FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

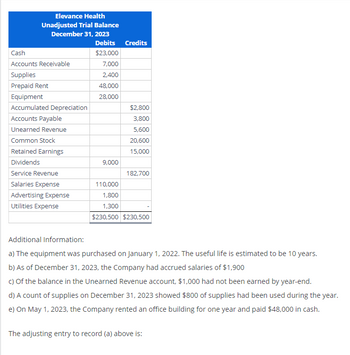

Transcribed Image Text:Elevance Health

Unadjusted Trial Balance

December 31, 2023

Cash

Accounts Receivable

Supplies

Prepaid Rent

Equipment

Accumulated Depreciation

Accounts Payable

Unearned Revenue

Common Stock

Retained Earnings

Dividends

Service Revenue

Salaries Expense

Advertising Expense

Utilities Expense

Debits Credits

$23,000

7,000

2,400

48,000

28,000

9,000

$2,800

3,800

5,600

20,600

15,000

182,700

110,000

1,800

1,300

$230,500 $230,500

Additional Information:

a) The equipment was purchased on January 1, 2022. The useful life is estimated to be 10 years.

b) As of December 31, 2023, the Company had accrued salaries of $1,900

c) of the balance in the Unearned Revenue account, $1,000 had not been earned by year-end.

d) A count of supplies on December 31, 2023 showed $800 of supplies had been used during the year.

e) On May 1, 2023, the Company rented an office building for one year and paid $48,000 in cash.

The adjusting entry to record (a) above is:

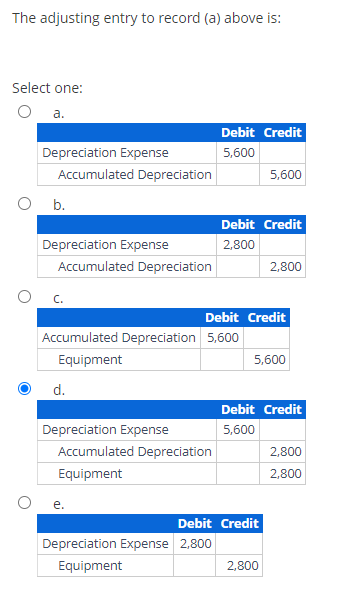

Transcribed Image Text:The adjusting entry to record (a) above is:

Select one:

a.

Depreciation Expense

Accumulated Depreciation

b.

Depreciation Expense

Accumulated Depreciation

C.

d.

Accumulated Depreciation 5,600

Equipment

Depreciation Expense

Accumulated Depreciation

Equipment

e.

Debit Credit

5,600

Debit Credit

2,800

Debit Credit

Depreciation Expense 2,800

Equipment

5,600

Debit Credit

2,800

5,600

Debit Credit

5,600

2,800

2,800

2,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Complete the aging schedule. Number of Days Accounts Outstanding Receivable Estimated % Uncollectible 0-45 days $ $734,000 2% 46-90 days 265,000 5% Over 90 days 106,000 15% Total $1,105,000 +A $ Total Estimated Uncollectible Accoarrow_forward2019 Ending Balances DEBITS CREDITS Cash 17,000 Marketable Securities 2,000 Accounts Rec. 14,000 Allowance for Bad Debt 2,000 Inventory 15,000 Prepaid Insurance 5,000 Land 30,000 Building 150,000 Accumulated Dep. - Building 45,000 Equipment 100,000 Accumulated Dep. - Equipment 20,000 Accounts Payable 9,000 Salaries Payable Unearned Revenue 2,000 Interest Payable Income Taxes Payable 3,000 Note Payable Bonds 100,000 Common Stock 50,000 Additional Pd-in-Capital 80,000 Retained Earnings 22,000 333,000 333,000 Complete the following jounral entries: Salaries are $2,200 per month (12 months of salaries expense must be booked). It is expected that one-half month will be owed on 12/31/20 because of when payday falls (therefore, 11.5 months of salaries have been paid and ½ month is still owed to the employees at year end). $56,000 in cash is borrowed on 9/30/20 by issuing a Note…arrow_forward25arrow_forward

- Account Title Beginning Balance Ending Balance Accounts receivable $28,600 $40,500 Allowance for doubtful accounts 1,760 2,160 Notes receivable 47,200 47,200 Interest receivable 930 4,234 The note receivable has a two-year term with a 7.00 percent interest rate. What amount of interest revenue was recognized during the period? How much cash was collected from interest? Please explain how you find the cash received for interestarrow_forwardeceivables in the Balance Sheet The following partial balance sheet contains errors. ZABEL COMPANYBalance SheetDecember 31, 20Y4 Assets Current assets: Cash $76,000 Notes receivable $117,500 Less interest receivable 9,300 108,200 Account receivable $477,000 Plus allowance for doubtful accounts 21,750 498,750 Prepare a corrected partial balance sheet for Zabel Company.arrow_forwardPrepaid rent Accounts receivable Cash Comon stock Retained earnings Current assets Prepare a classified balance sheet. Note: Allowance for doubtful accounts is subtracted from accounts receivable on the company's balance sheet. Total assets otal current assets Long-term Investments Current labies BENNETT COMPANY Balance Sheet Long term is Total abilities December 31 Assets Liabilities $ 2,700 Accounts payable 18,500 Allowance for doubtful accounts 29,098 Notes payable (due in 10 years) 13,500 Notes receivable (due in 4 years) 24,200 Equity Total quity Total abilities and equity 5 S 0 0 $ 4,200 1,000 11,400 0arrow_forward

- Cornerstone Exercise 5-28 Aging Method On December 31, 2021, Khalid Inc. has the following balances for accounts receivable and allowance for doubtful accounts: Accounts Receivable Allowance for Doubtful Accounts (a credit balance) During 2022, Khalid had $18,500,000 of credit sales, collected $17.945,000 of accounts receivable, and wrote off $60,000 of accounts receivable as uncollectible. At year-end. Khalid performs an aging of its accounts receivable balance and estimates that $52,000 will be uncollectible. Required: 1. Calculate Khalid's preadjustment balance in accounts receivable on December 31, 2022. $1,280,000 44,000 2. Calculate Khalid's preadjustment balance in allowance for doubtful accounts on December 31, 2022. 3. Prepare the necessary adjusting entry for 2022. Dec. 31 (Record adjusting entry for bad debt expense estimate)arrow_forwardcomplete part 2arrow_forward38 es Maps On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances: Accounts Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Land Equipment Accumulated Depreciation Accounts Payable Notes Payable (6%, due April 1, 2022) Common Stock Retained Earnings Totals Saved Helparrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education