FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

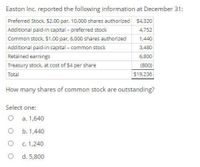

Transcribed Image Text:Easton Inc. reported the following information at December 31:

Preferred Stock, $2.00 par, 10,000 shares authorized $4,320

Additional paid-in capital - preferred stock

4,752

Common stock, $1.00 par, 6,000 shares authorized

1,440

Additional paid-in capital - common stock

3,480

Retained earnings

6,800

Treasury stock, at cost of $4 per share

(800)

Total

$19.236

How many shares of common stock are outstanding?

Select one:

a. 1,640

b. 1,440

c. 1,240

d. 5,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Reporting Stockholders' Equity Using the following accounts and balances, prepare the “Stockholders’ Equity” section of the balance sheet. 70,000 shares of common stock authorized, and 1,000 shares have been reacquired. Common Stock, $80 par $4,480,000 Paid-In Capital from Sale of Treasury Stock 90,000 Paid-In Capital in Excess of Par—Common Stock 784,000 Retained Earnings 2,330,000 Treasury Stock 60,000 Balance Sheet Stockholders' Equity Paid-in capital: $fill in the blank 2 fill in the blank 4 Paid-in capital, common stock $fill in the blank 5 fill in the blank 7 Total paid-in capital $fill in the blank 8 fill in the blank 10 Total $fill in the blank 11 fill in the blank 13 Total stockholders' equity $fill in the blank 14arrow_forwardUsing the following accounts and balances, prepare the “Stockholders' Equity" section of the balance sheet. 20,000 shares of common stoCk authorized, and 10,000 shares have been reacquired. Common Stock, $80 par $1,120,000 Paid-In Capital from Sale of Treasury Stock 45,000 Paid-In Capital in Excess of Par-Common Stock 168,000 Retained Earnings 661,000 Treasury Stock 23,000 Balance Sheet Stockholders' Equity Paid-in capital: Paid-in capital, common stock $ Total paid-in capital Total Total stockholders'eauity.arrow_forwardnit.0arrow_forward

- Calculating the Number of Shares Issued Chester Inc. issued shares of its $3.85 par value common stock for $16.50 per share. In recording the issuance of the stock, Chester credited the Additional Paid-In Capital-Common Stock account for $1,062,600. Required: How many shares were issued? sharesarrow_forwardPlease don't give image formatarrow_forwardSelected Stock Transactions The following selected accounts appear in the ledger of Parks Construction Inc. at the beginning of the current year: Preferred 2% Stock, $100 par (70,000 shares authorized, 35,000 shares issued) $3,500,000 Paid-In Capital in Excess of Par—Preferred Stock 420,000 Common Stock, $20 par (800,000 shares authorized, 270,000 shares issued) 5,400,000 Paid-In Capital in Excess of Par—Common Stock 700,000 Retained Earnings 21,242,000 During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarized as follows: Issued 80,000 shares of common stock at $26, receiving cash. Issued 18,000 shares of preferred 2% stock at $115. Purchased 48,000 shares of treasury common for $23 per share. Sold 24,000 shares of treasury common for $26 per share. Sold 16,000 shares of treasury common for $21 per share. Declared cash dividends of $2.00 per share on preferred stock and $0.04 per share on common stock.…arrow_forward

