FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

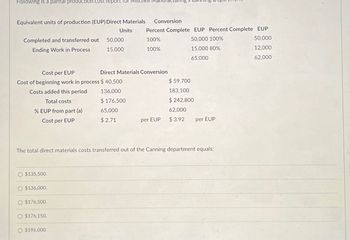

Transcribed Image Text:Following is a partial production cost report for Mitchell Mar

Equivalent units of production (EUP) Direct Materials

Units

Completed and transferred out

Ending Work in Process

Cost per EUP

Cost of beginning work in process $40,500

Costs added this period

136,000

Total costs

$ 176,500

% EUP from part (a)

Cost per EUP

O $135,500.

O $136,000.

O $176,500.

50,000

15,000

O $176,150.

O $196,000.

Conversion

65,000

$2.71

Percent Complete EUP Percent Complete EUP

100%

50,000 100%

50,000

100%

15,000 80%

12,000

65,000

62,000

Direct Materials Conversion

The total direct materials costs transferred out of the Canning department equals:

per EUP

$ 59,700

183,100

$ 242,800

62,000

$3.92

per EUP

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question Content Area Use this information about Department G to answer the question that follows. Department G had 2,040 units 25% completed at the beginning of the period, 12,400 units were completed during the period, 1,700 units were 20% completed at the end of the period, and the following manufacturing costs were debited to the departmental work in process account during the period: Work in process, beginning of period $33,300 Costs added during period: Direct materials (12,060 units at $9) 108,540 Direct labor 85,610 Factory overhead 24,460 All direct materials are added at the beginning of the process, and the first-in, first-out cost flow method is used. Determine the total cost of the inventory in process at the end of the period. Round the unit cost computation to the nearest cent. a. $18,360 b. $23,868 c. $15,300 d. $17,680arrow_forwardQuestion Content Area Department G had 2,400 units 25% completed at the beginning of the period, 13,500 units were completed during the period, 2,000 units were 20% completed at the end of the period, and the following manufacturing costs debited to the departmental work in process account during the period: Work in process, beginning of period $27,200 Costs added during period: Direct materials (13,100 units at $8) 104,800 Direct labor 79,800 Factory overhead 26,600 All direct materials are placed in process at the beginning of production and the first-in, first-out method of inventory costing is used. The total cost of the departmental work in process inventory at the end of the period (round unit cost calculations to four decimal places and round your final answer to the nearest dollar)? a.$18,400 b.$19,200 c.$16,000 d.$24,960arrow_forwardEquivalent Units of Conversion Costs The Filling Department of Ivy Cosmetics Company had 4,100 ounces in beginning work in process inventory (80% complete). During the period, 51,800 ounces were completed. The ending work in process inventory was 3,600 ounces (40% complete). What are the total equivalent units for conversion costs? Feedback X units Check My Work Are you determining the equivalent units of materials added or of conversion of materials? When would materials typically be added in the process? When would conversion of these materials take place? Recall the definition of work in process.arrow_forward

- Equivalent Units of Conversion Costs The Rolling Department of Oak Ridge Steel Company had 5,236 tons in beginning work in process inventory (70% complete) on July 1. During July, 74,800 tons were completed. The ending work in process inventory on July 31 was 5,984 tons (10% complete). What are the total equivalent units for conversion costs? Round to the nearest whole unit.fill in the blank 1 unitsarrow_forwardEquivalent Units of Conversion Costs The Filling Department of Ivy Cosmetics Company had 4,700 ounces in beginning work in process inventory (90% complete). During the period, 33,500 ounces were completed. The ending work in process inventory was 1,700 ounces (70% complete). What are the total equivalent units for conversion costs? 38,920 X units. Featharkarrow_forwardhow can I resolve this problem? Percent Completed Units Materials Conversion Work in process, beginning 50,000 70% 40% Started into production 265,000 Completed and transferred out 255,000 Work in process, ending 60,000 75% 25% Materials Conversion Work in process, beginning $ 16,600 $ 5,000 Cost added during June $ 178,400 $ 105,700 Required: 1. Calculate the Blending Department's equivalent units of production for materials and conversion in June. 2. Calculate the Blending Department's cost per equivalent unit for materials and conversion in June. 3. Calculate the Blending Department's cost of ending work in process inventory for materials, conversion, and in total for June. 4. Calculate the Blending Department's cost of units transferred out to the Bottling Department for materials, conversion, and in total for June. 5. Prepare a cost reconciliation report for the Blending Department for June.arrow_forward

- 144 Cost per Equivalent Unit The cost of direct materials transferred into the Rolling Department of Kraus Company is $523,800. The conversion cost for the period in the Rolling Department is $304,000. The total equivalent units for direct materials and conversion are 2,700 tons and 4,750 tons, respectively. torial and conversion costs ner covalent unitarrow_forwardUnits Direct Materials Conversion Percent Complete Percent Complete Beginning work in process inventory 60,000 60% 40% Units started this period 322,000 Completed and transferred out 300,000 Ending work in process inventory 82,000 80% 30% Compute the number of equivalent units of production for both direct materials and conversion for April using the weighted average method.arrow_forwardQuestion Content Area Department A had 4, 800 units in Work in Process that were 79% completed at the beginning of the period at a cost of $6, 100. During the period, 25,000 units of direct materials were added at a cost of $55,000, and 27,700 units were completed. At the end of the period, 2, 100 units were 36% completed. All materials are added at the beginning of the process. Direct labor was $25,200 and factory overhead was $4,200. The cost of the 2,100 units in process at the end of the period if the first - in, first-out method is used to cost inventories was a. $5,521 b. $6, 422 c. $5,071 d. $4,620arrow_forward

- 2arrow_forward4arrow_forwardces Beginning work in process inventory Units started this period Beginning work in process Direct materials Completed and transferred out Ending work in process inventory Production cost information for the forming department follows. Conversion Costs added this period Direct materials Conversion Total costs to account for Required A Required B Required C Units Costs of beginning work in process Costs added this period Total costs Equivalent units of production (from part a) Cost per equivalent unit of production 320,000 312,000 35,000 $ $ $ 40,000 16,100 Complete this question by entering your answers in the tabs below. 1,660,000 929,300 a. Calculate the equivalent units of production for both direct materials and conversion for the Forming department. b. Calculate the costs per equivalent unit of production for both direct materials and conversion for the Forming departm c. Using the weighted average method, assign costs to the forming department's output-specifically, its units…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education