FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Plant Assets, Natural Re

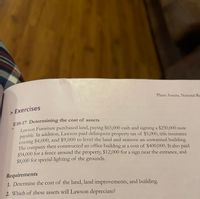

> Exercises

E10-17 Determining the cost of assets

Lawson Furniture purchased land, paying $65,000 cash and signing a $250,000 note

pavable. In addition, Lawson paid delinquent property tax of $5,000, title insurance

costing $4,000, and $9,000 to level the land and remove an unwanted building.

The company then constructed an office building at a cost of $400,000. It also paid

$54.000 for a fence around the property, $12,000 for a sign near the entrance, and

$8,000 for special lighting of the grounds.

Requirements

1. Determine the cost of the land, land improvements, and building.

2. Which of these assets will Lawson depreciate?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- RenFair Clothing purchased land, paying $80,000 cash and signing a $220,000 note payable. In addition, RenFair Clothing paid delinquent property tax of $1,500, title insurance costing $800, and $4,000 to level the land and remove an unwanted building. Record the journal entry for purchase of the land. Begin by determining the cost of the land. Purchase price of land Add related costs: Total cost of landarrow_forwardHow to calculate the Amortization Expense?arrow_forwardO Determine Cost of Land Four Corners Delivery Company acquired an adjacent lot to construct a new warehouse, paying $29,000 and giving a short-term note for $325,000. Legal fees paid were $2,375, delinquent taxes assumed were $9,200, and fees paid to remove an old building from the land were $22,200. Materials salvaged from the demolition of the building were sold for $5,300. A contractor was paid $1,076,200 to construct a new warehouse. Determin he cost of the land to be reported on the balance sheet.arrow_forward

- asv.1arrow_forwardDetermining cost of land On-Time Delivery Company acquired an adjacent lot to construct a new warehouse, paying $28,000 in cash and giving a short-term note for $258,000. Legal fees paid were $1,565, delinquent taxes assumed were $10,000, and fees paid to remove an old building from the land were $20,000. Materials salvaged from the demolition of the building were sold for $4,300. A contractor was paid $869,400 to construct a new warehouse. Determine the cost of the land to be reported on the balance sheet.fill in the blank 1 of 1$arrow_forwardDetermining Cost of Land On-Time Delivery Company acquired an adjacent lot to construct a new warehouse, paying $27,000 in cash and giving a short-term note for $256,000. Legal fees paid were $2,200, delinquent taxes assumed were $9,800, and fees paid to remove an old building from the land were $20,700. Materials salvaged from the demolition of the building were sold for $4,200. A contractor was paid $860,300 to construct a new warehouse. Determine the cost of the land to be reported on the balance sheet.arrow_forward

- Auto purchased a $500,000 tract of land that is intended to be the site of a new office complex. The company incurred additional costs and realized salvage proceeds as follows: Demolilitipn of existing building on site: $75,000 Legal and other fees to close escrow: $15,000 Proceeds from sale of demolition scrap: $10,000 What would be the cost of land? A. $500,000 B. $575,000 C. $580,000 D. $590,000arrow_forwardK- Belvidere Furniture purchased land, paying $95,000 cash and signing a $280,000 note payable. In addition, Belvidere paid delinquent property tax of $5,000, title insurance costing $1,500, and $8,000 to level the land and remove an unwanted building. The company then constructed an office building at a cost of $400,000. It also paid $51,000 for a fence around the property, $13,000 for a sign near the entrance, and $3,000 for special lighting of the grounds. Read the requirements. Requirement 1. Determine the cost of the land, land improvements, and building. The cost of the land is $ 389,500 The total cost of the land improvements is Requirements 1. Determine the cost of the land, land improvements, and building. 2. Which of these assets will Belvidere depreciate? Print Done - Xarrow_forwardA company purchased new equipment for $40,000. The company paid cash for the equipment. Other costs associated with the equipment were: transportation costs, $2,300; sales tax paid, $2,400; and installation cost, $2,300. The total capitalized cost reported for the equipment was: Multiple Choice $44,700. $47,000. $40,000. $42,300.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education