ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

1 E, F

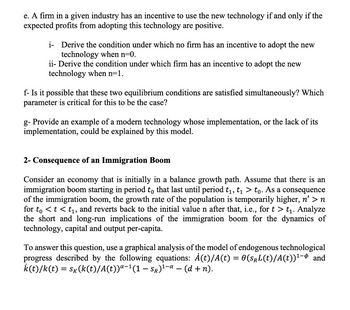

Transcribed Image Text:e. A firm in a given industry has an incentive to use the new technology if and only if the

expected profits from adopting this technology are positive.

i-Derive the condition under which no firm has an incentive to adopt the new

technology when n=0.

ii- Derive the condition under which firm has an incentive to adopt the new

technology when n=1.

f- Is it possible that these two equilibrium conditions are satisfied simultaneously? Which

parameter is critical for this to be the case?

g- Provide an example of a modern technology whose implementation, or the lack of its

implementation, could be explained by this model.

2- Consequence of an Immigration Boom

Consider an economy that is initially in a balance growth path. Assume that there is an

immigration boom starting in period to that last until period t₁, t₁ > to. As a consequence

of the immigration boom, the growth rate of the population is temporarily higher, n' > n

for to < t < t₁, and reverts back to the initial value n after that, i.e., for t > t₁. Analyze

the short and long-run implications of the immigration boom for the dynamics of

technology, capital and output per-capita.

To answer this question, use a graphical analysis of the model of endogenous technological

progress described by the following equations: À(t)/A(t) = 0(SrL(t)/A(t))¹- and

k(t)/k(t) = Sk(k(t)/A(t))ª−¹(1 − Sr)¹−¤ − (d + n).

Transcribed Image Text:1- Complementarities

and Industrialization

Consider the following variation of the model of industrialization and coordination

failures by Murphy, Shleifer and Vishny (1989) discussed in lectures 8.

Consumers: The economy is populated by N consumers, each of them demanding N

different goods. Individuals expend a constant fraction, 1/N, of their income in each

of the N goods.

Traditional Firms: In each sector, there are a large number of firms that can produce

using a traditional technology. Using the traditional technology, 1 unit of labor can be

used to produce 1 unit of the good, qold-1. Notice that the price of the good could never

exceed the wage w (why?). Therefore, traditional firms will earn zero profits.

Modern Firms: In each sector, there is a potential firm that must decide whether to use a

modern technology. To use the modern technology a firm must purchase yF/N units of

the goods produced by each of the N industries (including itself) and hire (1-y)F units of

labor, so that the total fixed cost is equal to F. If the modern technology is adopted by a

given firms in a sector, this firm produces using a superior technology that transform 1

unit of labor into a units of the good, qmodern=a*1, where a>1.

Labor Market: Traditional and modern firms compete in the same labor market, and

therefore, they must pay the same wage. Wages paid by traditional and modern firms is

normalized to 1, wold- wmodern =1.

a. Suppose that the expected sales in each industry are equal to q. Derive an expression

for

TT, the expected profits of using the new technology as a function of F, q, a.

b. The income per capita in this economy, y, is the sum of per capita labor income as well

as the profit income from the firms adopting the modern technology. Derive an

expression for y in terms of n, à and where n is the fraction of sectors using the modern

technology.

c. The expected sales of each industry, q, are the sum of the demand from consumers and

the demand from modern firms. The demand from modern firms is equal to nyF, the total

purchases by firms adopting the new technology. Therefore, the expected sales of an

industry are

q=y+nyF

Using this equation and your answer to a-b, derive an equation relating y with n, a, y and

F. Solve for y in terms of n, a, y and F.

d. Combining a-c, derive an expression for a in terms of n, a, y and F.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 13 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Tract 1 123 2 3 4 Group A Group B 25 50 75 100 25 25 25 25 Calculate the dissimilarly index for this county.arrow_forwardThe ratio of Consumption to savings is given as 5/3 Calculate the value of savings if the value of income is $6000arrow_forwardTotal Total Total Product Fixed Variable (Blankets) Cost Cost 0 A 0 1 60 25 2 60 40 3 60 I 4 60 55 5 60 55 6 60 70 7 60 100 8 60 145 A What is the numerical value of B? A/ What is the numerical value of C? A/ Total Cost What is the numerical value of D? B 85 100 110 G 115 130 160 205 Average Average Average Variable Total Fixed Cost Cost cost - с 60 30 20 15 12 8.6 7.5 25 20 16.7 13.8 Ꭰ 11.7 14.3 18.1 E The table describes the short-run daily costs of the Baby Blanket Company. What is the numerical value of A? 85 36.7 28.8 J 21.7 22.9 25.6 Marginal Cost F H 15 10 0 15 30 45arrow_forward

- question part c should contain a grapharrow_forwardA doctor's office staff studied the waiting times for patients who arrive at the office with a request for emergency service. The following data with waiting times in minutes were collected over a one- month period. a. Fill in the frequency values below. Waiting Time Frequency 49 11 16 4 2 3 18 11 7 9 8 12 24 7 8 7 13 19 5 4 0-4 5-9 8 4 10-14 15-19 3 20-24 1 Total 20 b. Fill in the relative frequency (2 decimals) values below. Waiting Time Relative Frequency 0.2 0-4 5-9 0.4 0.2 10-14 15-19 0.15 20-24 0.05 Total 1arrow_forwardurgentarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education