Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

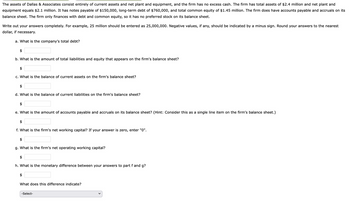

Transcribed Image Text:The assets of Dallas & Associates consist entirely of current assets and net plant and equipment, and the firm has no excess cash. The firm has total assets of $2.4 million and net plant and

equipment equals $2.1 million. It has notes payable of $150,000, long-term debt of $760,000, and total common equity of $1.45 million. The firm does have accounts payable and accruals on its

balance sheet. The firm only finances with debt and common equity, so it has no preferred stock on its balance sheet.

Write out your answers completely. For example, 25 million should be entered as 25,000,000. Negative values, if any, should be indicated by a minus sign. Round your answers to the nearest

dollar, if necessary.

a. What is the company's total debt?

$

b. What is the amount of total liabilities and equity that appears on the firm's balance sheet?

$

c. What is the balance of current assets on the firm's balance sheet?

$

d. What is the balance of current liabilities on the firm's balance sheet?

$

e. What is the amount of accounts payable and accruals on its balance sheet? (Hint: Consider this as a single line item on the firm's balance sheet.)

$

f. What is the firm's net working capital? If your answer is zero, enter "0".

$

g. What is the firm's net operating working capital?

$

h. What is the monetary difference between your answers to part f and g?

$

What does this difference indicate?

-Select-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:e. What is the amount of accounts payable and accruals on its balance sheet? (Hint: Consider this as a single line item on the firm's balance sheet.)

$

f. What is the firm's net working capital? If your answer is zero, enter "0".

$

g. What is the firm's net operating working capital?

$

h. What is the monetary difference between your answers to part f and g?

$

What does this difference indicate?

-Select-

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:e. What is the amount of accounts payable and accruals on its balance sheet? (Hint: Consider this as a single line item on the firm's balance sheet.)

$

f. What is the firm's net working capital? If your answer is zero, enter "0".

$

g. What is the firm's net operating working capital?

$

h. What is the monetary difference between your answers to part f and g?

$

What does this difference indicate?

-Select-

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Clayton Industries has the following account balances: Current assets Noncurrent assets The company wishes to raise $45,000 in cash and is considering two financing options: Clayton can sell $45,000 of bonds payable, or it can issue additional common stock for $45,000. To help in the decision process, Clayton's management wants to determine the effects of each alternative on its current ratio and debt-to-assets ratio. Required a-1. Compute the current ratio for Clayton's management. Note: Round your answers to 2 decimal places. Currently If bonds are issued If stock is issued $ 22,000 Current liabilities 77,880 Noncurrent liabilities stockholders' equity Currently If bonds are issued If stock is issued Current Ratio 2.44 to 1 a-2. Compute the debt-to-assets ratio for Clayton's management. Note: Round your answers to 1 decimal place. Bonds Stock to 1 to 1 Debt to Assets Ratio Additional Retained Earnings $ 9,000 50,000 48,888 % % % b. Assume that after the funds are invested, EBIT…arrow_forwardThe management of Sheridan Company is trying to decide whether it can increase its dividend. During the current year, it reported net income of $805,900. It had net cash provided by operating activities of $784,300, paid cash dividends of $89,500, and had capital expenditures of $328,400. Compute the company's free cash flow. (Show a negative free cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) The company's free cash flowarrow_forwardThe assets of the River & Stone Corp. company include current assets, property, plant and equipment and does not have excess cash (Free Cash). It has assets valued at $ 4 million and its fixed assets are valued at $ 3 million. It reports debts payable of $ 350,000, long-term debts of $ 650,000 and equity of $ 2 million. Your balance sheet reflects that you have accounts payable and accumulated debts. Generally, the company operates on a debt and equity basis. 1. Determine the total amount of the company's debt. 2. Calculate the balance of current assets and liabilities. 3. Determine the net working capital of the company. 4. Calculate the net operating working capital. 5. Explain how net working capital and operating working capital can support managerial decisions and strategic goals.arrow_forward

- Chandler Sporting Goods produces baseball and football equipment and lines of clothing. This year the company had cash and marketable securities worth $335,485, accounts payables worth $1,159,357, inventory of $1,651,599, accounts receivables of $1,488,121, short-term notes payable worth $313,663, and other current assets of $121,427. What is the company's net working capital? $3,596,632 $1,801,784 $2,123,612 $1,673,421arrow_forwardYou are evaluating the balance sheet for SophieLex’s Corporation. From the balance sheet you find the following balances: cash and marketable securities = $280,000; accounts receivable = $1,380,000; inventory = $2,280,000; accrued wages and taxes = $590,000; accounts payable = $890,000; and notes payable = $780,000. What is the quick ratio (round your answer to 2 decimal placesarrow_forwardYou are evaluating the balance sheet for SophieLex's Corporation. From the balance sheet you find the following balances: cash and marketable securities = $450,000; accounts receivable = $1,100,000; inventory = $2,000,000; accrued wages and taxes = $450,000; accounts payable = $750,000; and notes payable = $500,000. Calculate SophieLex's current ratio.arrow_forward

- The Stancil Corporation provided the following current information: Proceeds from long-term borrowing $ 13,800 Proceeds from the sale of common stock 5,000 Purchases of fixed assets 27,500 Purchases of inventories 2,600 Payment of dividends 13,800 Determine the total cash flows spent on fixed assets and NWC, and determine the cash flows to investors of the firm. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations.)arrow_forwardVikrambhaiarrow_forwardThe CEO was puzzled that despite a net profit of $198,750, the bank accountdecreased from $205,670 on 1 October 2017 to $113,670 on 30 September 2018.Examine and explain the main causes and comment on the company's cash level to the CEO.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education