FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

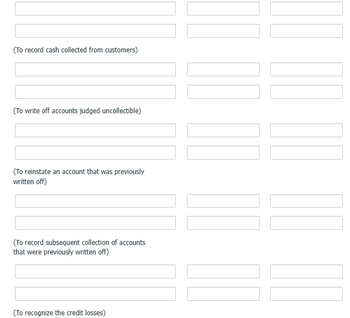

Transcribed Image Text:(To record cash collected from customers)

(To write off accounts judged uncollectible)

(To reinstate an account that was previously

written off)

(To record subsequent collection of accounts

that were previously written off)

(To recognize the credit losses)

||||| |||

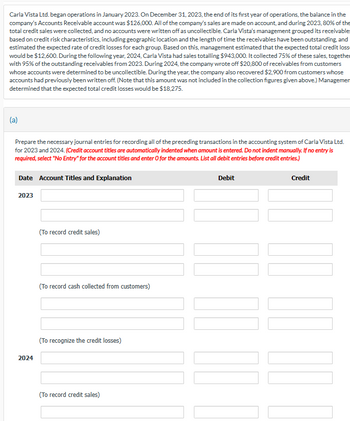

Transcribed Image Text:Carla Vista Ltd. began operations in January 2023. On December 31, 2023, the end of its first year of operations, the balance in the

company's Accounts Receivable account was $126,000. All of the company's sales are made on account, and during 2023, 80% of the

total credit sales were collected, and no accounts were written off as uncollectible. Carla Vista's management grouped its receivable

based on credit risk characteristics, including geographic location and the length of time the receivables have been outstanding, and

estimated the expected rate of credit losses for each group. Based on this, management estimated that the expected total credit loss

would be $12,600. During the following year, 2024, Carla Vista had sales totalling $943,000. It collected 75% of these sales, together

with 95% of the outstanding receivables from 2023. During 2024, the company wrote off $20,800 of receivables from customers

whose accounts were determined to be uncollectible. During the year, the company also recovered $2,900 from customers whose

accounts had previously been written off. (Note that this amount was not included in the collection figures given above.) Managemen

determined that the expected total credit losses would be $18,275.

(a)

Prepare the necessary journal entries for recording all of the preceding transactions in the accounting system of Carla Vista Ltd.

for 2023 and 2024. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is

required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)

Date Account Titles and Explanation

2023

2024

(To record credit sales)

(To record cash collected from customers)

(To recognize the credit losses)

(To record credit sales)

Debit

Credit

|||||

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jars Plus recorded $865,430 in credit sales for the year and $493,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.0% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,670, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. If an amount box does not require an entry, leave it blank. If required, round final answers to two decimal places. A. Dec. 31 To record bad debt, income statement method B. Dec. 31…arrow_forwardplease help mearrow_forwardJayco Inc. started its operations in 2022. Its sales during 2022, all on account, totalled $700,000. The company collected $500,000 in cash from customers during the year and wrote off $8,000 in uncollectible accounts. The company set up an allowance for doubtful accounts at December 31, 2022, its fiscal year-end, and determined the account balance to be $14,000. The unadjusted balances of selected accounts at December 31, 2023 are as follows: Accounts receivable $ 300,000 Allowance for doubtful accounts (debit) 10,000 Sales revenue (including 80 percent in sales on account) 800,000 Aging of the accounts receivable on December 31, 2023, resulted in an estimate of $11,000 in potentially uncollectible accounts. Required: 2. Prepare the journal entries to record all the transactions during 2023 and post them to appropriate T-accounts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)…arrow_forward

