FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:eBook

Show Me How

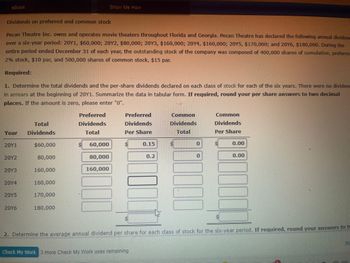

Dividends on preferred and common stock

Pecan Theatre Inc. owns and operates movie theaters throughout Florida and Georgia. Pecan Theatre has declared the following annual dividene

over a six-year period: 20Y1, $60,000; 20Y2, $80,000; 20Y3, $160,000; 20Y4, $160,000; 20YS, $170,000; and 20Y6, $180,000. During the

entire period ended December 31 of each year, the outstanding stock of the company was composed of 400,000 shares of cumulative, preferre

2% stock, $10 par, and 500,000 shares of common stock, $15 par.

Required:

1. Determine the total dividends and the per-share dividends declared on each class of stock for each of the six years. There were no dividen

in arrears at the beginning of 20Y1. Summarize the data in tabular form. If required, round your per share answers to two decimal

places. If the amount is zero, please enter "0".

Preferred

Preferred

Total

Dividends

Dividends

Common

Dividends

Common

Dividends

Year Dividends

Total

Per Share

Total

Per Share

20Y1

$60,000

60,000

0.15

0

$

0.00

20Y2

80,000

80,000

0.2

0

0.00

20Y3

160,000

160,000

20Y4

160,000

20Y5

170,000

20Y6

180,000

2. Determine the average annual dividend per share for each class of stock for the six-year period. If required, round your answers to tw

Check My Work 3 more Check My Work uses remaining.

Ne

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Company A has earrings per share of $3 with 20 million shares outstanding. The current market price of Company As Stock is $40 per share. Company A is in process of acquiring Company B., which has earnings per share of $1.50, 4 million of common stock shares. Currently, Company Bs stock trades at $25. The acquisition will be done 100% by stock issue by Company A. Exchange ratio will be set in a way that, at current pre-announcement share prices for both firms, the offer represents a 10% premium to buy Company B. What will be the price per share of Company A immediately after the announcement of acquisition? What will be subsequent price action in both Company As and Company Bs stocks? Explain briefly.arrow_forward"Andrews Company has $80,000 available to pay dividends. It has 2,000 shares of 10%, $100 par, preferred stock and 30,000 shares of $10 par common stock outstanding. The preferred stock is selling for $125 per share, and the common stock is selling for $20 per share." I need help with Question C pleasearrow_forwardAt the beginning of last year, you purchased Delta Derivatives and Zeta Functions. The Delta Derivatives shares cost you $12 per share and paid 6% in dividends for the year, while Zeta Functions shares cost you $4 per share and paid 5% in dividends for the year. If you invested a total of $7,400 and earned $430 in dividends at the end of the year, how many shares of each company did you purchase?arrow_forward

- 1. Aaron Mechanic, CFA is responsible for valuing the shares of Duotronics Research Laboratories (DRL). The stock is currently trading at $8.75 and he gathers the following financial information about the company: Expect ROE 16% annually for each of the next 4 years Current BV of equity $435,000,000 Shares outstanding 60 million Required return on equity 12% No dividends paid All earnings are reinvested EPS is equal to the beginning book value time ROE Continuing residual income = will remain constant at the 4 year forecast level for the foresee-able future 2. Based on the Residual Income Model, what recommendation would Mechanic issue for the stock of DRL. State 1 ideal condition for each of the 3 predominant future cash flow definitions in stock valuation modelsarrow_forwardPower Drive Corporation designs and produces a line of golf equipment and golf apparel. Power Drive has 100,000 shares of common stock outstanding as of the beginning of 2024. Power Drive has the following transactions affecting stockholders' equity in 2024. March 1 May 10 June 1 Issues 45,000 additional shares of $1 par value common stock for $42 per share. Purchases 4,000 shares of treasury stock for $45 per share. Declares a cash dividend of $1.00 per share to all stockholders of record on June 15. (Hint: Dividends are not paid on treasury stock.) Pays the cash dividend declared on June 1. July 1 October 21 Resells 2,000 shares of treasury stock purchased on May 10 for $50 per share. Power Drive Corporation has the following beginning balances in its stockholders' equity accounts on January 1, 2024: Common Stock, $100,000; Additional Paid-in Capital, $3,500,000; and Retained Earnings, $1,000,000. Net income for the year ended December 31, 2024, is $500,000. Required: Prepare the…arrow_forward↑ 3 minutes ago ☆ Live Large Inc. had the following transactions involving non-strategic investments during 2023. 2023 Apr. 1 Paid $100,ese to buy a 90-day term deposit, $100,000 principal amount, 5.0%, dated April 1. There was a $50 transaction fee included in the above-noted payment amount. 12 Purchased 3,000 common shares of Blue Balloon Ltd. at $22.25. There was a $50 transaction fee included in the above-noted payment amount. June 9 Purchased 1,800 common shares of Purple Car Corp. at $49.50. There was a $50 transaction fee included in the above-noted payment amount. 20 Purchased 700 common shares of Yellow Tech Ltd. at $15.75. There was a $50 transaction fee included in the above-noted payment amount. July 1 Purchased for $67,412 a 7.0%, $65,000 Space Explore Inc. bond that matures in eight years when the market interest rate was 6.4%. There was a $50 transaction fee included in the above-noted payment amount. Interest is paid semiannually beginning December 31, 2023. Live Large…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education