Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

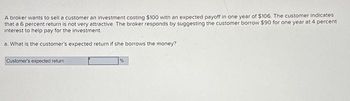

Transcribed Image Text:A broker wants to sell a customer an investment costing $100 with an expected payoff in one year of $106. The customer indicates

that a 6 percent return is not very attractive. The broker responds by suggesting the customer borrow $90 for one year at 4 percent

interest to help pay for the investment

a. What is the customer's expected return if she borrows the money?

Customer's expected return

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- have tried this and keep getting the answer wrong i can’t figure it outarrow_forwardC. ich total money will you pull out of the account? account at the beginning How much of that money is interest? 19. You can afford a $700 per month mortgage payment. You've found a 30 year loan at 5% interest. a. How big of a loan can you afford? b. How much total money will you pay the loan company? How much of that money is interest? C. down paynarrow_forwardYou borrow $1,000 from a bank at 6% annual interest and promise to pay it back after a year. As you sign the loan documents, both you and the bank expect inflation to be 3% in the coming year. During the course of the year, however, the average price level rises by only 1%. What best describes this situation? Select one: a. Both you and the bank are better off because the inflation rate is less than the nominal interest rate but greater than zero. O b. The bank has gained at your expense because the real interest rate on the loan is higher than expected. c. Neither you nor the bank has gained anything extra because the inflation rate is less than the nominal interest rate. O d. You have gained at the bank's expense because you can pay the bank back in inflated dollars.arrow_forward

- Suppose you are shopping for a mortage and the lender presents you with long menu on loan options. For each option, there is a discount point charged at an interest rate given. The amount of the point ranges anywhere from -2% to 3%. When would it be optimal for you select a loan with a discount point of 3%? Group of answer choices 1) Only when the point is equal to the effective borrowing cost 2) Never 3) Only with ARM 4) If you have a very short holding period 5) If you have a very long holding periodarrow_forwardYou have been given the choice to reduce your mortgage interest rate for each point received by the lender at closingyou decided to give points , on a $500,000 loan, how much money will you be needing to bring to close to cover your points?arrow_forwardThe time value of money is used for many important financial decisions that could affect long-term goals. The interest rate you pay on a loan can affect the amount you pay each period. An advertised monthly lending rate of 9% is about 11% per year. This difference between an advertised rate and the annualized rate is based on finer TVM details that may be overlooked by borrowers. What practical TVM application would you expect to encounter in your future? Explain.arrow_forward

- A house is selling for $180,000 and the seller owes $140,000. The borrower is short $40,000 for the down payment, but the seller is willing to carry back $20,000 of the $40,000 equity as a second mortgage as long as the buyer agrees to pay $20,000 cash. This type of financing by the seller is called subprime financing. b.junior financing. c.high-cost financing. d.senior financing.arrow_forwardYou borrow $2mn at an interest rate of 5% per year to purchase a real estate property for the cost of $2.5mn. The borrowing costs are due only at the end of the year. 1). At what property price is it optimal to default on the loan when the borrowing rate is 1%, 5% and 10%?2). Consider three different interest rates of 1%, 5% and 10% and different equity shares of 5%, 20% and 50%. Discuss how the different interest rates and leverage affect the return on equity.arrow_forwardThe buyer of a piece of real estate is often given the option of buying down the loan. This option gives the buyer a choice of loan terms in which various combinations of interest rates and discount points are offered. The choice of how many points and what rate is optimal is often a matter of how long the buyer intends to keep the property. Darrell Frye is planning to buy an office building at a cost of $983,000. He must pay 10% down and has a choice of financing terms. He can select from a 9% 30-year loan and pay 4 discount points, a 9.25% 30-year loan and pay 3 discount points, or a 9.5% 30-year loan and pay 2 discount points. Darrell expects to hold the building for two years and then sell it. Except for the three rate and discount point combinations, all other costs of purchasing and selling are fixed and identical. (Round your answers to the nearest cent. Use this table, if necessary.) (a) What is the amount being financed? $ (b) If Darrell chooses the 4-point 9% loan,…arrow_forward

- You were planning to purchase a house this month with a mortgage and just learned that the Fed is conducting open market purchase. Your situation is flexible in terms of the timing of the purchase; right now or later. It is assumed that everything else stays constant. What'd be the best strategy for your purchase? Explain using economic theory, not as a personal finance advisorarrow_forwardThe buyer of a piece of real estate is often given the option of buying down the loan. This option gives the buyer a choice of loan terms in which various combinations of interest rates and discount points are offered. The choice of how many points and what rate is optimal is often a matter of how long the buyer intends to keep the property. Darrell Frye is planning to buy an office building at a cost of $982,000. He must pay 10% down and has a choice of financing terms. He can select from a 9% 30-year loan and pay 4 discount points, a 9.25% 30-year loan and pay 3 discount points, or a 9.5% 30-year loan and pay 2 discount points. Darrell expects to hold the building for three years and then sell it. Except for the three rate and discount point combinations, all other costs of purchasing and selling are fixed and identical. (Round your answers to the nearest cent. Use this table, if necessary.) (a) What is the amount being financed? 2$ (b) If Darrell chooses the 4-point 9% loan, what…arrow_forwardYou get hired by a residential mortgage lender to help them revamp their mortgage pricing models. They ask you to start by exploring three common client scenarios. First, they give you the “Second Lien Scenario.” In this scenario, a borrower goes to one of your competitors with the intention to buy a $1.2 million house. Your competitor gives them two options: • A 30-year, fully amortizing FRM with 80% LTV and an interest rate of 6.1%; or • A 20-year, fully amortizing FRM with 90% LTV and an interest rate of 6.8%. Next, the borrower comes to you and asks for a quote on a second lien (i.e. a junior loan) worth 10% LTV for 30 years. They want to price a scenario where they get the 80% LTV loan from your competitor and the 10% LTV loan from you instead of the 90% LTV loan from your competitor (in other words, paying for the same amount with two loans instead of one). 1. In order to be competitive, (a) what monthly payment and (b) what interest rate should you charge on this second lien?…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education