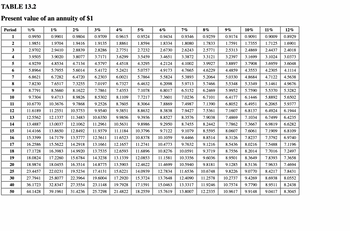

Transcribed Image Text:**Table 13.2: Present Value of an Annuity of $1**

This table provides the present value of an annuity of $1 received annually for a certain number of periods, given different interest rates. The values listed are factors used to calculate the present value of annuities.

- **Period (rows):** Represents the number of periods (years) over which the annuity is received, ranging from 1 to 50 periods.

- **Interest Rates (columns):** Given as percentages, ranging from 0.5% to 12%.

**How to Use the Table:**

1. Identify the interest rate for your annuity.

2. Find the row corresponding to the number of annuity periods.

3. The intersecting value is the factor to use to find the present value.

For example, if the annuity is received for 10 periods at an interest rate of 5%, the present value factor is 7.7217.

**Detailed Explanation:**

In financial calculations, this table helps determine what a series of future payments is worth in today's terms, considering the time value of money. Lower interest rates will result in higher present values, as the discounting effect is less pronounced. Conversely, higher interest rates decrease the present value factor, reflecting greater discounting of future payments.

**Note:** This table assumes that payments are made once per period (yearly), and the interest rate is compounded annually.

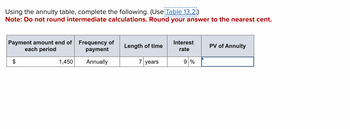

Transcribed Image Text:**Instructions:**

Using the annuity table, complete the following. (Use Table 13.2)

**Note:** Do not round intermediate calculations. Round your answer to the nearest cent.

| Payment amount end of each period | Frequency of payment | Length of time | Interest rate | PV of Annuity |

|-----------------------------------|----------------------|----------------|---------------|---------------|

| $1,450 | Annually | 7 years | 9% | |

**Explanation:**

The table requires calculating the present value (PV) of an annuity. The given details include:

- **Payment amount at the end of each period:** $1,450

- **Frequency of payment:** Annually

- **Length of time:** 7 years

- **Interest rate:** 9%

The task is to use Table 13.2 (the annuity table) to find the present value of the annuity based on the specified interest rate and duration.

Expert Solution

arrow_forward

Step 1

Present value of annuity is the equivalent amount based on the future cash flow and interest rate and time period of cash flow.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Tait is entering high school and is determined to save money for college. Tait feels he can save $2,500 each year for the next four years from his part-time job. If Tait is able to invest at 6%, how much will he have when he starts college? (Click the icon to view Present Value of $1 table.) E (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table.) E (Click the icon to view Future Value of Ordinary Annuity of $1 table.) - X Reference (Round your answer to the nearest dollar.) Reference When Tait starts college he will have Present Value of $1 Periods Period 1 Period 2 Period 3 Period 4 Period 5 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% Future Value of $1 0.990 0.980 0.971 0.962 0.952 0.943 0.980 0.961 0.943 0.925 0.907 0.971 0.942 0.915 0.889 0.864 0.840 0.961 0.924 0.888 0.855 0.823 0.792 0.951 0.906 0.863 0.822 0.784 0.747 0.917 0.909 0.893 | 0.877 0.870 0.862 0.847 0.833 0.826 0.797 0.769 0.756 0.743…arrow_forwardNonearrow_forwardUse the table below to answer the following questions: Period 4 567 8 9 10 11 Present Value of an Annuity of 1 4% Future Value of an Annuity of 1 5% 5% 8% 10% 4% 8% 10% 3.6299 3.5460 3.3121 3.1699 4.2465 4.3101 4.5061 4.6410 4.4518 4.3295 3.9927 3.7908 5.4163 5.5256 5.8666 6.1051 5.2421 5.0757 4.6229 4.3553 6.6330 6.8019 7.3359 7.7156 6.0021 5.7864 5.2064 4.8684 7.8983 8.1420 8.9228 9.4872 5.7466 5.3349 9.2142 9.5491 10.6366 11.4359 7.4353 7.1078 6.2469 5.7590 10.5828 11.0266 12.4876 13.5795 8.1109 7.7217 6.7101 6.1446 12.0061 12.5779 14.4866 15.9374 8.7605 8.3064 7.1390 6.4951 13.4864 14.2068 16.6455 18.5312 6.7327 6.4632 Bobby receives alimony payments every 6 months and the next payment is tomorrow. Median homes go for $950,000 and he wants to save $190,000 in 4 years. How much money should Bobby put away into an investment each time he receives alimony payments if he can get a 8% return a year? $35,593 O $31,624 O $23,131 O $46,262arrow_forward

- Complete the ordinary annuity as an annuity due (future value) for the following: (Please use the following provided Table) Note: Do not round intermediate calculations. Round your answer to the nearest cent. $ Amount of payment Payment payable 5,000 Annually Years Interest rate 5% 5 Annuity duearrow_forwardPerpetuityarrow_forward7. Present Value of a Perpetuity Determine the present value of each of the following perpetuities. Part Annual CF Interest Rate A $34,000 B $90,000 C $6,000 D $60,000 8% 10% 6% 5%arrow_forward

