Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

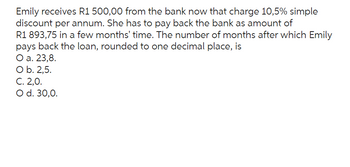

Transcribed Image Text:Emily receives R1 500,00 from the bank now that charge 10,5% simple

discount per annum. She has to pay back the bank as amount of

R1 893,75 in a few months' time. The number of months after which Emily

pays back the loan, rounded to one decimal place, is

O a. 23,8.

O b. 2,5.

C. 2,0.

O d. 30,0.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 10. Kristine has $5,000 in an account today that pays 3% interest rate. Two years from now she withdraws $1,000 from that account to buy a laptop. How much will she have in this account in 6 years if she does not make any other deposits or withdrawals? Assume annual compounding. a. $4,844.75 b. $7,095.77 c. $4,776.21 d. $7,164.31 e. $4,970.26 11. Your grandaunt wants to buy an (ordinary) annuity that will pay her cost of living of $70,000 per year for 20 years. If the quoted interest rate today is 5% and the annuity compounds monthly, how much does this annuity cost? a. $872,354.72 b. $865,404.52 c. $883,897.66 d. $863,824.15 12. After graduation, you get a great job. You budget $1,000 per month towards housing. You'd like to buy a house. Assume that the interest rate = 4% for a 30-year mortgage. a. How much can you borrow? i. $209,461.24 ii. $207,504.40 iii. $694,049.40 iv. $24,999.98 b. Eight years into the mortgage, your company decides to relocate you to Hawaii. How much must you…arrow_forwardLauren deposited $10,000 today. He plans to withdraw $1100 every year. For how long can she withdraw from the account starting 1 year from now if interest is 89% compounded annually? State your answor in years and months (trom 0 to 11 months) This is an example of OA Compound Interest Problem (PMT-0) OB. Payout Annuity Problem (FV0) OC. Savings Annuity Problem (PV= 0) The TVM variable being solved is OA PMY OB. n Use your TVM solver to answer the following questions (a) It will take years to depelete the account Round UP to the nearest whole period (b) She can make withdrawals for year(s) and month(s) Answers should be whole numbers with months is between 0 and 11 CHES O.C. FV OD. PVarrow_forwardEngr. Marquez wants to get from her bank account P29,120.84, 12 years from now. How much should she invests for three consecutive years (annually) starting this year if the interest rate is 0.23? "Use 4 decimal placesarrow_forward

- Jack and Jill borrow $21,000 at 6.4% amoritzed over 7 years to drill a well and renovate their kitchen and bathrooms. Assuming that the monthly principal and interest payments are made as agreed, what is the loan balance at the end of 2 years? (Round to nearest penny and enter, for example, as 123456.78) Answer: Checkarrow_forwardH5. Emily borrows a 2-year loan amount L, which she has to repay in 24 end-of-themonth payments. The first 16 payments are $1,000 each and the final 8 payments are $2,000 each. The nominal annual interest rate compounded monthly is 12%. Find L and then find the outstanding balance right after the 12th payment has been made.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education