ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Consider the competitive market for steel. Assume that, regardless of how many firms are in the industry, every firm in the industry is identical and

faces the marginal cost (MC), average total cost (ATC), and average variable cost (AVC) curves shown on the following graph.

(?)

100

90

80

70

60

50

40

ATC

30

20

MCO

AVC

10

+

5

10

15

20

25 30

35

40

45

50

QUANTITY (Thousands of tons)

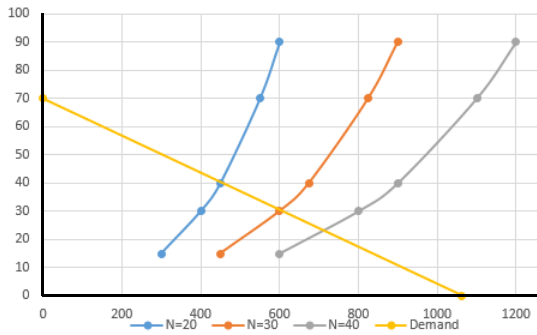

The following diagram shows the market demand for steel.

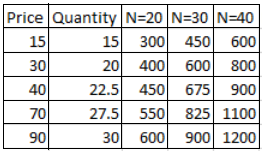

Use the orange points (square symbol) to plot the initial short-run industry supply curve when there are 20 firms in the market. (Hint: You can

disregard the portion of the supply curve that corresponds to prices where there is no output since this is the industry supply curve.) Next, use the

purple points (diamond symbol) to plot the short-run industry supply curve when there are 30 firms. Finally, use the green points (triangle symbol) to

plot the short-run industry supply curve when there are 40 firms.

100

90

Supply (20 firms)

80

70

E 60

Supply (30 firms)

50

40

Supply (40 firms)

Demand

30

20

10

125

250

375

500

625

750 875 1000 1125 1250

QUANTITY (Thousands of tons)

If there were 20 firms in this market, the short-run equilibrium price of steel would be S

per ton. At that price, firms in this industry would

. Therefore, in the long run, firms would

v the steel market.

▼

Because you know that competitive firms earn

v economic profit in the long run, you know the long-run equilibrium price must be

$

|per ton. From the graph, you can see that this means there will be

v firms operating in the steel industry in long-run equilibrium.

True or False: Assuming implicit costs are positive, each of the firms operating in this industry in the long run earns negative accounting profit.

O True

O False

PRICE (Dollars per ton)

COSTS (Dollars perton)

Expert Solution

arrow_forward

Step 1

Below is the table:

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A firm has a fixed production cost of $4000. For the first 100 units of production, the firm has a marginal cost of $50 per unit produced. Producing more than 100 units has a marginal cost of $70 per unit produced. The firm cannot produce more than 150 units. How much does it cost to produce at q=0? at q=50? at q=100? at q=125? at q=150? Graph the firm’s marginal cost functionarrow_forwardHow would you calculate the marginal cost of your firm's output? (think of a single product, not an industry).arrow_forwardUse the table below to answer the following question. Units Total Fixed Cost Total Variable of Output (dollars) Cost (dollars) 1 150 25 2 150 48 3 150 70 150 100 What is the marginal cost (MC) of producing the fourth unit of output?arrow_forward

- Question 13 of 16 Lisa and Adam started a business that manufactures cutting tools. They sell the tools for $80 each. Their monthly fixed costs are $4,500 for the building lease and utilities, and $2,300 for salaries. The cost of supplies for each tool is $14. a. To break even, how many tools do they have to sell every month? Round up to the next whole number b. If the cost of supplies for each tool is reduced to $11 and they hire one more person for $1,100 per month, calculate the minimum number of tools that they would have to sell to ensure that they do not incur a loss. Round up to the next whole numberarrow_forwardConsider an airline's decision about whether to cancel a particular flight that hasn't sold out. The following table provides data on the total cost of operating a 100-seat plane for various numbers of passengers. Total Cost Number of Passengers (Dollars per flight) 40,000 10 60,000 20 65,000 30 68,000 40 70,000 50 71,000 60 72,500 70 73,500 80 74,000 90 74,300 100 74,500 Given the information presented in the previous table, the fixed cost to operate this flight is s At each ticket price, a different number of consumers will be willing to purchase tickets for this flight. Assume that the price of a flight is fixed for the duration of ticket sales. Use the previous table as well as the following demand schedule to complete the questions that follow. Price Quantity Demanded (Dollars per ticket) (Tickets per flight) 1,000 700 30 400 90 200 100arrow_forwardNote: The answer should be typed.arrow_forward

- See image for question with sub-parts.arrow_forwardThe table shows three short-run cost schedules for three plants of different sizes that a firm might build in the long run. Plant 1 Plant 2 Plant 3 Output ATC Output ATC Output ATC 10 $ 10 10 $ 15 10 $ 20 20 9 20 10 20 15 30 8 30 7 30 10 40 9 40 10 40 8 50 10 50 14 50 9 What is the long-run average cost of producing 10 units of output? Multiple Choice $10 $15 $20 $45arrow_forwardQ15arrow_forward

- (This is a single question with five parts to the answer. I would appreciate help with all five parts if possible. Image screenshot of the original question with the formulas more easily readable than can be identified here is attached) Tech firms produce goods and services from labor and energy. The total cost in dollars to produce y amount of goods and services for each firm j is cj(yj) = yi2. There are 100 identical tech firms which all behave competitively. What is the individual supply of technological goods and services? What is the market supply of technological goods and services? Suppose the demand curve for these goods is D(p)=200-50p. What is the equilibrium price and quantity sold? How much is the total surplus of this economy? Now suppose that the industry makes a one-time investment for $K amount of dollars to innovate in a new technology of production that allows every firm to reduce its cost of production to a 1/4 fraction of the previous cost. What is the new total…arrow_forwardQUESTION 15 Imagine a small juice producer named " Bilberry Infused Beverages" known for its refreshing beverages. The owner, Louis, keeps track of the production costs. Recently he decided to expand his operations and produce more Juices to meet the increasing demand. Table 15.1 below shows the data he has collected: Complete Table 15.1 below and use the information to answer the question that follows. Table 15:1 Production Costs for Bilberry Infused Beverages (4 Marks) Output Total cost Fixed cost Variable Marginal Average cost cost cost Average fixed cost 0 30 O 1 10 2 18 3 22 4 5 64 B 832 8 76 7 8 15 15 What is the marginal cost of producing the 8th unit of the good? a) 4 b) 10 c) 12 d) 29arrow_forwardThe following table represents the short-run total cost schedule of a bottled water manufacturer. Study the table below and then answer the question. When output increases from 30 to 80 bottles of mineral water, the marginal cost of producing one of those 50 bottles of mineral water is: Labour (workers per day) Output (bottles of mineral Total cost (R) water per day 0 0 400 1 30 700 2 80 1000 3 120 1300 4 140 1 600 5 150 1900 a) R5 b) R6 이이 c) R12,50 d) R20arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education