Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Solve this Accounting problem

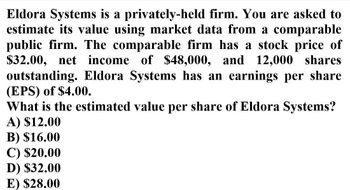

Transcribed Image Text:Eldora Systems is a privately-held firm. You are asked to

estimate its value using market data from a comparable

public firm. The comparable firm has a stock price of

$32.00, net income of $48,000, and 12,000 shares

outstanding. Eldora Systems has an earnings per share

(EPS) of $4.00.

What is the estimated value per share of Eldora Systems?

A) $12.00

B) $16.00

C) $20.00

D) $32.00

E) $28.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please provide the answer to this financial accounting question using the right approach.arrow_forwardWhat is the percentage return on these financial accounting question?arrow_forward(Market value analysis) The balance sheet for Larry Underwood Motors shows a book value of stockholders' equity (book value per share x total shares outstanding) of $1,391,000. Furthermore, the firm's income statement for the year just ended has a net income of $505,000, which is $0.232 per share of common stock outstanding. The price-earnings ratio for firms similar to Underwood Motors is 20.54. a. What price would you expect Underwood Motors shares to sell for? b. What is the book value per share for Underwood's shares? a. What price would you expect Underwood Motors shares to sell for? The market price per share is $ (Round to the nearest cent.)arrow_forward

- (Market value analysis) The balance sheet for Larry Underwood Motors shows a book value of stockholders' equity (book value per share x total shares outstanding) of $1,314,000. Furthermore, the firm's income statement for the year just ended has a net income of $578,000, which is $0.264 per share of common stock outstanding. The price-earnings ratio for firms similar to Underwood Motors is 21.81. a. What price would you expect Underwood Motors shares to sell for? b. What is the book value per share for Underwood's shares? a. What price would you expect Underwood Motors shares to sell for? The market price per share is $ (Round to the nearest cent.) C...arrow_forwardWhat is it's price earnings ratio on these financial accounting question?arrow_forward(Market value analysis) The balance sheet for Larry Underwood Motors shows a book value of stockholders' equity (book value per share total shares outstanding) of $1,367,000. Furthermore, the firm's income statement for the year just ended has a net income of $513,000, which is $0.276 per share of common stock outstanding. The price-earnings ratio for firms similar to Underwood Motors is 19.86. a. What price would you expect Underwood Motors shares to sell for? b. What is the book value per share for Underwood's shares? a. What price would you expect Underwood Motors shares to sell for? The market price per share is $. (Round to the nearest cent.)arrow_forward

- (Market value analysis)The balance sheet for Larry Underwood Motors shows a book value of stockholders' equity (book value per sharetimestotal shares outstanding) of $ 1,369,000. Furthermore, the firm's income statement for the year just ended has a net income of $ 505,000, which is $ 0.243 per share of common stock outstanding. The price-earnings ratio for firms similar to Underwood Motors is 18.55. a. What price would you expect Underwood Motors shares to sell for? b. What is the book value per share for Underwood's shares? Question content area bottom Part 1 a.What price would you expect Underwood Motors shares to sell for? The market price per share is $4.51.(Round to the nearest cent.) Part 2 b.What is the book value per share for Underwood's shares? The book value per share is $ ??? enter your response here. (Round to the nearest cent.)arrow_forwardOn the balance sheet of Bearcat Inc., you notice "Common Stock ($0.10 par)" of $248,655, "Capital Surplus" of $282,621, and "Retained Earnings" of $210,534. If Bearcat Inc. has Sales of $292,6836 and a profit margin of 30.52%, what is the price/earnings (P/E) ratio of the firm if their stock is currently selling for $21.94 per share? O None of these options are correct 67.18 54.97 240.97 61.07 DISCLarrow_forwardWhat is the percentage return on these financial accounting question?arrow_forward

- (Market value analysis) The balance sheet for Larry Underwood Motors shows a book value of stockholders' equity (book value per share x total shares outstanding) of $1,343,000. Furthermore, the firm's income statement for the year just ended has a net income of $530,000, which is $0.265 per share of common stock outstanding The price-earnings ratio for firms similar to Underwood Motors 20.91 a. What price would you expect Underwood Motors shares to sell for? b. What is the book vidue por share for Underwood's sharus? What price would you expect Underwood Motors shares to sell for? The market price per shares S (Round to the nearest cent)arrow_forwardYou are valuing Estelle Company, a private firm that manufactures shop tools, and you have identified several comparable firms that are publicly owned from which to calculate an estimated price-to-earnings multiple to use in your valuation. One of the comparable firms, Comp A, has a market value per share of $53.40, earnings per share for last year of $4.20 per share, a dividend for last year that was $1.10 per share, forecast earnings per share for the next year of $7.05, and a dividend that is expected to be unchanged. The forward price-to-earnings multiple for Comp A is: a. 17.2 b. 12.7 c. 9.0 d. 7.6 e. None of the above.arrow_forwardChoice???arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT