FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

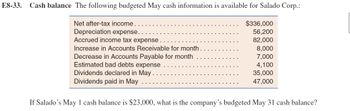

Transcribed Image Text:E8-33.

Cash balance The following budgeted May cash information is available for Salado Corp.:

$336,000

56,200

82,000

Net after-tax income

Depreciation expense..

Accrued income tax expense.

Increase in Accounts Receivable for month.

Decrease in Accounts Payable for month

Estimated bad debts expense

Dividends declared in May..

Dividends paid in May

8,000

7,000

4,100

35,000

47,000

If Salado's May 1 cash balance is $23,000, what is the company's budgeted May 31 cash balance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- QOPPC company chief accountant has provided you with the following information relating to the next budget period. Expenses: (in GH¢) October November December Selling & distribution 20,000 30,000 34,000 General & administration 15,000 18,000 12,000 Bad debts 21,000 15,000 20,000 Rate 8,000 6,000 10,000 Interest charges 1,600 2,000 2,400 Depreciation expenses 30,000 10,000 10,000 Expenses are payable in the month of incurrence. 2. A contingent liability of GH¢10,000 is expected to mature in November 3. Estimated cash balance at the end of September will be GH¢5000. Cash balances should not be less than GH¢10,000. Cash can be borrowed in multiples of GH¢10,000 to finance any deficit at an interest rate of 15% per annum. 4. The sales manager's salary, which is GH¢ 7000 per month is expected to increase by GH¢1,000 every month after June 5. Motor vehicle will be purchased in November at GH¢240,000.…arrow_forwardNonearrow_forwardThe following information pertains to Direct Projects Ltd for the three months ended 31 December 2020. Actual October Budgeted November Budgeted December Revenue (20% for cash and 80% on credit) 360 000,00 380 000,00 400 000,00 Purchases (10% for cash 90% on credit) 240 000,00 280 000,00 320 000,00 Salaries and wages paid 40 000,00 60 000,00 60 000,00 Cash expenses 24 000,00 28 000,00 32 000,00 Depreciation 2 000,00 2 000,00 2 000,00 Additional information: It is expected that debtors will settle their accounts as follows: 20% in the month of invoice 70% in the month after the month of invoice, and 5% in the second month after the month of invoice. The remaining 5% is usually written off as bad debts. Trade creditors are paid in the month after the purchases at a discount of 5%. 50% of the salaries and wages are weekly wages. Because wages…arrow_forward

- Do not give solution in imagearrow_forwardThe treasurer of Gateway Co. has accumulated the following budget information for the first two months of the coming year: March $450,000 290,000 41,400 250,000 45,000 51,000 121,500 April $520,000 350,000 46,400 Sales Inventory costs Operating expenses Capital expenditures March 1 Cash balance Accounts Receivables-March 1 Accounts Payable-March 1 ($102,000 for inventory purchases and $19,500 for operating expenses) The company expects to sell about 35% of sales for cash. Of sales on account, 80% are expected to be collected in full in the month of the sale and the remainder in the month following the sale. One fourth of the inventory costs are expected to be paid in the month in which they are incurred and the other three fourths in the month following. Depreciation, insurance, and property taxes represent $6,400 of the total budgeted monthly operating expenses. Insurance is paid in February and a $40,000 installment on property taxes is expected to be paid in April. Of the remainder…arrow_forwardEdelmar Corp. has prepared a preliminary cash budget for the third quarter as shown below: Cash Budget Beginning cash balance Plus: Cash collections Cash available Less: Cash payments: Purchases of direct materials July $36,000 $56,000 92,000 Operating expenses Capital expenditures Ending cash balance Aug $17,000 $52,000 $69,000 34,000 41,000 0 $17,000 Subsequently, the marketing department revised its figures for cash collections. New data are as follows: $54,000 in July, $55,000 in August, and $44,000 in September. Based on the new data, calculate the new projected cash balance at the end of July Sep $21,500 47,800 $69,300 9,000 30,500 8,000 $21,500 10,000 30,800 7,700 $20,800arrow_forward

- The following information pertains to Omega Projects Ltd for the three months ended 31 December 2020. Actual Budgeted October November December R R R Revenue (20% for cash and 80% on credit) 360 000 380 000 400 000 Purchases (10% for cash 90% on credit) 240 000 280 000 320 000 Salaries and wages paid 40 000 60 000 60 000 Cash expenses 24 000 28 000 32 000 Depreciation 2 000 2 000 2 000 Additional information: It is expected that debtors will settle their accounts as follows: 20% in the month of invoice 70% in the month after the month of invoice, and 5% in the second month after the month of The remaining 5% is usually written off as bad Trade creditors are paid in the month after the purchases at a discount of 5%. 50% of the salaries and wages are weekly wages. Because wages are paid weekly, usually 10% of the wages are paid in the month following the month in which they were…arrow_forward! Required information [The following information applies to the questions displayed below.] Built-Tight is preparing its master budget. Budgeted sales and cash payments follow: July $ 56,000 August $ 72,000 September $ 56,000 Budgeted sales Budgeted cash payments for Direct materials 15,560 3,440 19,600 12,840 2,760 16,200 13,160 2,840 16,600 Direct labor Overhead Sales to customers are 20% cash and 80% on credit. Sales in June were $53,500. All credit sales are collected in the month following the sale. The June 30 balance sheet includes balances of $47,000 in cash and $4,400 in loans payable. A minimum cash balance of $47,000 is required. Loans are obtained at the end of any month when the preliminary cash balance is below $47,000. Interest is 1% per month based on the beginning-of-the-month loan balance and is paid at each month-end. Any preliminary cash balance above $47,000 is used to repay loans at month-end. Expenses are paid in the month incurred and consist of sales…arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education