FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

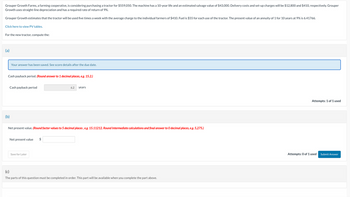

Transcribed Image Text:Grouper Growth Farms, a farming cooperative, is considering purchasing a tractor for $559,050. The machine has a 10-year life and an estimated salvage value of $43,000. Delivery costs and set-up charges will be $12,800 and $410, respectively. Grouper

Growth uses straight-line depreciation and has a required rate of return of 9%.

Grouper Growth estimates that the tractor will be used five times a week with the average charge to the individual farmers of $410. Fuel is $55 for each use of the tractor. The present value of an annuity of 1 for 10 years at 9% is 6.41766.

Click here to view PV tables.

For the new tractor, compute the:

(a)

Your answer has been saved. See score details after the due date.

Cash payback period. (Round answer to 1 decimal places, e.g. 15.2.)

Cash payback period

(b)

Net present value

Net present value. (Round factor values to 5 decimal places, e.g. 15.11212. Round Intermediate calculations and final answer to O decimal places, e.g. 5,275.)

Save for Later

6.2

$

years

(c)

The parts of this question must be completed in order. This part will be available when you complete the part above.

Attempts: 1 of 1 used

Attempts: 0 of 1 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you explain how to do thisarrow_forwardExercise 6-8 The following comparative information is available for Culver Corporation for 2017. LIFO FIFO $93,430 $93,430 37,860 29,750 29,280 29,280 9,200 9,200 32,380 32,380 Sales revenue Cost of goods sold Operating expenses (including depreciation) Depreciation Cash paid for inventory purchases Determine net income under each approach. Assume a 30% tax rate. Net Income $ LINK TO TEXT LIFO FIFO Determine net cash provided by operating activities under each approach. Assume that all sales were on a cash basis and that income taxes and operating expenses, other than depreciation, were on a cash basis. Net cash provided by operating activities s LIFO $ FIFOarrow_forwardThe following  transactions occurred for Lawrence engineering Post the transactions to the T-accountsarrow_forward

- Entries for Stock Investments, Dividends, and Sale of Stock Seamus Industries Inc. buys and sells investments as part of its ongoing cash management. The following investment transactions were completed during the year: Feb. 24 Acquired 400 shares of Tett Co.'s stock for $105 per share plus a $148 brokerage commission. May 16 Acquired 1,600 shares of Issacson Co.'s stock for $26 per share plus a $80 commission. July 14 Sold 200 shares of Tett Co. stock for $117 per share less a $76 brokerage commission. Aug. 12 Sold 600 shares of Issacson Co. stock for $21 per share less a $65 brokerage commission. Oct. 31 Received dividends of $0.24 per share on Tett Co, stock. Dec. 31 At the end of the accounting period, the fair value of the remaining 200 shares of Tett Co.'s stock was $105.57 per share. The fair value of the remaining 1,000 shares of Isaacson Co.'s stock was equal to its cost of $26.05 per share. Journalize the entries for these transactions. In your computations, round per share…arrow_forwardWhen to use either the one in grey or yellow? They yield different results- for the one in grey i put t = to number of years *number of times a year compounded, as instructed in text from tutorarrow_forwardPlease help me with show all calculation thankuarrow_forward

- How would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardWhat is the present value of $3,000 to be received 2 years from now, if the discount rate is: (a) 9%, (b) 13%, and (c) 25%? 1. Use the appropriate table (Appendix C: Table 1) to answer the above questions. 2. Use the formula shown at the bottom of Appendix C, Table 1, to answer the above questions. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Use the appropriate table (Appendix C: Table 1) to answer the above questions. (Round your answers to the nearest whole dollar amount.) (a) (b) (c) Discount Rate 9% 13% 25% $ GAGA $ X Answer is complete but not entirely correct. $ Present Values 1 x 1 x 1 xarrow_forwardNeed only handwritten solution only (not typed one).arrow_forward

- please help me provide complete and correct answer for all requirements with all working for all parts answer in text please answer correct please remember answer all requirements or skip /leave for other expert thanks million thanks please double underline need answer for all requirements or skip please do not waste time or question by giving incomplete or incorrect answer please no copy paste from other answerarrow_forward19. for simple interest FIND THE UNKNOWN QUANTITY FOR EVERY GIVEN CONDITION (show your solution submit to classwork) t= 1 1/2 years, r = 10% F= P50,000 Find P and | *arrow_forwardUsing formulas, no tables, correct answer= 6,962.6, can you try again?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education