FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

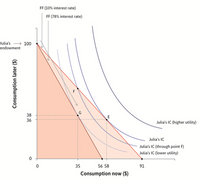

If the interest rate is 10%, Julia could borrow up to $91. Is it true or false?

Transcribed Image Text:FF (10% interest rate)

FF (78% interest rate)

Jdia's 100

endowment

38

36

Julia's IC (higher utility)

Julia's IC

Julia's IC (through point F)

Julia's IC (lower utility)

35

56 58

91

Consumption now (S)

Consumption later ($)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Answer the following question using a spreadsheet and the material in the appendix. You would like to buy a house. Assume that given your income, you can afford to pay $12,000 a year to a lender for the next 30 years. If the interest rate is 7% how much can you borrow today based on your ability to pay? What about if the interest rate is 3%? Maximum mortgage at 7%: $ Maximum mortgage at 3%: $arrow_forward2) Whiskers wants to buy a $400,000 house. She plans to pay $80,000 down and make monthly payments for 20 years. If the loan has an interest rate of 6% monthly with 3 points, what is the true interest rate?arrow_forwardMf4.arrow_forward

- "Nathaniel is saving $172 per month. If their account earns a 2.5% interest rate, how many years will it take before they can buy a $28, 000 car? Enter your answer to two decimal places"arrow_forwardWhat is the amount Ginger Logan can borrow today it must be in 13 with simple interest at 5% and sho knows that at time she will be able to repay no more than 66000arrow_forwardSuppose the interest rate is 3.9%. a. Having $350 today is equivalent to having what amount in one year? b. Having $350 in one year is equivalent to having what amount today? c. Which would you prefer, $350 today or $350 in one year? Does your answer depend on when you need the money? Why or why not? a. Having $350 today is equivalent to having what amount in one year? It is equivalent to $. (Round to the nearest cent.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education