Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

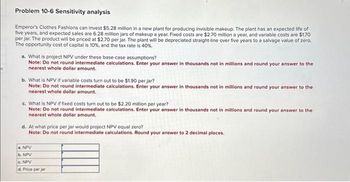

Transcribed Image Text:## Problem 10-6: Sensitivity Analysis

Emperor’s Clothes Fashions can invest $5.28 million in a new plant for producing invisible makeup. The plant has an expected life of five years, and expected sales are 6.28 million jars of makeup a year. Fixed costs are $2.70 million a year, and variable costs are $1.70 per jar. The product will be priced at $2.70 per jar. The plant will be depreciated straight-line over five years to a salvage value of zero. The opportunity cost of capital is 10%, and the tax rate is 40%.

### Questions:

a. **What is the project NPV under these base-case assumptions?**

*Note: Do not round intermediate calculations. Enter your answer in thousands not in millions and round your answer to the nearest whole dollar amount.*

b. **What is NPV if variable costs turn out to be $1.90 per jar?**

*Note: Do not round intermediate calculations. Enter your answer in thousands not in millions and round your answer to the nearest whole dollar amount.*

c. **What is NPV if fixed costs turn out to be $2.20 million per year?**

*Note: Do not round intermediate calculations. Enter your answer in thousands not in millions and round your answer to the nearest whole dollar amount.*

d. **At what price per jar would project NPV equal zero?**

*Note: Do not round intermediate calculations. Round your answer to 2 decimal places.*

### Table for Answers:

- a. NPV

- b. NPV

- c. NPV

- d. Price per jar

(Note: In this problem, no graphs or diagrams are present to explain.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Caradoc Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $410,000 is estimated to result in $150,000 in annual pre-tax cost savings. The press falls into Class 8 for CCA purposes (CCA rate of 20% per year), and it will have a salvage value at the end of the project of $55,000. The press also requires an initial investment in spare parts inventory of $20,000, along with an additional $3,100 in inventory for each succeeding year of the project. If the shop’s tax rate is 35% and its discount rate is 9%. Calculate the NPV of this project.arrow_forwardGrouper Growth Farms, a farming cooperative, is considering purchasing a tractor for $559,050. The machine has a 10-year life and an estimated salvage value of $43,000. Delivery costs and set-up charges will be $12,800 and $410, respectively. Grouper Growth uses straight-line depreciation and has a required rate of return of 9%. Grouper Growth estimates that the tractor will be used five times a week with the average charge to the individual farmers of $410. Fuel is $55 for each use of the tractor. The present value of an annuity of 1 for 10 years at 9% is 6.41766. Click here to view PV tables. For the new tractor, compute the: (a) Your answer has been saved. See score details after the due date. Cash payback period. (Round answer to 1 decimal places, e.g. 15.2.) Cash payback period (b) Net present value Net present value. (Round factor values to 5 decimal places, e.g. 15.11212. Round Intermediate calculations and final answer to O decimal places, e.g. 5,275.) Save for Later 6.2 $…arrow_forwardVikarmbhaiarrow_forward

- Tanaka Machine Shop is considering a 4-year project to improve its production efficiency. Buying a new machine press for $395,000 is estimated to result in $151,000 in annual pretax cost savings. The press falls in the 5-year MACRS class, and it will have a salvage value at the end of the project of $51,000. The press also requires an initial investment in spare parts inventory of $22,000, along with an additional $3,200 in inventory for each succeeding year of the project. The shop’s tax rate is 22 percent and its discount rate is 9 percent. (MACRS schedule) Calculate the NPV of this project. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardCori's Meats is looking at a new sausage system with an installed cost of$304,000. This cost will be depreciated straight-line to zero over the project's five-year life, at theend of which the sausage system can be scrapped for $30,000. The sausage system will save the firm$116,000 per year in pretax operating costs and the system requires an initial investment in net workingcapital of $15,000. If the tax rate is 23 percent and the discount rate is 10 percent, what is the NPV ofthis project? Security F has an expected return of 11 percent and a standarddeviation of 47 percent per year. Security G has an expected return of 14 percent and a standarddeviation of 63 percent per year.a. What is the expected return on a portfolio composed of 65 percent of Security F and 35 percent ofSecurity G?b. If the correlation between the returns of Security F and Security G is. 15, what is the standarddeviation of the portfolio described in part (a)? One potential criticism of the internal rate of…arrow_forwardBriggs Excavation Company is planning an investment of $932,100 for a bulldozer. The bulldozer is expected to operate for 3,000 hours per year for eight years. Customers will be charged $140 per hour for bulldozer work. The bulldozer operator costs $32 per hour in wages and benefits. The bulldozer is expected to require annual maintenance costing $30,000. The bulldozer uses fuel that is expected to cost $42 per hour of bulldozer operation. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.352 2.991 6 4.917 4.355 4.111 3.784 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Determine the equal annual net cash flows from operating the bulldozer. Use a minus sign to indicate cash outflows.…arrow_forward

