FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

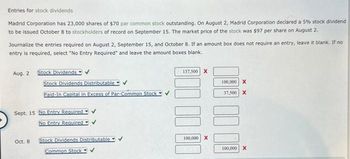

Transcribed Image Text:Entries for stock dividends

Madrid Corporation has 23,000 shares of $70 par common stock outstanding. On August 2, Madrid Corporation declared a 5% stock dividend

to be issued October 8 to stockholders of record on September 15. The market price of the stock was $97 per share on August 2.

Journalize the entries required on August 2, September 15, and October 8. If an amount box does not require an entry, leave it blank. If no

entry is required, select "No Entry Required" and leave the amount boxes blank.

Aug. 2 Stock Dividends

Stock Dividends Distributable ✔

Paid-In Capital in Excess of Par-Common Stock

Sept. 15 No Entry Required

Oct. 8

No Entry Required ✔

Stock Dividends Distributable

Common Stock ✔

137,500 X

100,000 X

100,000 X

37,500 X

100,000 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Owearrow_forwardEntries for Stock Dividends Madrid Corporation has 22,000 shares of $80 par common stock outstanding. On August 2, Madrid Corporation declared a 4% stock dividend to be issued October 8 to stockholders of record on September 15. The market price of the stock was $96 per share on August 2. Journalize the entries required on August 2, September 15, and October 8. If an amount box does not require an entry, leave it blank. If no entry is required, select "No Entry Required and leave the amount boxes blank. Aug. 2 Sept. 15 Oct. 8arrow_forwardEntries for treasury stock On May 27, Mama Mia Inc, reacquired 79,000 shares of its common stock at $10 per share. On August 3, Mama Mia sold 53,000 of the reacquired shares at $13 per share. On November 14, Mama Mia sold the remaining shares at $8 per share. Journalize the transactions of May 27, August 3, and November 14. If an amount box does not require an entry, leave it blank. May 27 Treasury Stock Cash Aug. 3 Cash Treasury Stock Paid-In Capital from Sale of Treasury Stock Nov. 14 Cash Paid-In Capital from Sale of Treasury Stock Treasury Stock °arrow_forward

- Help me plsarrow_forwardOn May 10, a company issued for cash 2,000 shares of no-par common stock (with a stated value of $5) at $14, and on May 15, it issued for cash 2,000 shares of $18 par preferred stock at $58. Journalize the entries for May 10 and 15, assuming that the common stock is to be credited with the stated value. If an amount box does not require an entry, leave it blank. May 10 May 15arrow_forwardOn May 10, a company issued for cash 1,600 shares of no-par common stock (with a stated value of $4) at $17, and on May 15, it issued for cash 2,000 shares of $17 par preferred stock at $61. Journalize the entries for May 10 and 15, assuming that the common stock is to be credited with the stated value. If an amount box does not require an entry, leave it blank.arrow_forward

- Entries for Stock Dividends Vienna Corporation has 29,000 shares of $80 par common stock outstanding. On August 2, Vienna Corporation declared a 4% stock dividend to be issued October 8 to stockholders of record on September 15. The market price of the stock was $115 per share on August 2. Journalize the entries required on August 2, September 15, and October 8. If an amount box does not require an entry, leave it blank. If no entry is required, select "No Entry Required" and leave the amount boxes blank. Aug. 2 fill in the blank 2 fill in the blank 3 fill in the blank 5 fill in the blank 6 fill in the blank 8 fill in the blank 9 Sept. 15 fill in the blank 11 fill in the blank 12 fill in the blank 14 fill in the blank 15 Oct. 8 fill in the blank 17 fill in the blank 18 fill in the blank 20 fill in the blank 21arrow_forwardEntries for stock dividends Zurich Corporation has 30,000 shares of $90 par common stock outstanding. On August 2, Zurich Corporation declared a 4% stock dividend to be issued October 8 to stockholders of record on September 15. The market price of the stock was $136 per share on August 2. Journalize the entries required on August 2, September 15, and October 8. If an amount box does not require an entry, leave it blank. If no entry is required, select "No Entry Required" and leave the amount boxes blank.arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image) On January 23, 15,000 shares of Aurora Company’s common stock are acquired at a price of $25 per share plus a $140 brokerage commission. On April 12, a $0.35-per-share dividend was received on the Aurora Company stock. On June 10, 5,200 shares of the Aurora Company stock were sold for $31 per share less a $115 brokerage commission. At the end of the accounting period on December 31, the fair value of the remaining 9,800 shares of Aurora Company’s stock was $30 per share. Aurora Company has 190,000 shares of common stock outstanding. Required: Journalize the entries for the original purchase, dividend, sale, and change in fair value under the fair value method. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for…arrow_forward

- Vincent Corporation has 90,000 shares of $105 par common stock outstanding, On June 30, Vincent Corporation declared a 3% stock dividend to be issued on July 30 to stockholders of record on July 15. The market price of the stock was $ $121 per share on June 30 If no entry is required, select "No Entry Required" and leave the amount boxes blank Journalize the entry required on June 30. If an amount box does not require an entry, leave it blank June 30 Journalize the entry required on July 15. If an amount box does not require an entry, leave it Mank My 15 Sourmalize the entry required on July 30, If an amount box does not require an entry, leave it blank July 30arrow_forwardEntries for Stock Dividends Red Market Corporation has 370,000 shares of $27 par common stock outstanding. On June 8, Red Market Corporation declared a 5% stock dividend to be issued August 12 to stockholders of record on July 13. The market price of the stock was $51 per share on June 8. Journalize the entries required on June 8, July 13, and August 12. If no entry is required, select "No Entry Required" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. Stock Dividends / | 943,500 June 8 Stock Dividends Distributable / Paid-In Capital in Excess of Par-Common Stock No Entry Required July 13 No Entry Required v 0. 0. Aug. 12 Stock Dividends Distributable / Common Stock /arrow_forwardpleasee dont provide answer in image format thank youarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education