FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

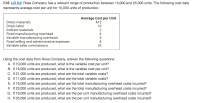

Transcribed Image Text:EA5. LO 2.2 Rose Company has a relevant range of production between 10,000 and 25,000 units. The following cost data

represents average cost per unit for 15,000 units of production.

Average Cost per Unit

$12

Direct materials

Direct labor

10

Indirect materials

2

Fixed manufacturing overhead

Variable manufacturing overhead

Fixed selling and administrative expenses

Variable sales commissions

4

3.

8

25

Using the cost data from Rose Company, answer the following questions:

A. If 10,000 units are produced, what is the variable cost per unit?

B. If 18,000 units are produced, what is the variable cost per unit?

C. If 21,000 units are produced, what are the total variable costs?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 2. Baxter Company has a relevant range of production between 15,000 and 30,000 units. The following cost data represents average variable costs per unit for 25,000 units of production. Average Cost per Unit Direct Materials $10.00 Direct Labor $9.00 Variable Manufacturing Overhead $5.00 Variable Sales Commission $14.00 Fixed Selling & Administrative Expenses $8.00 Fixed Manufacturing Overhead $6.00 PLEASE NOTE #1: Costs per unit dollar amounts will be rounded to two decimal places and shown with "$" and commas as needed (i.e. $1,234.56). PLEASE NOTE #2: Total costs dollar amounts will be whole dollars and shown with "$" and commas as needed (i.e. $12,345). Using the costs data from Baxter Company, answer the following questions: If 15,000 units are produced, what is the variable cost per unit? If 28,000 units are produced, what is the variable cost per unit? If 21,000 units are produced, what are the total variable costs? If 29,000 units are…arrow_forwardN1. Accountarrow_forwardKubin Company's relevant range of production is 15,000 to 19,000 units. When it produces and sells 17,000 units, its average costs per unit are as follows: Amount per Unit $ 7.60 $ 4.60 $ 2.10 $ 5.60 $ 4.10 $ 3.10 $ 1.60 $ 1.10 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Required: 1. If 15,000 units are produced and sold, what is the variable cost per unit produced and sold? 2. If 19,000 units are produced and sold, what is the variable cost per unit produced and sold? 3. If 15,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 4. If 19,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 5. If 15,000 units are produced, what is the average fixed manufacturing cost per unit produced? 6. If 19,000 units are produced,…arrow_forward

- Required information [The following information applies to the questions displayed below] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): $ 10,000 5,500 4,500 2,250 Sales Variable expenses Contribution margin Fixed expenses Net operating income 2,250 2. What is the contribution margin ratio? Contribution margin ratioarrow_forward0 Ellerie, Incorporated, manufactures and sells two products Product G8 and Product 00. Data concerning the expected production of each product and the expected total direct labor hours (DLH) required to produce that output appear below: Activity Cost Pools Labor-related Expected Hours Per Production Unit 710 5.1 310 2.1 Product CB Product 00 Total direct labor-hours The direct labor rate is $22.20 per DLH. The direct materials cost per unit for each product is given below Direct Materials Cost per Unit $114.10 $ 114.50 Machine setups Order sice Direct Labor- Product CB Product 00 The company is considering adopting an activity based costing system with the following activity cost pools, activity measures, and expected activity Estimated Overhead Multiple Choice Activity Measures Total Direct Labor- Hours 3,621 651 4,272 Cost $56,055 54,890 366,008 $ 476,953 Which of the following statements concerning the unit product cost of Product GB is true? (Round your intermediate calculations…arrow_forwardPresented below is data of B Ltd for next year. XYZ Selling price ($) 3.0 2.0 4.0 Unit variable cost ($) 1.0 0.8 1.2 Standard labor hours 2.5 2 3.5 Maximum sales demand (units) 300 500 400 Total labor hours available for production in a month is 1000 hours. Requirements: 1. Compute unit contribution per unit of labor hour and show the product mix to maximize profit. 2. If the labor hours can be increased by 100 hours, how many units of product should the company produce to maximize profit?arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense 2. For financial accounting purposes, what is the total amount of period costs incurred to sell 10,000 units? (Do not round intermediate calculations.) X Answer is complete but not entirely correct. $ 65.000 x Average Cost Per Unit $ 6.30 $ 3.80 $ 1.50 $ 4.00 $ 3.30 $ 2.00 $ 1.00 $ 0.50 Total period costarrow_forwardhrd.2arrow_forwardHharrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education