ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

option c

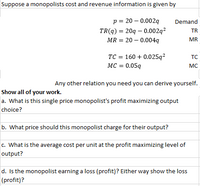

Transcribed Image Text:Suppose a monopolists cost and revenue information is given by

p = 20 – 0.002q

Demand

TR(q) = 20q – 0.002q?

MR = 20 – 0.004q

TR

MR

TC = 160 + 0.025q²

MC = 0.05q

TC

MC

Any other relation you need you can derive yourself.

Show all of your work.

a. What is this single price monopolist's profit maximizing output

choice?

b. What price should this monopolist charge for their output?

c. What is the average cost per unit at the profit maximizing level of

output?

d. Is the monopolist earning a loss (profit)? Either way show the loss

(profit)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- An integrated, combined cycle power plant produces 295 MW of electricity by gasifying coal. The capital investment for the plant is $450 million, spread evenly over two years. The operating life of the plant is expected to be 15 years. Additionally, the plant will operate at full capacity 72% of the time (downtime is 28% of any given year). The MARR is 8% per year. a. If this plant will make a profit of two cents per kilowatt-hour of electricity sold to the power grid, what is the simple payback period of the plant? Is it a low-risk venture? b. What is the IRR for the plant? Is it profitable? a. The simple payback period of the plant is 12.1 years. (Round up to one decimal place.) It's a high-risk venture. b. The IRR for the plant is %. (Round to one decimal place.)arrow_forwardToday, you have $35,000 to invest. Two investment alternatives are available to you. One would require you to invest your $35,000 now; the other would require the $35,000 investment two years from now. In either case, the investments will end five years from now. The cash flows for each alternative are provided below. Using a MARR of 13%, what should you do with the $35,000 you have? Click the icon to view the alternatives description. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 13% per year. The FW of the Alternative 1 is $ (Round to the nearest dollar.) More Info Year OT N345 0 1 2 Alternative 1 - $35,000 $15,000 $15,000 $15,000 $13,000 $13,000 Alternative 2 $0 $0 - $35,000 $16,500 $16,500 $16,500 0 Xarrow_forwardYou are considering getting a Little Nero Caesar Salad Franchise, because your boss (the owner of a Down Under Sandwich Shoppe) seems to be making it big. The Down Under Shoppe grosses an average of $380,000 sales annually. You estimate that your business will gross an average of 95% of Down Under’s sales. You must borrow $320,000 from the bank. The bank will charge you 12% per annum interest on this loan. You also will invest $50,000 of your savings in the business (thus you will no longer receive the 4% per annum interest from this). NOTE: neither the bank loan principal nor the $50,000 of your savings you invest is an explicit or implicit cost. However, the interest paid on the bank loan is explicit and the interest foregone on your savings is implicit. Other estimated explicit expenses are: labor $130,000 per year; rent $12,000 a year; utilities $4,000 a year; and salad ingredients $140,000 a year. An explicit expense you will have to pay Little Nero, Inc., is a franchise…arrow_forward

- You are considering buying a company for $699, 000. If you expect the business to earn $97,000 per year, how long is the discounted payback period if your MARR is 5% ? (in years)arrow_forwardjust c thanksarrow_forwardJonathan is considering opening a shop for online baseball memorabilia. He has two options. He can build the web site himself and only pay for hosting. This would cost him $2,000/year. The average item for sale is $4.01. Average costs associated with each sale are $2.99. His second option is to use an existing e-commerce service. This incurs an additional monthly cost of $15/month. The site takes a cut of his sales of $0.22/item, so he is planning on also increasing his prices by $0.46/item. The remaining costs stay the same. If Jonathan sells 700 items, which option does he prefer? a. He prefers to build the site himself at Q=700. b. None of the other options. c. He is indifferent between the two options at Q=700. d. He prefers to use the e-commerce site at Q=700.arrow_forward

- You are trying to decide between two mobile phone carriers. Carrier A requires you to pay $185 for the phone and then monthly charges of $60 for 24 months. Carrier B wants you to pay $115 for the phone and monthly charges of $76 for 12 months. Assume you will keep replacing the phone after your contract expires. Your cost of capital is 4.1% APR, compounded monthly. Based on cost alone, which carrier should you choose? ... The EAA for plan A is $ (Round to the nearest cent.) The EAA for plan B is $ (Round to the nearest cent.) Based on the cost alone, you will choose (Select from the drop-down menu.)arrow_forwardSuppose that average labor productivity in Country B is $7,000, and that Countries B and E have the same real GDP per capita. Based on the information in the table, what must be the average labor productivity in Country E? Country A B CDE E Population (millions) 100 150 75 250 95 Multiple Choice O $9,625 Share of Population Employed (%) 60 55 50 45 40arrow_forwardYou are weighing the economics of installing a triple-glazed energy efficient window system in your building. The following life cycle costs and savings are provided. The study period is 25 years, and the discount rate is 10%. Is this an economically viable approach based on the Savings-to-Investment Ratio (SIR)? Triple- Glazed Energy Efficient Windows: Window Quantity takeoff: 10000 sf Initial Cost: $100/sf Annual Operating Costs: $2.5/sf Annual Energy Saving: $10/sfarrow_forward

- True/False: Explain your Answer. Highway engineers want to improve a dangerous stretch of highway. They expect that it will reduce the risk of someone dying in anaccident from 4 percent to 1 percent over the life of the highway. If a human life is worth $4 million, then the project is worth doing as long as it does not cost more than S67,200.arrow_forwardAn integrated, combined cycle power plant produces 280 MW of electricity by gasifying coal. The capital investment for the plant is $690 million, spread evenly over two years. The operating life of the plant is expected to be 17 years. Additionally, the plant will operate at full capacity 78% of the time (downtime is 22% of any given year). The MARR is 5% per year. a. If this plant will make a profit of three cents per kilowatt-hour of electricity sold to the power grid, what is the simple payback period of the plant? Is it a low-risk venture? b. What is the IRR for the plant? Is it profitable? Oarrow_forward4arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education