ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Economics

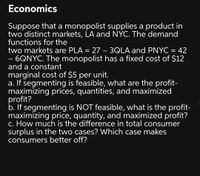

Suppose that a monopolist supplies a product in

two distinct markets, LA and NÝC. The demand

functions for the

two markets are PLA = 27 – 3QLA and PNYC = 42

- 6QNYC. The monopolist has a fixed cost of $12

and a constant

marginal cost of $5 per unit.

a. If segmenting is feasible, what are the profit-

maximizing prices, quantities, and maximized

profit?

b. If segmenting is NOT feasible, what is the profit-

maximizing price, quantity, and maximized profit?

c. How much is the difference in total consumer

surplus in the two cases? Which case makes

consumers better off?

-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 24 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- only question #4 pleasearrow_forwardSuppose a monopolist faces a market demand that is the first two columns in the table below. Also, in the short run, assume that Total Fixed Cost equals $100 and the monopolist has Total Variable Cost according to the table. Find Total Revenue for each price and quantity combination, and then Marginal Revenue as price falls and quantity increases. Fill in the rest of the costs in the table and find profit at each price and quantity combination as the difference between Total Revenue and Total Cost. If profit is less than zero that indicates a loss. What is the maximum profit you found in this table? At what quantity and price combination is profit maximized for this monopolist? Next, verify this result by using Marginal Analysis to find the profit maximizing price and quantity combination. For each quantity, ask yourself if Marginal Revenue exceeds Marginal Cost. If it does, then profits would be increased by producing that quantity. As you go down the table to higher quantities, stop…arrow_forwardSuppose that a monopolist supplies a product in two distinct markets, LA and SF. The demand functions for thetwo markets are PLA = 52 – 4QLA and PSF = 70 – 7QSF. The monopolist has a fixed cost of $20 and a constantmarginal cost of $10 per unit.a. If segmenting is feasible, what are the profit-maximizing prices, quantities, and maximized profit?b. If segmenting is NOT feasible, what is the profit-maximizing price, quantity, and maximized profit?c. How much is the difference in total consumer surplus in the two cases? Which case makes consumers better off?arrow_forward

- Refer to the accompanying table, which represents the costs and production for a monopolist. Price Quantity Fixed Cost Variable Cost $20 0 $10 $0 $18 1 $10 $5 $16 2 $10 $8 $14 3 $10 $18 $12 4 $10 $30 $10 5 $10 $44 1) At Q=2, the marginal cost of this firm is $ ____ 2)The profit made by this profit-maximizing firm is $ __arrow_forwardSuppose a monopolist sells a product to faculty members and students on the campus. If the firm sets a single price, the monopolist produces 5000 units and sell them at the price of $3 per unit. At this price, the price elasticity of demand for faculty member is -2.5. And the price elasticity of demand for students is -1.5. The monopolist is considering whether she should set different prices for the faculty members and students and asks for your advice. The monopolist is thinking about charging faculty members a 10% higher price. The quantity demanded by the faculty members would fall by %. The monopolist is thinking about charging students a 10% higher price. The quantity demanded by the students would fall by %. Who should the monopolist charge more? mention faculty and students and how mucharrow_forwardSuppose the inverse demand function for a monopolist's product is given by P=100-2Q and the cast function isC(Q)=10+2Q. What is the profit-maximizing price of the firm?A. $15 B. $51 C. $41 D. $32 And what is the profit-maximizing quantity of the firm?A. 24.5B. 18C. 20.5D. 16arrow_forward

- A monopolist book publisher with a constant marginal cost of 2 and no fixed costs sells novels in only two countries. Assume the inverse demand curve in country 1 is given by P1=10-2/3q and the inverse demand curve in country 2 is given by P2=18-qIf book imports are permitted in both countries so that price discrimination is impossible, what is the equilibrium price and quantity sold in the two countries combined? (Incomplete)arrow_forwardSuppose that monopolist faces the following demand curve: P = 80-3Q. Monopolist operates in two plants with the following cost functions: TC, = 2q, + an output in each plant. %3D and: TC, 12qh+q%. Find the optimum %3D 9, = 12 and q, = 13 9 = 4 and 4, = 1 91 = 6 and 92 = 4 Oq = 8 and q2 = 7arrow_forwardA firm facing a downward sloping demand curve is producing a level of output at which price is $16, marginal revenue is $12, and average total cost, which is at its minimum value, is $8. In order to maximize profit, the firm should decrease price. A monopolist is producing a level of output at which price is $138, marginal revenue is $72, average total cost is $72, and marginal cost is $103. In order to maximize profit, the firm should output. A firm with market power is producing a level of output at which price is $19, marginal revenue is $12, average variable cost is $14, and marginal cost is $26. In order to maximize profit, the firm should price.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education