ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

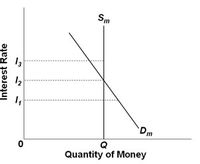

Refer to the diagram. Given Dm and Sm, an interest rate of i3 is not sustainable because the:

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

Transcribed Image Text:Sm

13

12

Dm

Q

Quantity of Money

İnterest Rate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If interest rates fall after a bond issue, the bond’s price will _____. This change will be more noticeable for _________ bonds. a. decrease ... long-term b. increase ... short-term c. decrease ... short-term d. increase ... long-termarrow_forwardShort-term interest rates: fluctuate widely, depending on their terms. tend to move together. always move in the same direction as long-term interest rates. are always above long-term interest rates.arrow_forwardIntroduce the concept of the yield curve and its relevance in economic activities in the Caribbean. Explain each of the four Modern Theories of Interest Rates (Pure Expectations Theory, Liquidity Preference Theory, Market Segmentation Theory, Preferred Habitat Theory) with examples from the Caribbean region. Compare and contrast the assumptions and implications of each theory in explaining interest rate dynamics in the context of the Caribbean.arrow_forward

- Which of the following is a true statement? Multiple Choice ___ If interest rates fall, U.S. Treasury bonds will have decreasing values. ___ If interest rates fall, corporate bonds will have decreasing values. ___ If interest rates fall, no bonds will enjoy rising values. ___ If interest rates fall, all bonds will enjoy rising valuesarrow_forwardWhy is the relationship between price and yield negative?a. Because investors reward higher cash-flows with a lower price.b. Because governments regulation prohibits a positive relationship.c. Because an increase in the yield discounts cash flows at a higher rate and so their netpresent value decreases.d. Because cash flows are variable over a bond’s life.arrow_forward26arrow_forward

- “The Security Market Line is flatter than the ‘Capital Asset Pricing Model’ (CAPM) would predict.” Describe the theory and empirical evidence related to this statement.arrow_forwardSuppose the current annual interest rate on a one-year government bond is 8% and the expected annual interest rate on a one-year bond one year from now is 8.5%, and a one- year bond two years from now is 9%. Based on this information, the current annual interest rate on a three-year government bond is approximately, A. 8.0% B. 9.0% 8.5% D. 8.2% 10% ABCDE C. E.arrow_forwardThe demand D (in billions of £) for a bond with coupon rate 5% and face value FV = 1000, and two years to maturity as a function of its price P is D = 4000 − 2P. The supply in (billions of £)as a function of the price of the bond is S = 2P + 400. b) Suppose that the yield to maturity of the bond is i = 0.05. What is the quantity demanded/supplied at this interest rate? What happens to the demand/supply of the bond as the interest rate increases? Explain why. c) What is the equilibrium interest rate? d) Suppose that the bond trades at premium. Is there excess demand or supply? Explain. e) There is a business cycle contraction, so both supply and demand shifts. After the shift, the new demand curve is given by: D = 4000 + X − 2P , whereas the new supply curve is S = 2P + 200. For which values of X will the interest increase/decrease? Which values of X are in line with empirical data?arrow_forward

- E3 The demand curve and supply curve for one-year discount bonds were estimated using the following equations: Bd Price=-2/5Quantity+990 Bs Price=Quantity+500 As the stock market continued to rise, the Federal Reserve felt the need to increase the interest rates. As a result, the new market interest rate increased to 19.65%, but the equilibrium quantity remained unchanged. What are the new demand and supply equations? Assume parallel shifts in the equationsarrow_forwardInflationary expectations in the economy increase rapidly, evoking a much stronger response from issuers of bonds than borrowers of bonds. Using the model of supply and demand for bonds, illustrate and explain the impact of this increase in inflationary expectation on equilibrium bond price and interest rate.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education