FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:eBook

Show Me How

A Calculator

Print Item

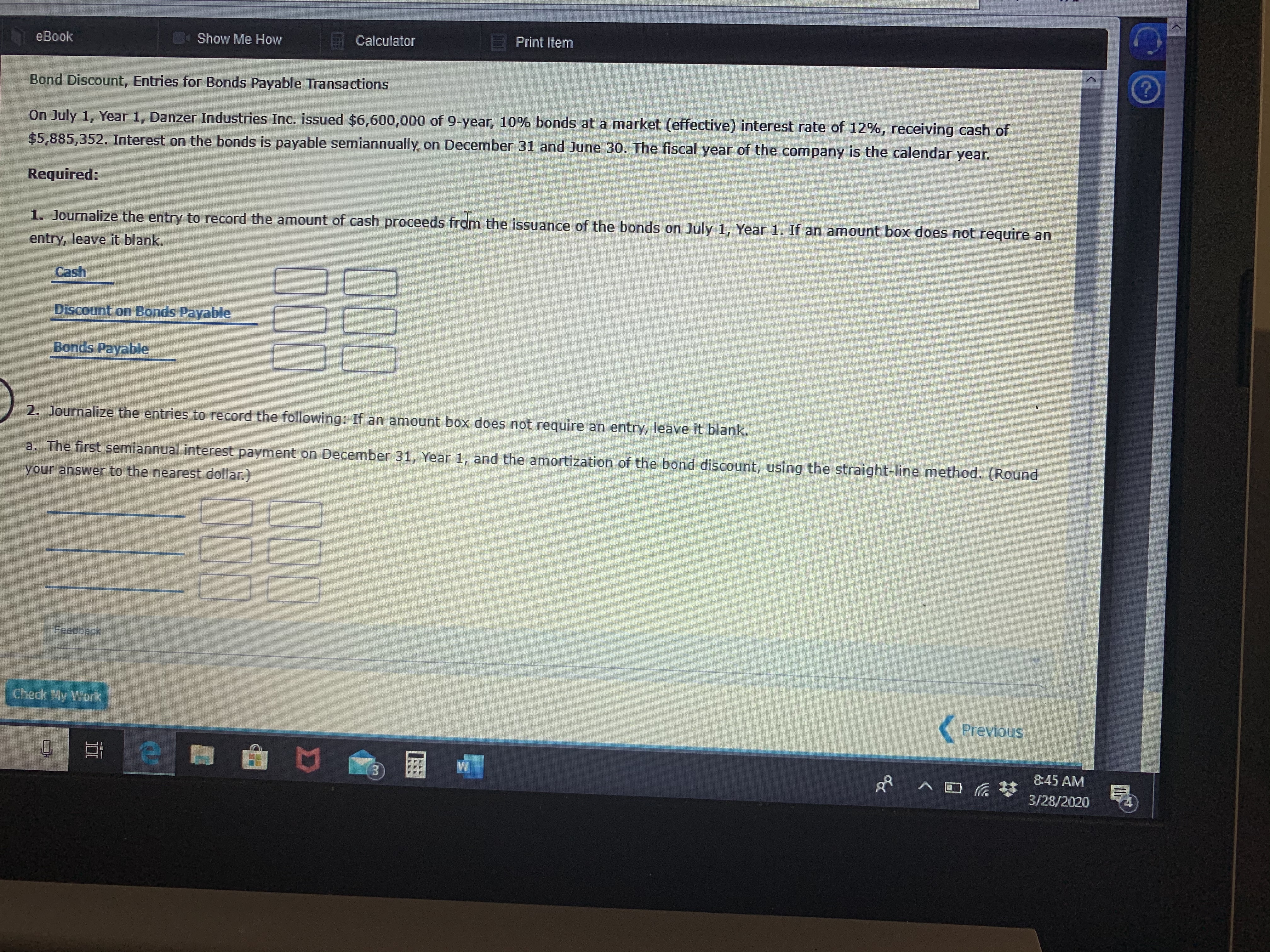

Bond Discount, Entries for Bonds Payable Transactions

On July 1, Year 1, Danzer Industries Inc. issued $6,600,000 of 9-year, 10% bonds at a market (effective) interest rate of 12%, receiving cash of

$5,885,352. Interest on the bonds is payable semiannually, on December 31 and June 30. The fiscal year of the company is the calendar year.

