FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

I need this( https://www.chegg.com/homework-help/top-quality-appliance-long-beach-purchased-franchise-top-qua-chapter-9-problem-1cpp-solution-9780134486833-exc ) problem solved for requirment 1 only. I can not apload more than one picture thats why I send half of it from website and other half in picture. Thank you.

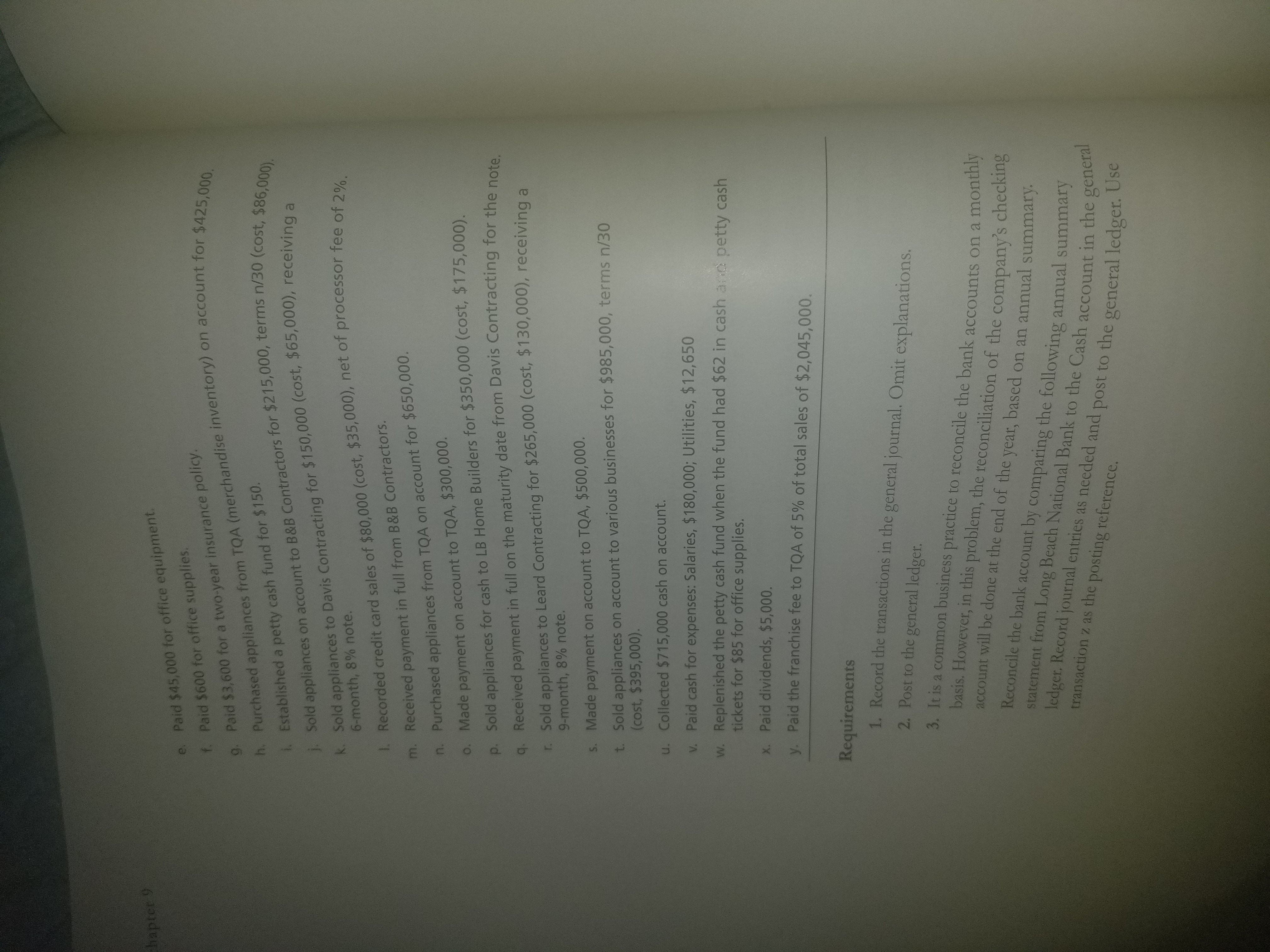

Transcribed Image Text:e. Paid $45,000 for office equipment

f. Paid $600 for office supplies

9. Paid $3,600 for a two-year insurance polic

h. Purch

. Established a petty cash fund for $150.

i. Sold applia

k. Sold appliances to Davis Contracting for 5

(merchandise inventory) on account for $425

ased appliances from TQA

),

nces on account to B&B Contractors for $215,000, terms

tracting for $150,000 (cost, $65,00o), receiving a

6-month, 8% note.

l. Recorded credit card sales of $80,000 (cost, $35,000), net of processor fee of 2%

m. Received payment in full from B&B Contractors.

n. Purchased appliances from TQA on account for $650,000.

o. Made payment on account to TQA, $300,000.

p. Sold appliances for cash to LB Home Builders for $350,000 (cost, $175,000)

. Received payment in full on the maturity date from Davis Contracting for the note

r. Sold appliances to Leard Contracting for $265,000 (cost, $130,000), receiving a

9-month, 8% note.

s. Made payment on account to TQA, $500,000

t. Sold appliances on account to various businesses for $985,000, terms n/30

(cost, $395,000)

u. Collected $715,000 cash on account.

v. Paid cash for expenses: Salaries, $180,000; Utilities, $12,650

w. Replenished the petty cash fund when the fund had $62 in cash ae petty cash

tickets for $85 for office supplies

x. Paid dividends, $5,000.

y, paid the franchise fee to TQA of 5% of total sales of $2,045,000.