- Harlan Company uses the Allowance method for accounting for receivables. They had the following information as of December 31, 2022: Net Credit Sales, year 2022 6,867,750 Accounts Receivable, December 31, 2021 655,000 Accounts Receivable, December 31, 2022 745,000 Allowance for Doubtful Accounts, December 31, 2022 4,350 Credit Harlan Company estimates that 2% of the Accounts Receivable will become uncollectible. What are some things that a company can do to improve the collection of its Accounts Receivable? On January 7, 2023 it was determined that Bundy Company’s account in the amount of $3,800 will be uncollectible. Prepare the entry to write off the Bundy Company account. What is the Cash Realizable Value of the receivables after the write-off of the Bundy Company account?arrow_forwardMckinney & Co. estimates its uncollectible accounts as a percentage of credit sales. Mckinney made credit sales of' $1,500,000 in 2019. Mckinney estimates 2.5% of its sales will be uncollectible. Prepare the journal entry to record bad debt expense for McKinney at the end of 2019.arrow_forwardFrom inception of operations to December 31, 2025, Swifty Corporation provided for uncollectible accounts receivable under the allowance method. The provisions are recorded, based on analyses of customers with different risk characteristics. Bad debts written off were charged to the allowance account; recoveries of bad debts previously written off were credited to the allowance account, and no year-end adjustments to the allowance account were made. Swifty's usual credit terms are net 30 days. The balance in Allowance for Doubtful Accounts was $144,200 (Cr.) at January 1, 2025. During 2025, credit sales totaled $9,170,300. the provision for doubtful accounts was determined to be $183,406, $91,703 of bad debts were written off, and recoveries of accounts previously written off amounted to $19,570. Swifty installed a computer system in November 2025, and an aging of accounts receivable was prepared for the first time as of December 31, 2025. A summary of the aging is as follows.…arrow_forward

- At the beginning of 2018 Evan Company had a $1,958 balance in its accounts receivable account and a $448 balance in allowance for doubtful accounts. During 2018, Evan experienced the following events. (1) Earned $4,577 of revenue on account. (2) Collected $1,505 cash from accounts receivable. (3) Wrote-off $339 of accounts receivable as uncollectible. Evan estimates uncollectible accounts to be 3% of sales. Based on this information, the December 31, 2018 adjusted balance in the allowance for doubtful accounts isarrow_forwardThe balance sheet at the end of 2018 reported Accounts Receivable of $785,500 and Allowance for Doubtful Accounts of $11,783 (credit balance). The company’s total sales during 2019 were $8,350,200. Of these, $1,252,530 were cash sales the rest were credit sales. By the end of the year, the company had collected $6,291,700 of accounts receivable. It also wrote off an account for $10,380. Prepare the journal entry for collections. Account Names DR CR Blank 1. Fill in the blank, read surrounding text. Blank 2. Fill in the blank, read surrounding text. Blank 3. Fill in the blank, read surrounding text. Blank 4. Fill in the blank, read surrounding text. Blank 5. Fill in the blank, read surrounding text. Blank 6. Fill in the blank, read surrounding text. Blank 7. Fill in the blank, read surrounding text. Blank 8. Fill in the blank, read surrounding text. Blank 9. Fill in the blank, read surrounding text. Blank 10. Fill in the blank, read surrounding text. Blank 11.…arrow_forwardMr. Husker's Tuxedos Corp. ended the year 2021 with an average collection period of 35 days. The firm's credit sales for 2021 were $56.4 million. What is the year-end 2021 balance in accounts receivable for Mr. Husker's Tuxedos? (Enter your answer in dollars not in millions.) Accounts receivablearrow_forward

- Jars Plus recorded $862,430 in credit sales for the year and $489,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.0% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,470, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. If an amount box does not require an entry, leave it blank. If required, round final answers to two decimal places. A. Dec. 31 Bad Debt Expense 88 88 88 38 88 88 Allowance for…arrow_forwardDuring its first year of operations, Fall Wine Tour earned net credit sales of $311,000. Industry experience suggests that bad debts will amount to 3% of net credit sales. At December 31, 2024, accounts receivable total $44,000. The company uses the allowance method to account for uncollectibles. Read the requirements. Requirement 1. Journalize Fall Wine Tour's Bad Debts Expense using the percent-of-sales method. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Dec. 31 Requirement 2. Show how to report accounts receivable on the balance sheet at December 31, 2024. Balance Sheet (Partial): Current Assets:arrow_forwardAt January 1, 2015, Windy Mountain Flagpoles had accounts receivable of $30,000 and allowance for bad debts had a credit balance of $3,000. During the year, Windy Mountain Flagpoles recorded the following: Sales of $178,000 ($158,000 on account; $20,000 for cash) Collections on account, $124,000 Write-offs of uncollectible receivables, $2,800 Accounting for uncollectible accounts using the allowance method (percent-of-sales) and reporting receivables on the balance sheet Question 1 Requirements Journalize Windy's transaction that occurred during 2015. The company uses the allowance method. Post Windy's transaction to the account receivable and allowance for bad debts T-accounts Journalize Windy's adjustment to record bad debts expense assuming Windy estimate bad debts as 4% of credit sales. Post the adjustment to the appropriate T-accounts. Show how Windy Mountain Flagpoles will report net accounts receivable on its December 31, 2015 balance sheet. Question 2 Requirements Journalize…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education