- Tanaka Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $429,000 is estimated to result in $161,000 in annual pretax cost savings. The press falls in the MACRS five- year class (MACRS schedule) and it will have a salvage value at the end of the project of $62,000. The press also requires an initial investment in spare parts inventory of $16,700. along with an additional $3,700 in inventory for each succeeding year of the project. The shop's tax rate is 22 percent and its discount rate is 9 percent. Calculate the project's NPV.arrow_forwardCameron Industries is purchasing a new chemical vapor depositor in order to make silicon chips. It will cost $6,000,000 to buy the machine and $20,000 to have it delivered and installed Building a clean room in the plant for the machine will cost an additional $3 million. The machine is expected to raise gross profits by $3,000,000 per year, starting at the end of the first year, with associated costs of $1 million for each of those years. The machine is expected to have a working life of six years and will be depreciated over those six years. The marginal tax rate is 20%. What are the incremental free cash flows associated with the new machine in year 0? OA-$6,000,000 OB. -$8,118,000 C. $1,003,333 OD. -$9.020,000arrow_forwardThe company would like you to look at a new project. This project involves the purchase of a new $2,000,000 fully auto mated plasma cutter that can be used in our metal works division. The products manufactured using the new technol ogy are expected to sell for an average price of $300 per unit, and the company analyst expects that the firm can sell 20,000 units per year at this price for a period of five years. The cutter will have a residual or savage value of $200,000. at the end of the project's five-year te. The firm also expects to have to invest an additional $300,000 in working capital to support the new business. Other pertinent Information concerning the business venture is as follows: (look at the picture attached) a) Estimate the cash flows for the investment under the listed base-case assumptions. Calculate the project NPV for these cash flows. b) Evaluate the NPV of the investment under the worst-case and best-case assumptions.arrow_forward

- Tanaka Machine Shop is considering a 4-year project to improve its production efficiency. Buying a new machine press for $420,000 is estimated to result in $166,000 in annual pretax cost savings. The press falls in the 5-year MACRS class, and it will have a salvage value at the end of the project of $66,000. The press also requires an initial investment in spare parts inventory of $27,000, along with an additional $3,450 in inventory for each succeeding year of the project. The shop's tax rate is 22 percent and its discount rate is 9 percent. (MACRS schedule) Calculate the NPV of this project. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV Should the company buy and install the machine press? O Yes O No 4arrow_forwardEsquire Company needs to acquire a molding machine to be used in its manufacturing process. Two types of machines that would be appropriate are presently on the market. The company has determined the following: Machine A could be purchased for $33,000. It will last 10 years with annual maintenance costs of $1,100 per year. After 10 years the machine can be sold for $3,465. Machine B could be purchased for $27,500. It also will last 10 years and will require maintenance costs of $4,400 in year three, $5,500 in year six, and $6,600 in year eight. After 10 years, the machine will have no salvage value. Required: Assume an interest rate of 8% properly reflects the time value of money in this situation and that maintenance costs are paid at the end of each year. Ignore income tax considerations. Calculate the present value of Machine A & Machine B. Which machine Esquire should purchase?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education