- Share Issuances for Cash Finlay, Inc., issued 4,000 shares of $50 par value preferred stock at $119 per share and 6,000 sharesof no-par value common stock at $18 per share. The common stock has no stated value. All issuances were for cash. a. Determine the financial statement effect of the share issuances (preferred and common). Balance Sheet Income Statement Assets = Liabilities + Equity Revenues - Expenses = Net Income Answer Answer Answer Answer Answer Answer b. Determine the financial statement effect of the issuance of the common stock assuming that it had a stated value of $5 per share. Balance Sheet Income Statement Assets = Liabilities + Equity Revenues - Expenses = Net Income Answer Answer Answer Answer Answer Answer c. Determine the financial statement effect of the issuance of the common stock assuming that it had a par value of…arrow_forwardStatement of Stockholders' Equity The stockholders' equity T accounts of I-Cards Inc. for the fiscal year ended December 31, 20Y9, are as follows. COMMON STOCK Jan. 1 Balance 1,300,000 Apr. 14 Issued 11,400 570,000 shares Dec. 31 Balance 1,870,000 PAID-IN CAPITAL IN EXCESS OF PAR Jan. 1 Balance 208,000 Apr. 14 Issued 11,400 136,800 shares Dec. 31 Balance 344,800 TREASURY STOCK Aug. 7 Purchased 1,900 shares 91,200 RETAINED EARNINGS Mar. 31 Dividend 33,000 Jan. 1 Balance 2,260,000 June. 30 Dividend 33,000 Dec. 31 Closing Sept. 30 Dividend 33,000 (Net income) 339,000 Dec. 31 Dividend 33,000 Dec. 31 Balance 2,467,000 Prepare a statement of stockholders' equity for the year ended December 31, 20Y9. If an amount box does not require an entry I-Cards Inc. Statement of Stockholders' Equity For the Year Ended December 31, 20Y9arrow_forwardReporting Stockholders' Equity Using the following accounts and balances, prepare the “Stockholders’ Equity” section of the balance sheet. 30,000 shares of common stock authorized, and 1,000 shares have been reacquired. Common Stock, $60 par $1,080,000 Paid-In Capital from Sale of Treasury Stock 43,000 Paid-In Capital in Excess of Par—Common Stock 378,000 Retained Earnings 594,000 Treasury Stock 22,000 Balance Sheet Stockholders' Equity Paid-in capital: $ Paid-in capital, common stock $ Total paid-in capital $ Total $ Total stockholders' equity $arrow_forward

- The stockholders' equity section of Cullumber Company's balance sheet at December 31 is presented here. Cullumber Company Balance Sheet(Partial) Stockholders' equity Paid-in capital Preferred stock, cumulative, 8,000 shares authorized, 4,000 shares issued and outstanding $320,000 Common stock, no par, 700,000 shares authorized, 500,000 shares issued 2,500,000 Total paid-in capital Retained earnings Total paid-in capital and retained earnings Less: Treasury stock (6,000 common shares) Total stockholders' equity 2,820,000 1,858,000 4,678,000 31,200 $4,646,800 From a review of the stockholders' equity section, answer the following questions. (a) How many shares of common stock are outstanding? shares (b) Assuming there is a stated value, what is the stated value of the common stock? $ per share (c) What is the par value of the preferred stock? 6A $ per share (d) If the annual dividend on preferred stock is $16,000, what is the dividend rate on preferred stock? % (e) If dividends of…arrow_forwardTreasury Shares On October 10, the capital of the shareholders (stockholders' equity) of Sherman Systems, Inc. it consisted of the following: Common stock–$10 par value, 72,000 shares authorized, issued, and outstanding $ 720,000 Paid-in capital in excess of par value, common stock 216,000 Retained earnings 864,000 Total stockholders’ equity $ 1,800,000 Prepare the daily entries to record the following transactions: October 11 – Sherman Systems purchased 5,000 of its own common stock at a price of $25 per share. November 1 – Sherman Systems sold 1,000 of its shares in treasury stock at a price of $31 per share. November 25 – Sherman Systems sold the remaining shares in treasury at a price of $20 per share.arrow_forwardOn October 10, the stockholders’ equity section of Sherman Systems appears as follows. Common stock–$10 par value, 86,000 shares authorized, issued, and outstanding $ 860,000 Paid-in capital in excess of par value, common stock 286,000 Retained earnings 976,000 Total stockholders’ equity $ 2,122,000 Prepare journal entries to record the following transactions for Sherman Systems. Purchased 6,400 shares of its own common stock at $39 per share on October 11. Sold 1,350 treasury shares on November 1 for $45.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education