FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

None

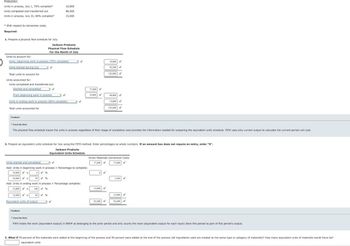

Transcribed Image Text:Production:

Units in process, July 1, 70% complete*

Units completed and transferred out

10,800

88,000

Units in process, July 31, 80% complete*

15,000

*With respect to conversion costs.

Required:

1. Prepare a physical flow schedule for July.

Jackson Products

Physical Flow Schedule

For the Month of July

Units to account for:

Units, beginning work is process (70% complete)

Units started during July

Total units to account for

Units accounted for:

Units completed and transferred out:

Started and completed

From beginning work in process

Units in ending work in process (80% complete)

Total units accounted for

Feedback

Check My Work

10,800

92.200

103,000

77,200

10,800✓

88,000

15,000

103,000

The physical flow schedule traces the units in process regardless of their stage of completion and provides the information needed for preparing the equivalent units schedule. FIFO uses only current output to calculate the current-period unit cost.

2. Prepare an equivalent units schedule for July using the FIFO method. Enter percentages as whole numbers. If an amount box does not require an entry, enter "0".

Jackson Products

Equivalent Units Schedule

Direct Materials Conversion Costs

77,200 V

77.200✔

Units started and completed

Add: Units in beginning work in process x Percentage to complete:

10,800 x

10,800 x

30 %

Add: Units in ending work in process x Percentage complete:

15,000 x

100 %

15,000 x

80 %

Equivalent units of output

Feedback

3,240

15,000

12,000

92,200

92,440

▼ Check My Work

FIFO treats the work (equivalent output) in BWIP as belonging to the prior period and only counts the work (equivalent output for each input) done this period as part of this period's output.

3. What if 70 percent of the materials were added at the beginning of the process and 30 percent were added at the end of the process (all ingredients used are treated as the same type or category of materials)? How many equivalent units of materials would there be?

equivalent units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education