Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:eBook

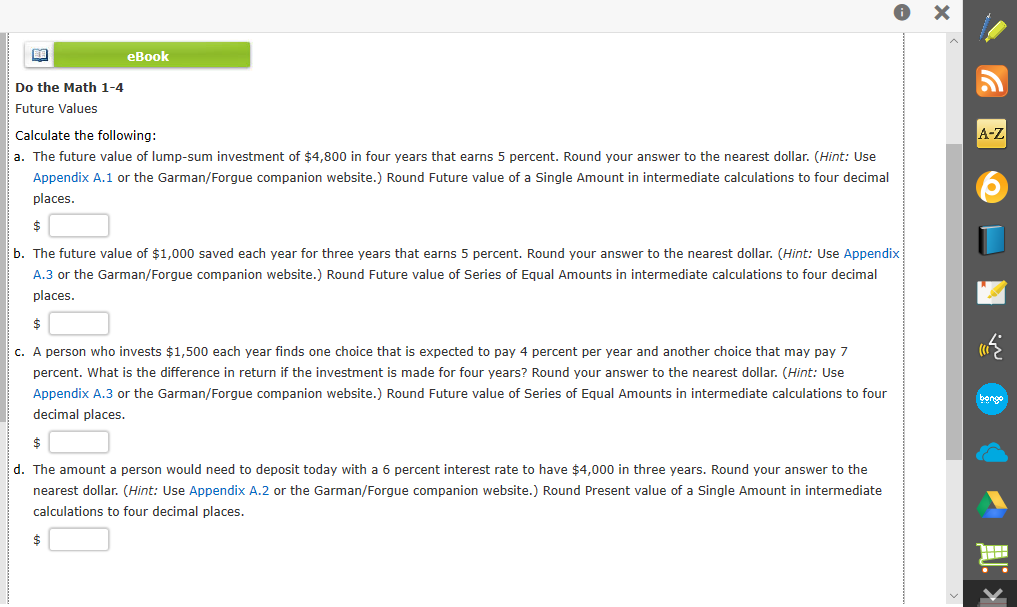

Do the Math 1-4

Future Values

Calculate the following:

A-Z

a. The future value of lump-sum investment of $4,800 in four years that earns 5 percent. Round your answer to the nearest dollar. (Hint: Use

Appendix A.1 or the Garman/Forgue companion website.) Round Future value of a Single Amount in intermediate calculations to four decimal

places.

b. The future value of $1,000 saved each year for three years that earns 5 percent. Round your answer to the nearest dollar. (Hint: Use Appendix

A.3 or the Garman/Forgue companion website.) Round Future value of Series of Equal Amounts in intermediate calculations to four decimal

places.

c. A person who invests $1,500 each year finds one choice that is expected to pay 4 percent per year and another choice that may pay 7

percent. What is the difference in return if the investment is made for four years? Round your answer to the nearest dollar. (Hint: Use

Appendix A.3 or the Garman/Forgue companion website.) Round Future value of Series of Equal Amounts in intermediate calculations to four

ిగ

decimal places.

d. The amount a person would need to deposit today with a 6 percent interest rate to have $4,000 in three years. Round your answer to the

nearest dollar. (Hint: Use Appendix A.2 or the Garman/Forgue companion website.) Round Present value of a Single Amount in intermediate

calculations to four decimal places.

2$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Similar questions

- V A ALEKS-Harley Biltoc - Learn O Exponential and Logarithmic Functions Finding the present value of an investment earning compound interest www-awu.aleks.com $ myPascoConnect Ć 0/5 Portal Harley Lena is going to invest to help with a down payment on a home. How much would she have to invest to have $46,900 after 9 years, assuming an interest rate of 1.65% compounded annually? Do not round any intermediate computations, and round your final answer to the nearest dollar. If necessary, refer to the list of financial formulas.arrow_forwardplz solve it within 30-40 mins I'll give you multiple upvotearrow_forwardSub : FinancePls answer very faast.I ll upvote. Thank You Bobbie has $6,000 that she wants to invest today to grow into $50,000. She finds an investment that earns 8.5% with quarterly compounds. How many years will she wait till she has the $50,000? Group of answer choices 25.99 years 28.00 years 25.21 years 100.83 year Please answer using excel function for NPERarrow_forward

- eBook Question Content Area Time Value of Money Concept The following situations involve the application of the time value of money concept. Use the full factor when calculating your results. Use the appropriate present or future value table: FV of $1, PV of $1, FV of Annuity of $1 and PV of Annuity of $1 1. Janelle Carter deposited $9,840 in the bank on January 1, 2000, at an interest rate of 10% compounded annually. How much has accumulated in the account by January 1, 2017? Round to the nearest whole dollar. 2. Lee Spony made a deposit in the bank on January 1, 2010. The bank pays interest at the rate of 10% compounded annually. On January 1, 2017, the deposit has accumulated to $13,120. How much money did Lee originally deposit on January1, 2010? Round to the nearest whole dollar.arrow_forwardCheck My Work eBook Your parents will retire in 28 years. They currently have $300,000 saved, and they think they will need $2,500,000 at retirement. What annual interest rate must they earn to reach their goal, assuming they don't save any additional funds? Round your answer to two decimal places. %arrow_forwardQuestion content area top Part 1 (Related to Checkpoint 6.1) (Future value of an annuity) Imagine that Homer Simpson actually invested the $ 160,000 he earned providing Mr. Burns entertainment 10 years ago at 11 percent annual interest and that he starts investing an additional $ 1,800 a year today and at the beginning of each year for 15 years at the same 11 percent annual rate. How much money will Homer have 15 years from today? Question content area bottom Part 1 The amount of money Homer will have 15 years from now is $ enter your response here . (Round to the nearest cent.)arrow_forward

- Typed plz and Asap thanksarrow_forward< CO T R E # 3 Problem Set 1: Finance Progr Score: 19.8/50 8/20 answered Question 15 You want to be able to withdraw $35,000 from your account each year for 25 years after you retire. You expect to retire in 15 years. If your account earns 6% interest, how much will you need to deposit each year until retirement to achieve your retirement goals? 24 Question Help: D Video Submit Question MacBook Air 08 F3 DD F2 F4 F5 F8 & $ 2 5. Marrow_forwardeBook Do the Math 1-5Present and Future Values Using the present and future value tables in Appendix A, the appropriate calculations on the Garman/Forgue companion website, or a financial calculator, calculate the following: The amount a person would need to deposit today to be able to withdraw $9,000 each year for ten years from an account earning 6 percent. Round your answer to the nearest whole dollar. Round Present Value of Series of Equal Amounts in intermediate calculations to four decimal places. $ A person is offered a gift of $4,900 now or $8,000 five years from now. If such funds could be expected to earn 3 percent over the next five years, which is the better choice? Round Future Value of a Single Amount in intermediate calculations to four decimal places.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education