FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Ee.68.

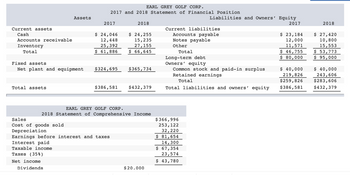

Transcribed Image Text:Current assets

Cash

Accounts receivable

Inventory

Total

Fixed assets

Net plant and equipment

Total assets

Assets

Sales

Cost of goods sold

Depreciation

EARL GREY GOLF CORP.

2017 and 2018 Statement of Financial Position

2017

$ 24,046

12,448

25,392

$ 61,886

$324,695

$386,581

Earnings before interest and taxes

Interest paid

Taxable income

Taxes (35%)

Net income

Dividends

2018

$ 24,255

15,235

27,155

$ 66,645

$365,734

EARL GREY GOLF CORP.

2018 Statement of Comprehensive Income

$432,379

$20.000

Current liabilities

Accounts payable

Notes payable

Other

Total

Liabilities and Owners' Equity

2017

Long-term debt

Owners' equity

Common stock and paid-in surplus

Retained earnings

Total

Total liabilities and owners' equity

$366,996

253,122

32,220

$ 81,654

14,300

$ 67,354

23,574

$ 43,780

$ 23,184

12,000

11,571

$ 46,755

$ 80,000

$ 40,000

219,826

$259,826

$386,581

2018

$ 27,420

10,800

15,553

$ 53,773

$ 95,000

$ 40,000

243,606

$283,606

$432,379

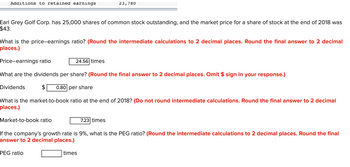

Transcribed Image Text:Additions to retained earnings

Earl Grey Golf Corp. has 25,000 shares of common stock outstanding, and the market price for a share of stock at the end of 2018 was

$43.

What is the price-earnings ratio? (Round the intermediate calculations to 2 decimal places. Round the final answer to 2 decimal

places.)

Price-earnings ratio

What are the dividends per share? (Round the final answer to 2 decimal places. Omit $ sign in your response.)

Dividends

Market-to-book ratio

24.56 times

23,780

0.80 per share

What is the market-to-book ratio at the end of 2018? (Do not round intermediate calculations. Round the final answer to 2 decimal

places.)

PEG ratio

7.23 times

If the company's growth rate is 9%, what is the PEG ratio? (Round the intermediate calculations to 2 decimal places. Round the final

answer to 2 decimal places.)

times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education