Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Financial accounting question

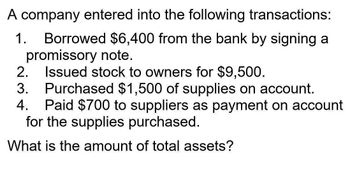

Transcribed Image Text:A company entered into the following transactions:

1.

Borrowed $6,400 from the bank by signing a

promissory note.

2. Issued stock to owners for $9,500.

3.

4.

Purchased $1,500 of supplies on account.

Paid $700 to suppliers as payment on account

for the supplies purchased.

What is the amount of total assets?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Provide journal entries to record each of the following transactions. For each, identify whether the transaction represents a source of cash (S), a use of cash (U), or neither (N). A. Paid $22,000 cash on bonds payable. B. Collected $12,600 cash for a note receivable. C. Declared a dividend to shareholders for $16,000, to be paid in the future. D. Paid $26,500 to suppliers for purchases on account. E. Purchased treasury stock for $18,000 cash.arrow_forwardXanthe Corporation had the following transactions occur in the current year: 1. Cash sale of merchandise inventory. 2. Sale of delivery truck at book value. 3. Sale of Xanthe common stock for cash. 4. Issuance of a note payable to a bank for cash. 5. Sale of a security held as an available-for-sale investment. 6. Collection of loan receivable. How many of the above items will appear as a cash inflow from investing activities on a statement of cash flows for the current year? Question 128 options: Five items Four items Three items Two itemsarrow_forwardAccompanying a bank statement for Borden Company is a credit memo for $21,200 representing the principal ($20,000) and interest ($1,200) on a note that had been collected by the bank. The company had been notified by the bank at the time of the collection but had made no entries. Journalize the entry that should be made by the company to bring the accounting records up to date. Refer to the Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTS Borden Company General Ledger ASSETS 110 Cash 111 Petty Cash 120 Accounts Receivable 131 Notes Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 181 Land 191 Office Equipment 192 Accumulated Depreciation-Office Equipment 193 Store Equipment 194 Accumulated Depreciation-Store Equipment LIABILITIES 210 Accounts Payable 221 Notes Payable 222 Interest Payable 231 Salaries Payable 241 Sales Tax Payable…arrow_forward

- Accompanying a bank statement for Santee Company is a credit memo for $15,120 representing the principal ($14,000) and interest ($1,120) on a note that had been collected by the bank. The company had been notified by the bank at the time of the collection but had made no entries. Required: On March 1, journalize the entry that should be made by the company to bring the accounting records up to date. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. Chart of Accounts CHART OF ACCOUNTS Santee Company General Ledger ASSETS 110 Cash 111 Petty Cash 120 Accounts Receivable 131 Notes Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 181 Land 191…arrow_forwardYou obtained the following information on the current account of Par Company during your examination of its financial statements for the year ended December 31, 2021. The bank statement on November 30, 2021 showed a balance of P 306,000 . Among the bank credits in November was customer’s noted for P 100,000 collected for the account of the company which the company recognized in December among its receipts. Included in the bank debits were costs of checkbooks amounting to P 1,200 and a P 40,000 check which was charged by the bank in error against Par Company account. Also in November, you ascertained that there were deposits in transit amounting to P 80,000 and outstanding checks totaling P 170,000. The bank statement for the month of December showed total credits of P 416,000 and total charges of P 204,000. The company’s books for December showed total debits of P 735,600 , total credits of P 407,200 and a balance of P485,600. Bank debit memos for December were: No. 121 for service…arrow_forward1. A check involves three parties. The person directed to receive the money is called the a.endorser. b.payee. c.drawer. d.drawee. 2. The time an asset is expected to last is called its a.fiscal period. b.depreciation. c.useful life. d.net loss value. 3. In reconciling a bank statement, the bank statement balance is $1,000 and the balance per books is $1,205. A bank service charge is $5; a deposit in transit totals $500; and outstanding checks total $300. The journal entry for a bank service charge would include a.debiting Cash and crediting Miscellaneous Expense. b.debiting Miscellaneous Expense and crediting Cash. c.debiting Cash and crediting Owner's Capital. d.debiting Accounts Payable and crediting Cash. 4. The journal entry to close revenue accounts includes a.debiting the revenue accounts and crediting the drawing account. b.debiting the revenue accounts and crediting Cash. c.debiting the revenue accounts and crediting Income Summary. d.debiting Income Summary…arrow_forward

- The following account balances were extracted from the accounting records of A and D Corporation: Accounts Receivable $280,000 Uncollectible Account Expense $45,000 Allowance for Uncollectible Accounts $35,000 What is the net realizable value of the accounts receivable? $280,000 O $270,000 O $200,000 O $245,000 O $235,000arrow_forwardAccompanying a bank statement for Santee Company is a credit memo for $21,600 representing the principal ($20,000) and interest ($1,600) on a note that had been collected by the bank. The company had been notified by the bank at the time of the collection but had made no entries.Required:On March 1, journalize the entry that should be made by the company to bring the accounting records up to date. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.arrow_forwardKindly answer the question belowarrow_forward

- Forest Beach Company experienced an event that had the following effects on its financial statements.arrow_forwardBelow you will see SOME (not all!) of UPS' transactions in their most recent fiscal year. Provide the journal entry or entries (accounts and amounts) needed to record each transaction. a) Borrowed $5,205 million cash from a bank by signing a note payable. Account Title Debit Creditarrow_forwardAccompanying a bank statement for Santee Company is a credit memo for $24,516 representing the principal ($22,700) and interest ($1,816) on a note that had been collected by the bank. The company had been notified by the bank at the time of the collection but had made no entries. Required: On March 1, journalize the entry that should be made by the company to bring the accounting records up to date. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College