Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

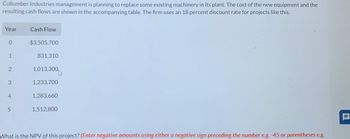

Cullumber Industries management is planning to replace some existing machinery in its plant. The cost of the new equipment and the resulting cash flows are shown in the accompanying table. The firm uses an 18 percent discount rate for projects like this. \table[[Year, Cash Flow ], [0, $3,505, 700

Transcribed Image Text:Cullumber Industries management is planning to replace some existing machinery in its plant. The cost of the new equipment and the

resulting cash flows are shown in the accompanying table. The firm uses an 18 percent discount rate for projects like this.

Year

0

1

2

3

4

5

Cash Flow

-$3,505,700

831,310

1,013,300,

1,233,700

1,283,660

1,512,800

What is the NPV of this project? (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- ealthy Food Ltd is considering to invest in one of the two following projects to buy new machinery. Each option will last 5 years and have no salvage value at the end. The company’s required rate of return for all investment projects is 7%. The cash flows of the projects are provided below. Machinery 1 Machinery 2 Cost $396,000 $415,000 Future Cash Flows Year 1 Year 2 Year 3 Year 4 Year 5 123,000 194,000 205,000 215,000 228,000 196, 000 204,000 212,000 217,000 233,000 Required: Identify which option of machinery should the company accept based on the simple payback period method if the firm maintains a policy that every investment project should recover the initial investment within 2 years.arrow_forwardKeone Products Company is considering an investment in one of two new product lines. The investment required for either product line is $750,000. The net cash flows associated with each product are as follows: Year Liquid Soap Body Lotion 1 $140,000 $ 125,000 2 150,000 125,000 3 160,000 125,000 4 150,000 125,000 5 150,000 125,000 6 100,000 125,000 7 80,000 125,000 8 70,000 125,000 Total $1,000,000 $1,000,000 a. Recommend a product offering to Keone Products Company, based on the cash payback period for each product line. Line Item Description Year Payback period for liquid soap Payback period for body lotion b. The project with the net cash flows in the early years of the project life will be favored over the one with the net cash flows in the initial years..arrow_forwardSalsa Company is considering an investment in technology to improve its operations. The investment costs $241,000 and will yield the following net cash flows. Management requires a 10% return on investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Year Net cash Flow 1 $ 48, 200 2 53,900 3 76, 400 4 95,500 5 126,500 Required: Determine the payback period for this investment. Determine the break - even time for this investment. Determine the net present value for this investment. Should management invest in this project based on net present value?arrow_forward

- Providence Health is evaluating two different linen supply vendors systems for handling facility linen replacement. There are no incremental revenues attached to the projects, so the decision will be made on the basis of the present value of costs. Providence's weighted average cost of capital is 6.25%. Here are the net cash flow estimates in thousands of dollars: Year 0 1 2 3 4 5 System X System Y S (1,800) $ (3,850) S (1,000) S (500) (1,000) S (500) S S (1,000) S S (1,000) S S (1,000) S (500) (500) (500) [a] Assume initially that the systems both have average risk. Which one should be chosen? [b] Assume that System Y is judged to have high risk. The organization accounts for differential risk by adjusting its corporate cost of capitalarrow_forwardBensington Glass Co. is considering the expansion of it spandrel glass business line. They plan to convert an unused space of their warehouse into additional manufacturing space. They estimate the initial investment will be $9,350,000 and expect the new production to create additional cash flows of $4,105,000 in year's one through ten. If Bensington Glass uses a discount rate of 15%, what is the project's discounted payback period? O 4.16 2.99 2.28 3.25arrow_forwardDogwood Company is considering a capital investment in machinery: (Click the icon to view the data.) 8. Calculate the payback. 9. Calculate the ARR. Round the percentage to two decimal places. 10. Based on your answers to the above questions, should Dogwood invest in the machinery? 8. Calculate the payback. Amount invested Expected annual net cash inflow Payback 1,500,000 24 500,000 3 years 9. Calculate the ARR. Round the percentage to two decimal places. Average annual operating income Average amount invested ARR Data Table Initial investment $ 1,500,000 Residual value 350,000 Expected annual net cash inflows 500,000 Expected useful life 4 years Required rate of return 15%arrow_forward

- Oriole Corporation is considering adding a new product line. The cost of the factory and equipment to produce this product is $1,700,000. Company management expects net cash flows from the sale of this product to be $630,000 in each of the next eight years. If Oriole uses a discount rate of 11 percent for projects like this, what is the net present value of this project? (Round intermediate calculations to 5 decimal places, e.g. 0.42354. Round answer to O decimal places, e.g. 52.25. Enter negative amounts using negative sign e.g. -45.25.) NPV $ 36695.55 What is the internal rate of return? (Round answer to 2 decimal places, e.g. 52.50.) Internal rate of return %arrow_forwardHook Industries is considering the replacement of one of its old metal stamping machines. Three alternative replacement machines are under consideration. The cash flows associated with each are shown in the following table attached: . The firm's cost of capital is 10%. a. Calculate the net present value (NPV) of each press. b. Using NPV, evaluate the acceptability of each press. c. Rank the presses from best to worst using NPV.arrow_forwardBeyer Company is considering buying an asset for $350,000. It is expected to produce the following net cash flows. Compute the payback period for this investment. (Cumulative net cash outflows must be entered with a minus sign. Round your Payback Period answer to 2 decimal places.)arrow_forward

- Home Security Systems is analyzing the purchase of manufacturing equipment that will cost $56,000. The annual cash inflows for the next three years will be: Year 1 2 3 Cash Flow $ 28,000 26,000 21,000 Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the financial calculator method. a. Determine the internal rate of return. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Internal rate of return %arrow_forwardPlease see image for question to solve.arrow_forwardThe Martian Corporation, a space vehicle development company, is starting a new division that will develop the next-generation launch missile engine configuration. Use a hand application of the MIRR method to determine the EROR for the estimated net cash flows (in $1000 units) of $-60,000 in year 0, $15,000 in years 1 through 7, and $-1,000 in year 8. Assume a borrowing rate of 8% and an investment rate of 25% per year. The external rate of return is %.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education