FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Hint: For taxes received

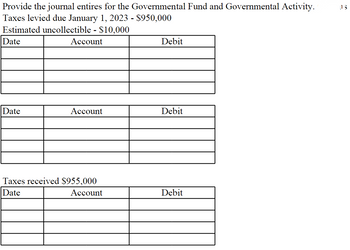

Transcribed Image Text:Provide the journal entires for the Governmental Fund and Governmental Activity.

Taxes levied due January 1, 2023 - $950,000

Estimated uncollectible - $10,000

Date

Account

Date

Account

Taxes received $955,000

Date

Account

Debit

Debit

Debit

DS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Find the tax owed on a purchase of $183.11 if the state sales tax rate is 6%.arrow_forwardournalize Payroll Tax The payroll register of Patel Heritage Co indicates $1,986 of social security withheld and $496.50 of Medicare tax withheld on total salaries of $33,100 for the period. Earnings of $9,600 are subject to state and federal unemployment compensation taxes at the federal rate of 0.8% and the state rate of 5.4%. Provide the journal entry to record the payroll tax expense for the period. If an amount box does not require an entry, leave it blank. Round to two decimal places. Payroll Tax Expense Payroll Tax Expense Social Security Tax Payable Social Security Tax Payable Medicare Tax Payable Medicare Tax Payable State Unemployment Tax Payable State Unemployment Tax Payable Federal Unemployment Tax Payable Federal Unemployment Tax Payablearrow_forwardtaxable income : 1225000 income taxes payable: 245000arrow_forward

- A customer purchases $28.14 in prodcts only $12.83 is taxable. How much sales tax is owed if the tax rate is 10%?arrow_forwardUse (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. Enter all amounts as positive numbers. Round your calculations and final answers to the nearest cent. Use the 2020 Federal income taxes tables for the percentage method table and the wage bracket method tablearrow_forwardFederal income taxes are allowed as an itemized deduction but are limited to $10,000? Ture or falsearrow_forward

- Nonearrow_forwardQuestion text The totals from the first payroll of the year are shown below. Total Earnings FICA OASDI FICA HI FIT W/H State Tax Union Dues Net Pay $36,195.10 $2,244.10 $524.83 $6,515.00 $361.95 $500.00 $26,049.22 Journalize the entry to deposit the FICA and FIT taxes.arrow_forwardPlease do not give image formatarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education