FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

B5).

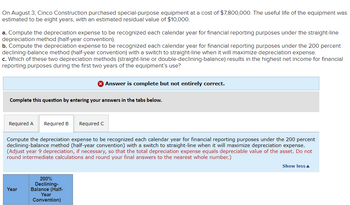

Transcribed Image Text:On August 3, Cinco Construction purchased special-purpose equipment at a cost of $7,800,000. The useful life of the equipment was

estimated to be eight years, with an estimated residual value of $10,000.

a. Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the straight-line

depreciation method (half-year convention).

b. Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the 200 percent

declining-balance method (half-year convention) with a switch to straight-line when it will maximize depreciation expense.

c. Which of these two depreciation methods (straight-line or double-declining-balance) results in the highest net income for financial

reporting purposes during the first two years of the equipment's use?

Complete this question by entering your answers in the tabs below.

Required A Required B

Year

Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the 200 percent

declining-balance method (half-year convention) with a switch to straight-line when it will maximize depreciation expense.

(Adjust year 9 depreciation, if necessary, so that the total depreciation expense equals depreciable value of the asset. Do not

round intermediate calculations and round your final answers to the nearest whole number.)

200%

Declining-

Balance (Half-

Answer is complete but not entirely correct.

Required C

Year

Convention)

Show less

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: introduction

VIEW Step 2: a) The calculation of the depreciation expenses as per straight line depreciation are as follows-

VIEW Step 3: b) The calculation of the depreciation expenses as per double decline depreciation are as follows-

VIEW Step 4: c) The method charging more deprecation-

VIEW Solution

VIEW Step by stepSolved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- E9.7(a,b2)arrow_forward48. Which of the following is not an issue associated with liabilities?a. Reportingb. Identificationc. Valuation and Measurementd. Assessmentarrow_forwardQuestion 3: When is an employer NOT required to file a quarterly Form 941? Answer: А. O When annual tax liability for federal income, Social Security, and Medicare tax is less than $1,000 В. O When annual tax liability for federal income, Social Security, and Medicare tax is less than $1,500 С. O When annual tax liability for federal income, Social Security, and Medicare tax is less than $2,500 D. When annual tax liability for federal income, Social Security, and Medicare tax is less than $100,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education