Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

NEGATIVE BETA QUESTION

So far, we have been silent about expected

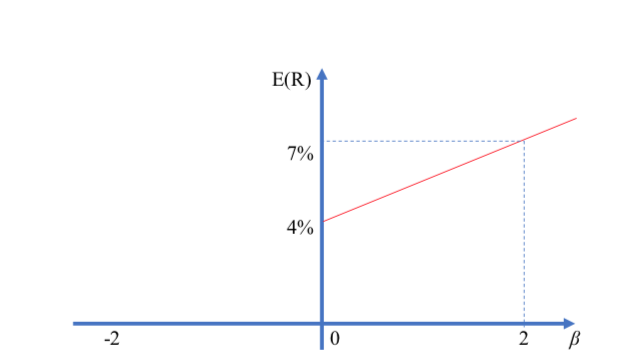

(a) There is something wrong about this conjecture. Using the numbers provided above, prove that this SML is flawed. (Prove a brief explanation)

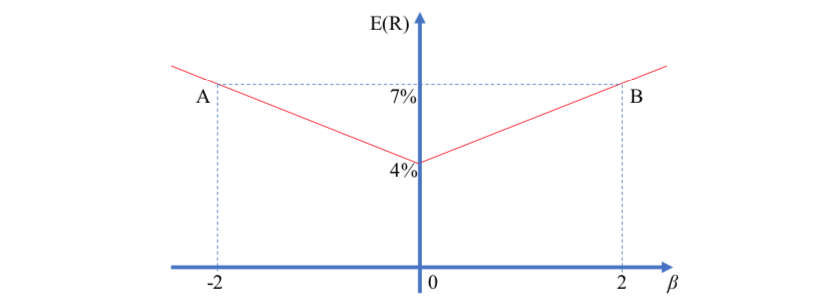

(b) Draw the rest of SML where is β negative in the above based on your answer in a) What is the meaning of the expected returns if they are lower (or higher or equal given your answer) then 4%? (Prove a brief explanation)

Transcribed Image Text:E(R) ↑

7%

4%

-2

Transcribed Image Text:E(R)

7%

-2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- q27- Which of the following related to the Correlation coefficient (r) are true? Select one: a. r = +1: a perfect linear relationship exists between the two variables b. r > 1: a non-linear relationship between the two variables c. r = 0: a weak linear relationship between the two variables d. r = -1: no linear relationship exists between the two variablesarrow_forwardPlease answer the following questions, and justify your opinion by providing peer-reviewed support to your arguments: Compare and contrast the risk versus expected rate of return tradeoff, the security market line, and determination of beta on this basis. Include explanation of all the constituents, namely security market line, risk measure, expected rate of return, risk-free rate of return, and market rate of return. Include hypothetical examples for better clarityarrow_forwardA barbell strategy outperforms a bullet strategy of the same duration in the face of a flattening yield curve. A. True B. Falsearrow_forward

- Within the Single Index Model paradigm, which of the following would contribute to higher overall risk for a security? O Higher beta O Lower alpha Lower market variance O Lower variance of residualsarrow_forwardA risky security has less risk than the overall market. What must the beta of this security be? O 0 but< 1 O 1 O The beta cannot be determined based on the information provided.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education