Required:

1. Journalize the entry to record the amount of cash proceeds fram the issuance of the bonds on July 1, Year 1. If an amount box does not require an

entry, leave it blank.

Cash

Discount on Bonds Payable

Bonds Payable

2. Journalize the entries to record the following: If an amount box does not require an entry, leave it blank.

a. The first semiannual interest payment on December 31, Year 1, and the amortization of the bond discount, using the straight-line method. (Round

your answer to the nearest dollar.)

Feedbeck

Check My Work

( Previous

8:45 AM

3/28/2020

00

00

00

00

Transcribed Image Text:agenow.com/im/takeAssignment/takeAssignmentMain.doinvoker atakeAssignmentSessionlocator &inprogress false

Print tem

BShow Me How

Calculator

eBook

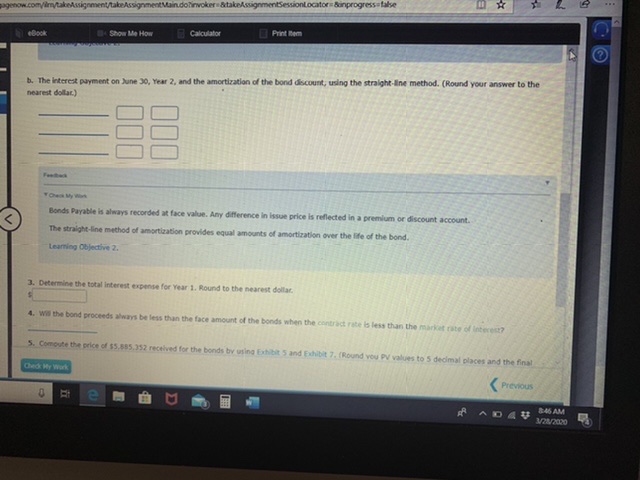

b. The interest payment on June 30, Year 2, and the amortization of the bond discount, using the straight-line method. (Round your answer to the

nearest dollar)

Ohek My n

Bonds Payable is always recorded at face value. Any difference in issue price is reflected in a premium or discount account.

The straight-line method of amortization provides equal amounts of amortization over the life of the bond.

Leaming Objective 2.

3. Determine the total interest expense for Year 1. Round to the nearest dollar.

4. Wi the bond proceeds always be less than the face amount of the bonds when the contract rabe is less than the market cate of interest?

5. Compute the price of $5.885.352 recelived for the bonds bv using Exhibit 5 and Exhibit 7. (Round vou PV values to 5 decimal places and the final

Ched y Work

(Previous

846 AM

3/2/2020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- eBook y Work Show Me How ator=&inprogress=false Issuing Bonds at a Discount On the first day of the fiscal year, a company issues a $1,300,000, 12%, 6-year bond that pays semiannual interest of $78,000 ($1,300,000 x 12% x 2), receiving cash of $1,196,745. Journalize the bond issuance. If an amount box does not require an entry, leave it blank. Save and Exi Previous Upd. Nextarrow_forwardanswer with formula and calculationsarrow_forwardHow do I journalize the bonds at face amount?arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardPlease help mearrow_forwardPlease don't provide answer in image format thank youarrow_forward

- What account would be debited (1), what account would be credit (2), and what amount would be paid to record the journal entry for each interest payment based on a $200,000 five-year, 10% bond and the bond was issued at $192,462 (11%) and interest is paid semiannually? JOURNAL Page 25 DATE DESCRIPTION P.REF. DEBIT CREDIT (1) ? (2) ? (1) Interest Expense debit $11,000, and (2) Cash credit $11,000 (1) Interest Expense debit $10,000 and (2) Cash credit $10,000 (1) Cash debit $20,000 and (2) Interest Expense credit $20,000 (1) Cash debit $22,000, and (2) Interest Expense credit $22,000arrow_forwardplease do not provide solution in image foptrmat thank you!arrow_forwardBond (Held-to-Maturity)Investment Journalize the entries to record the following selected bond investment transactions for Marr Products: If an amount box does not require an entry, leave it blank. D.) Received face value of remaining bonds at their maturity. Cash- Investments- Hotline Inc. Bonds- I just need help with part D, Thanks!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education