FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

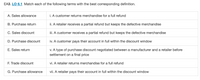

Transcribed Image Text:EA3. LO 6.1 Match each of the following terms with the best corresponding definition.

A. Sales allowance

i. A customer returns merchandise for a full refund

B. Purchase return

ii. A retailer receives a partial refund but keeps the defective merchandise

C. Sales discount

iii. A customer receives a partial refund but keeps the defective merchandise

D. Purchase discount

iv. A customer pays their account in full within the discount window

E. Sales return

v. A type of purchase discount negotiated between a manufacturer and a retailer before

settlement on a final price

F. Trade discount

vi. A retailer returns merchandise for a full refund

G. Purchase allowance

vii. A retailer pays their account in full within the discount window

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Decreases in the seller's receivable from a customer's return of merchandise or from granting the customer an allowance from the amount owed to the seller. Select one: O a. Freight Out b. Purchases Discount and Allowances c. Freight In d. Sales Discount and Allowancesarrow_forwardThe normal balance of the following accounts is a debit Multiple Choice O Sales returns and allowances, and purchase discounts. Cost of goods sold, and purchase discounts Transportation-in and income summary Sales returns and allowances, cost of goods sold Sales discounts and interest revenuearrow_forwardSellers use two methods in practice that simplify the process of recording sales discount. What are these methods of sales discount?arrow_forward

- When inventory is purchased on credit with terms FOB shipping point, what does the buyer do? Responses The buyer receives a discount if payment is made before the goods leave the seller’s place of business. The seller bears the insurance expense of goods during transit. The buyer reports the liability when the goods reach the buyer’s place of business. The buyer reports the liability when the goods leave the seller’s place of business.arrow_forwardWhat accounts are used to recognize a retailer’s purchase from a manufacturer on credit?A. accounts receivable, merchandise inventoryB. accounts payable, merchandise inventoryC. accounts payable, cashD. sales, accounts receivablearrow_forwardA receiving report is filled out when we receive: An inventory shipment from a vendor. Items that a customer is authorized to return from a previous sale. A payment on a customer's account. a and b only. Answer is not the First option!arrow_forward

- Early payment discounts offered by vendors are __________________ if payment is made within the discount period. Select one: A. automatically calculated by QBO B. displayed in the pay bills window C. displayed on the bill form D. None of the above are correctarrow_forwardCalculate the missing information for the purchase. Item SellingPrice(in $) SalesTaxRate SalesTax(in $) ExciseTax Rate ExciseTax TotalPurchase Price Book $ 8 $ 0 0 $19.44arrow_forwardUse the following sales journal to record the transactions. All credit sales are terms of n/30. (If a box is not used in the journal leave the box empty; do not select information or enter a zero.) A (Click the icon to view the transactions.) Sales Journal Page Invoice Customer Post. Accounts Receivable DR Cost of Goods Sold DR Date No. Account Debited Ref. Sales Revenue CR Merchandise Inventory CR 2024 Jun. More Info Jun. 1 Sold merchandise inventory on account to Fred Jig, $1,270. Cost of goods, $1,000. Invoice no. 101. Jun. 8 Sold merchandise inventory on account to lan Frog, $2,225. Cost of goods, $1,580. Invoice no. 102. Jun. 13 Sold merchandise inventory on account to Jillian Trump, $380. Cost of goods, $300. Invoice no. 103. Jun. 28 Sold merchandise inventory on account to Glen Whitney, $900. Cost of goods, $610. Invoice no. 104. Print Donearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education