FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

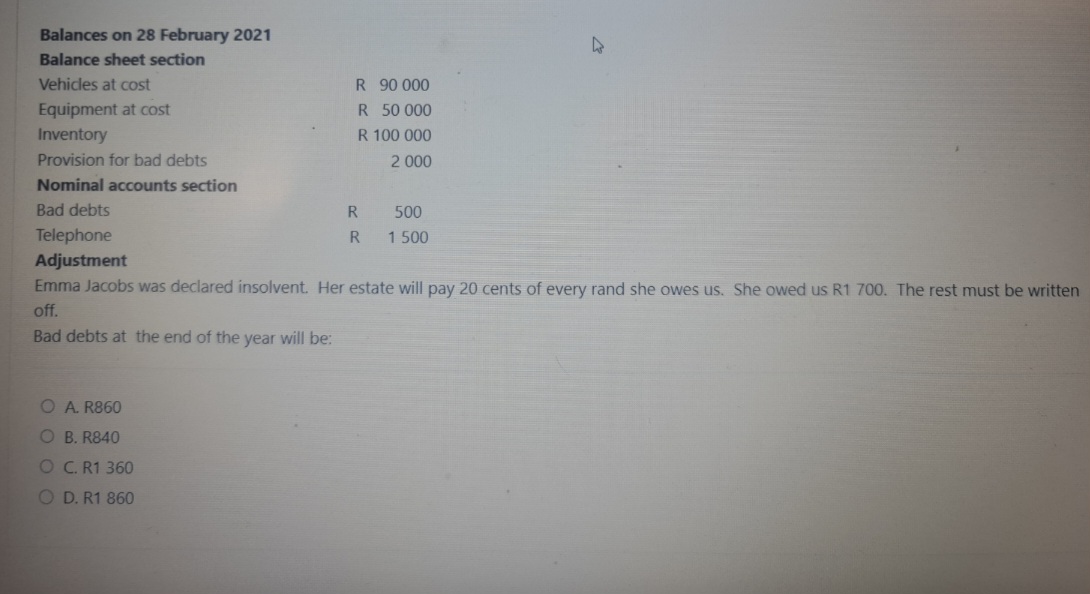

Transcribed Image Text:Balances on 28 February 2021

Balance sheet section

Vehicles at cost

Equipment at cost

Inventory

Provision for bad debts

Nominal accounts section

Bad debts

Telephone

Adjustment

R 90 000

R 50 000

R 100 000

2 000

O A. R860

OB. R840

OC. R1 360

OD. R1 860

R

R

500

1 500

4

Emma Jacobs was declared insolvent. Her estate will pay 20 cents of every rand she owes us. She owed us R1 700. The rest must be written

off.

Bad debts at the end of the year will be:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 3. Brittney won $765,000 in a lawsuit against MIT over theft of intellectual property. She and Santana decide to invest the money in a college fund for their 5-year-old daughter. How much will they have when their daughter is 18? Calculate the balance for each of the following account options: a. 4.36% APR interest compounded continuously b. 4.49% APR interest compounded quarterly c. 4.6% APR interest compounded yearlyarrow_forwardTina loaned P550,000 at 12% compounded annually. She signed a contract to repay the loan in 25 equal annual payments. If after she has made 15th payment, how much is still unpaid of the original principal? P396,221.78 P81,987.30 P477,611.74 P72,388.26arrow_forwardshobhaarrow_forward

- Emily receives R1 500,00 from the bank now that charge 10,5% simple discount per annum. She has to pay back the bank as amount of R1 893,75 in a few months' time. The number of months after which Emily pays back the loan, rounded to one decimal place, is O a. 23,8. O b. 2,5. C. 2,0. O d. 30,0.arrow_forwardYou have an HO policy with the following limits: A $75,000 (dwelling) B-$ 7,500 (other structures) C-$25,000 (personal property). A tornado strikes your property. You lose your house, which is worth $65,000 at the time of the loss. You also lose an unattached shed worth $8,000, and personal property worth $30,000. You will collect? (assume $0 deductible, ignore the ACV calculation and assume there is no fraud or other unusual circumstances surrounding the loss.) OA$107,500 OB. $97,500 OC.$103,000arrow_forwardMitt was injured by a bus called “Move Forward.” He won a lawsuit and will receive $10,000 per month, at the beginning of each month, for the next 10 years. How much must “Move Forward” deposit into an account earning 5%, compounded monthly, to satisfy this judgment?a. $946,742.b. $937,109.c. $942,814.d. $907,899.arrow_forward

- Patricia initially borrowed $6,700 from CIBC Bank at 2.9% compounded quarterly. After 4 years she repaid $1,809, then 6 years after the $6,700 was initially borrowed she repaid $2,010. If she pays off the debt 9 years after the $6,700 was initially borrowed, how much should her final payment be to clear the debt completely? Round all answers to two decimal places if necessary. P/Y = 4 % PV = $ 6700 P/Y = 4 % PV = $ 5711.92 C/Y = 4 Amount owed after 4 years (before the first payment) = $ 7,520.92✓ positive value) PMT= $ 0 P/Y = PV = $ Amount owed after the first payment of $1,809 (enter a positive value): $ 5711.92 ✓ C/Y = 4 PMT= $0 N = 16 C/Y = PMT = $ FV = $ 7,520.92✓ N = N = 12 Amount owed after 6 years (before the second payment) = $5816.91 x (enter a positive value) Amount owed after the second payment of $2,010 (enter a positive value): $ FV = $ FV = $5816.91 X I/Y = 2.9 Final payment (after 9 years); (enter a positive value) $ (enter a X I/Y = 2.9 I/Y = %arrow_forwardSam refuses to retire until his retirement account has a balance of at least $ 369,214 . Sam refuses to make any more deposits in the account. The account currently has a balance of$ 117,923 and earns 6% per year, compounded semi-annually. How long does Sam have before he will retire? You are computing number of years. Round your answer to one decimal place. For example, record 14.294 years as 14.3.arrow_forwardJoe Jay purchased a new colonial home for $260,000, putting down 20%. He decided to use Loyal Bank for his mortgage. They were offering a 6 1/2% for a 25-year mortgage. The principal after the first payment had a balance outstanding of: Multiple Choice $259,652.79 $207,722.24 $206,595.57 $258,244.46arrow_forward

- Edward loaned 55000 to a small business at 4.66% compounded quarterly for 1 year and 9 months how much would the business have to repay her at the end of periodarrow_forwardDick Hercher bought a home in Homewood, Illinois, for $230,00O. He put down 20% and obtained a mortgage for 25 years at 8%. The total interest cost of the loan is: Multiple Choice $327,372.80 None of these $184,000.00 $242,144.00 $242,411.00 acerarrow_forwardSteinar loaned a friend $9,500 to buy some stock 3 years ago. In the current year the debt became worthless. a. How much is Steinar's deduction for the bad debt for this year? (Assume he has no other capital gains or losses.) 4,750 X as a nonbusiness ✓ bad debt. Feedback ▼ Check My Work Bad debts fall into one of two categories, business bad debts or nonbusiness bad debts. Debts that arise from the taxpayer's trade or busin are classified as business bad debts, while all other debts are considered nonbusiness bad debts. The distinction between the two types of debts is important, since business bad debts are ordinary deductions and nonbusiness bad debts are short-term capital losses. b. What can Steinar do with the deduction not used this year? The remaining $ 0x can be carried forward as a short-term capital loss and deducted in future years, subject to an annual limitationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education