- Following is a table for the present value of $1 at compound interest: Year 6% 10% 1 0.943 0.909 0.890 0.826 0.840 0.751 0.792 0.683 5 0.747 0.621 Following is a table for the present value of an annuity of $1 at compound interest: Year 6% 10% 12% 1 0.943 0.909 0.893 2 1.833 1.736 1.690 3 2.673 2.487 2.402 3.465 3.170 3.037 5 4.212 3.791 3.605 Using the tables provided, the present value of $9,186.00 (rounded to the nearest dollar) to be received at the end of each of the next 4 years, assuming an earnings rate of 12%, is Oa. $9,186 Ob. $22,065 2 3 4 4 Oc. $27,898 Od. $33,116 12% 0.893 0.797 0.712 0.636 0.567arrow_forwardFuture value interest factor of an ordinary annuity of $1 per period at i% for n periods, FVIFA(i,n). Period 5.0% 5.5% 6.0% 1.0% 1.0000 1.5% 1.0000 2.0% 1.0000 1 1.0000 1.0000 1.0000 1.0000 1.0000 2 2.0050 2.0100 2.0150 2.0200 2.0250 2.0300 2.0350 1.0000 2.0400 3.1216 3 3.0150 3.0301 3.0452 3.0756 3.0909 3.1062 4 4.0301 3.0604 4.1216 5.2040 4.1525 4.1836 4.2149 4.2465 5 4.0604 4.0909 5.1010 5.1523 6.1520 6.2296 6.3081 5.0503 5.2563 5.3091 5.3625 5.4163 6 6.0755 6.3877 6.4684 6.5502 6.6330 7 7.1059 7.5474 7.6625 7.7794 7.4343 8.4328 8.5830 8 8.1414 9 10 11 12 13 14 15 16 17 18 19 6.5% 7.0% 7.5% 9.0% 8.5% 0.0% 0.5% 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 2.0450 2.0500 2.0550 2.0600 2.0650 2.0700 2.0750 2.0800 2.0850 2.0900 2.0950 3.1370 3.1525 3.1680 3.1836 3.1992 3.2149 3.2306 3.2464 3.2622 3.2781 3.2940 4.2782 4.3101 4.3423 4.3746 4.4072 4.4399 4.4729 4.5061 4.5395 4.5731 4.6070 5.4707 5.5256 5.5811 5.6371 5.6936 5.7507 5.8084 5.8666 5.9254 5.9847 6.0446…arrow_forwardTABLE 13.2 Present value of an annuity of $1 ½% 6% 7% 1% 0.9901 1.9704 2% 0.9804 3% 0.9709 4% 0.9615 0.9950 1.9851 1.9416 1.9135 1.8861 5% 0.9524 1.8594 2.7232 3.5459 4.3295 2.9702 2.9410 2.8839 2.7751 2.8286 3.7171 3.9505 3.9020 3.6299 4.9259 4.4518 3.8077 4.8534 4.7134 4.5797 5.7955 5.6014 6.7282 6.4720 5.8964 5.2421 6.8621 5.4172 6.2303 7.0197 6.0021 7.8230 7.6517 7.3255 8.7791 8.5660 7.7861 8.1622 8.9826 5.0757 5.7864 6.7327 6.4632 7.4353 7.1078 8.1109 7.7217 8.3064 8.8632 9.7304 9.4713 8.5302 10.6770 10.3676 9.7868 9.2526 8.7605 8% 0.9434 0.9346 0.9259 1.8334 1.8080 1.7833 2.6730 2.6243 2.5771 3.4651 3.3872 3.3121 4.2124 4.1002 3.9927 4.9173 4.7665 4.6229 5.5824 5.3893 5.2064 6.2098 5.9713 5.7466 6.8017 6.5152 6.2469 7.3601 7.0236 6.7101 7.8869 7.4987 7.1390 11.2551 10.5753 8.3838 7.9427 7.5361 12.1337 9.9856 8.8527 8.3576 7.9038 13.4887 13.0037 12.1062 11.2961 10.5631 9.8986 8.2442 14.4166 13.8650 12.8492 11.9379 11.1184 10.3796 9.7122 9.1079 8.5595 15.3399 14.7179 13.5777…arrow_forward

- EACTIVITY # 1 Find the future value and present value using the ordinary annuity and. No. Principal Rate Mode of Payment Term 3 years 5 years 10 years 12 years 2% P40,000 P100,000 P340,000 P1,240,000 Annually Quarterly Monthly Semiannually 4% 6% 9% 1234arrow_forwards/d/e/1FAlpQLSfgr9AkfTTNtEDdijdlH8qi7BUKNWLBInw/rS 4ywgwjmAsw/formRespons O ) $3,802 d) $852. e) None of the above: 5. What is the future value of a b year ordinary annuity with annual payments of $200, evaluated at a 15 per O a) $ 670 44 O Di S 842.91 O as1.522 64 G) S1.348 48 6. What is the present value of a7-vearordjnaryennu payments of $300. evaluated at a 10 percentinterestrate? O a S 670 43arrow_forwardPresent value of an Annuity of $1 in Arrears Periods 4% 6% 8% 10% 12% 14% 1 0.962 0.943 0.926 0.909 0.893 0.877 2 1.886 1.833 1.783 1.736 1.690 1.647 3 2.775 2.673 2.577 2.487 2.402 2.322 4 3.630 3.465 3.312 3.170 3.037 2.914 5 4.452 4.212 3.993 3.791 3.605 3.433 6 5.242 4.917 4.623 4.355 4.111 3.889 7 6.002 5.582 5.206 4.868 4.564 4.288 8 6.733 6.210 5.747 5.335 4.968 4.639 9 7.435 6.802 6.247 5.759 5.328 4.946 10 8.111 7.360 6.710 6.145 5.650 5.216 Lucas Company is considering a project with an initial investment of $530,250 in new equipment that will yield annual net cash flows of $95,000, and will be depreciated at $75,750 per year over its seven year life. What is the internal rate of return? a.6% b.14% c.10% d.12% e.8%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education