FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

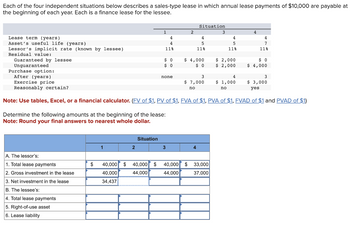

Transcribed Image Text:Each of the four independent situations below describes a sales-type lease in which annual lease payments of $10,000 are payable at

the beginning of each year. Each is a finance lease for the lessee.

Lease term (years)

Asset's useful life (years)

Lessor's implicit rate (known by lessee)

Residual value:

Guaranteed by lessee

Unguaranteed

Purchase option:

After (years)

Exercise price

Reasonably certain?

A. The lessor's:

1. Total lease payments

2. Gross investment in the lease

3. Net investment in the lease

B. The lessee's:

4. Total lease payments

5. Right-of-use asset

6. Lease liability

$

Determine the following amounts at the beginning of the lease:

Note: Round your final answers to nearest whole dollar.

1

1

2

4

4

118

Situation

$0

$0

none

3

2

Situation

$ 4,000

$0

40.000 $ 40,000 $ 40,000 $

44,000

44.000

40,000

34,437

4

5

118

3

$ 7,000

no

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

4

3

33,000

37,000

4

5

118

$ 2,000

$ 2,000

4

$ 1,000

no

4

4

7

118

$0

$ 4,000

3

$ 3,000

yes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Each of the four independent situations below describes a sales-type lease in which annual lease payments a at the beginning of each year. Each is a finance lease for the lessee. (FV of $1, PV of $1, FVA of $1, PVA of $1, $1) (Use appropriate factor(s) from the tables provided.) Situation 1 2 3 Lease term (years) 7 7 8 Lessor's and lessee's interest rate Residual value: 8 128 98 11% 10% Estimated fair value 0 $50,000 $8,000 $50,000 Guaranteed by lessee 0 0 $8,000 $60,000 Determine the following amounts at the beginning of the lease. (Round your intermediate and final answers dollar amount.) Situation 2 A The lessor's: 1. Lease payments 2. Gross investment in the lease 3. Net investment in the lease The lessee's: 4. Lease payments 5. Right-of-use asset 6. Lease payable Barrow_forwardNonearrow_forwardam. 127.arrow_forward

- Nonearrow_forwardThe following facts pertain to a non-cancelable lease agreement between Faldo Leasing Company and Pharoah Company, a lessee. Commencement date Annual lease payment due at the beginning of each year, beginning with January 1, Residual value of equipment at end of lease term, guaranteed by the lessee Expected residual value of equipment at end of lease term Lease term Economic life of leased equipment Fair value of asset at January 1, Lessor's implicit rate Lessee's incremental borrowing rate January 1, $126,840 $55,000 $50,000 6 years 6 years $653,000 9 % 9 % The asset will revert to the lessor at the end of the lease term. The lessee uses the straight-line amortization for all leased equipment.arrow_forwardThree independent situations are given. Each describes a finance lease in which annual lease payments are payable at the beginning of each year. Each lease agreement contains an option that permits the lessee to acquire the leased asset at an option price that is sufficiently lower than the expected fair value that the exercise of the option appears reasonably certain. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Lease term (years) Lessor's rate of return Fair value of leased asset. Lessor's cost of leased asset. Purchase option: Exercise price Exercisable at end of year: Reasonably certain? Situation 1 Situation 2 Situation 3 1 Annual lease payments 4 10% $92,000 $ 66,000 $ 26,000 4 yes Situation 2 4 11% $ 436,000 $ 436,000 $ 66,000 4 no 3 3 9% $ 201,000 $ 161,000 yes $ 38,000 2 Determine the annual lease payments for each situation: Note: Round your intermediate and final answers to the nearest whole dollar…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education