Requirements

1. Record the transactions in the general journal. Omit explanations.

2. Post to the general ledger.

3. It is a common business practice to reconcile the bank accounts on a monthly

basis. However,in this problem, the reconcliation of the company's checking

account will be done at the end of the year, based on an annual summary

Reconcile the bank account by comparing the following a

statement from Long Beach National Bank to the Cash account

ledget. Record journal entries as needed and post to the gener

transaction z as the posting reference.

nnual summary

in the general

al ledger. Use

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I am having a hard time with my ACC 118 homework. Can you help me understand this problem better?arrow_forwardcument95.docx Document94.doox M Inbox (204) - ladybuggsmX C Get Homework Help WithX C P4-4B. LO o https://naticollegeedu-my.sharepoint.com/w:/r/personal/hayess_students_an_edu/_layouts/15/Doc.aspx?sourced U ANU Canvas Search (Alt + Q) References Review View Help O Editing A A B I e A A E Ev E E EV 14 macnine nour anaa iarge pianket takes z macnine nours? EA5. LO 6.2ldentify appropriate cost drivers for these cost pools: A. setup cost pools B. assembly cost pool C. supervising cost pool D. testing cost poolarrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forward

- * My Home x : CengageNOWv2 | Online teachin x b Home | bartleby x + A v2.cengagenow.com/iln/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false M Gmail YouTube Maps Blackboard HW #10 - Chpt 22 1 eBook E Print Item Schedule of Cash Payments for a Service Company Oakwood Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March $124,500 April 115,800 Мay 105,400 Depreciation, insurance, and property taxes represent $26,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in June. 60% of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month. Prepare a schedule indicating cash payments for selling and administrative expenses for March, April, and May. Oakwood Financial Inc.…arrow_forwardHELP THESE TWO QUESTIONSarrow_forwardngageNOWv2 | Online teachin + takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Cancel Your. F Startup Opportuniti. V How brands are co... Assignment Practic. A COVID-19 Student. C20-128PRO1-2016. O Final Exam Review -. Professional Certific. Syntech makes digital cameras for drones. Their basic digital camera uses $80 in variable costs and requires $1,600 per month in fixed costs. Syntech sells 100 cameras per month. If they process the camera further to enhance its functionality, it will require an additional $45 per unit of variable costs, plus an increase in fixed costs of $800 per month. The current price of the camera is $160. The marketing manager is positive that they can sell more and charge a higher price for the improved version. At what price level would the upgraded camera begin to improve operational earnings? Price to be charged $ Previous Nextarrow_forward

- M Inbox (909) - camillejeunei @gm i General (BSA 1-1: FAR 2) | Micro O FAR 2 LONG QUIZ /Pages/ResponsePage.aspx?id3DcYWpTercOUiPsQvdXclp-WXyu19p0dpLjDbGCXgjKqpURFVGNzZDSzZDWUhSWkRNTUoxTjBXNzhF The net income from January 1 to September 30, 2019 is P44,000. Also, on this date, cash and liabilities are P40,000 and P90,000, respectively. For Romans to receive P55,200 in full settlement of his interest in the firm, how much must be realized from the sale of the firm's non-cash assets? * Corinthians and Galatians decide to dissolve the partnership on September 30, 2021. neir capital balances and profit ratio on this date, follow: Capital Balances Profit Ratio Romans P50,000 40% Corinthians 60,000 Galatians 20,000 30% P196,000 P177,000 P193,000 国 INarrow_forwardENOWV2 | Online teachin + Assignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false el Your.. Startup Opportuniti. V How brands are co. Assignment Practic.. A COVID-19 Student. O Final Exam Review -. C20-128PRO1-2016.. Professional Certific. Rough Stuff makes 2 products: khaki shorts and khaki pants for men. Each product passes through the cutting machine area, which is the chief constraint during production. Khaki shorts take 15 minutes on the cutting machine and have a contribution margin per pair of shorts of $16. Khaki pants take 24 minutes on the cutting machine and have a contribution margin per pair of pants of $32. If it is assumed that Rough Stuff has 4,800 hours available on the cutting machine to service a minimum demand for each product of 3,000 units, how much will profits increase if 106 more hours of machine time can be obtained? Previous Nextarrow_forwardHow to you solve this?arrow_forward

- Hi I need help, it says my answer is wrong but I read over and over and over. Please helparrow_forwardo.mheducation.com/ext/map/index.html?_con-con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnec gnment i Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $85,460 in assets to launch the business. On December 31, the company's records show the following items and amounts. Cash Accounts receivable office supplies Land office equipment Accounts payable Owner investments $ 6,650 Cash withdrawals by owner 18,650 Consulting revenue 4,640 Rent expense 46,000 Salaries expense 19,560 Telephone expense 9,890 Miscellaneous expenses 85,460 Exercise 1-20 (Algo) Preparing a balance sheet LO P2 $ Use the above information to prepare a December 31 balance sheet for Ernst Consulting. ERNST CONSULTING Balance Sheet 0 $ $ 3,490 18,650 4,920 8,500 $ 0 890 700 0 Saved < Prev 9 10 of 10 Next Carrow_forwardCan someone please help me with these questions? Thank you so much! Thumbs up if the answer is correct. For this question, you must use the data package "Cars93" available in the R package "MASS" followed by "dplyr" package. Find the number of cars that are USA company origin, whose max price is greater than 30, and Passenger capacity is greater than 4. Hint: Use "filter" function. 2 1 4 Pregunta 4 For this question, you must use the data package "Cars93" available in the R package "MASS" followed by "dplyr" package. On average, which manufacturer produces the heaviest car? Hint: Group and summarise. BMW 0000 Lexus Infiniti Dodgearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education