FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

H9.

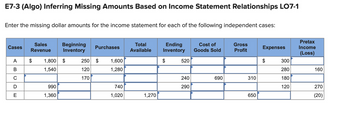

Transcribed Image Text:E7-3 (Algo) Inferring Missing Amounts Based on Income Statement Relationships LO7-1

Enter the missing dollar amounts for the income statement for each of the following independent cases:

Cases

A

B

C

D

E

Sales

Revenue

Beginning

Inventory

$ 1,800 $

1,540

990

1,360

Purchases

250 $ 1,600

120

1,280

170

740

1,020

Total

Available

1,270

Ending

Inventory

$

520

240

290

Cost of

Goods Sold

690

Gross

Profit

310

650

Expenses

$

300

280

180

120

Pretax

Income

(Loss)

160

270

(20)

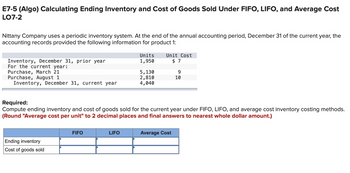

Transcribed Image Text:E7-5 (Algo) Calculating Ending Inventory and Cost of Goods Sold Under FIFO, LIFO, and Average Cost

LO7-2

Nittany Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the

accounting records provided the following information for product 1:

Inventory, December 31, prior year

For the current year:

Purchase, March 21

Purchase, August 1

Inventory, December 31, current year

Ending inventory

Cost of goods sold

FIFO

Units

1,950

LIFO

5, 130

2,810

4,040

Required:

Compute ending inventory and cost of goods sold for the current year under FIFO, LIFO, and average cost inventory costing methods.

(Round "Average cost per unit" to 2 decimal places and final answers to nearest whole dollar amount.)

Unit Cost

$ 7

9

10

Average Cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- how do i do PR 13-3Aarrow_forward10078+0987=arrow_forwardFans Company has two service departments-product design and engineering support, and two production departments - assembly and finishing. The distribution of each service department's efforts to the other departments is shown below: Design SERVICE DEPARTMENT Product Design 0% Engineering Support 20% The direct operating costs of the departments (including both variable and fixed costs) were as follows: Product Design Engineering Support Assembly Finishing Multiple Choice $1,863,265 SERVICES PROVIDED TO Support 10% 0% $623,878 $1,036,122 Assembly 30% 45% $100,000 $ 200,000 $540,000 $ 820,000 The total cost accumulated in the assembly department using the reciprocal method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) Finishing 60% 35% Darrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education