FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

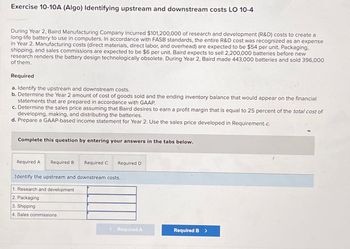

Transcribed Image Text:Exercise 10-10A (Algo) Identifying upstream and downstream costs LO 10-4

During Year 2, Baird Manufacturing Company incurred $101,200,000 of research and development (R&D) costs to create a

long-life battery to use in computers. In accordance with FASB standards, the entire R&D cost was recognized as an expense

in Year 2. Manufacturing costs (direct materials, direct labor, and overhead) are expected to be $54 per unit. Packaging,

shipping, and sales commissions are expected to be $6 per unit. Baird expects to sell 2,200,000 batteries before new

research renders the battery design technologically obsolete. During Year 2, Baird made 443,000 batteries and sold 396,000

of them.

Required

a. Identify the upstream and downstream costs.

b. Determine the Year 2 amount of cost of goods sold and the ending inventory balance that would appear on the financial

statements that are prepared in accordance with GAAP.

c. Determine the sales price assuming that Baird desires to earn a profit margin that is equal to 25 percent of the total cost of

developing, making, and distributing the batteries.

d. Prepare a GAAP-based income statement for Year 2. Use the sales price developed in Requirement-c.

Complete this question by entering your answers in the tabs below.

Required A

Required B Required C Required D

Identify the upstream and downstream costs.

1. Research and development

2. Packaging

3. Shipping

4. Sales commissions

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 6) New Brunswick Metalworks is evaluating a $100,000 polishing machine (CCA class 8). Services provided by the machine are expected to bring $15,000 per year in value over the next five years. Operating costs are expected to be $1,000 per year. Calculate the amount of taxes paid in each of the next five years of service life under the corporate tax rate of 40%.arrow_forwardYou are given the following financial data about an assembly machine to be implemented at a company: - Investment cost at year 0 (n=0) is $22,000 - Investment cost at the end of the first year (n=1) is $18,500 - Useful life: 15 years - Salvage value (at the end of 15 years): $7,000 Annual revenues: $18,000 per year - Annual expenses: $5,000 per year Assuming the first revenues and expenses will occur starting from the end of year 2, determine the conventional (non-discounted) payback period.arrow_forwardOn January 3, 2020, Gagne Inc. paid $320,000 for a computer system. In addition to the basic purchase price, the company paid a setup fee of $2,500, $6,400 sales tax, and $21,100 for special installation. Management estimates that the computer will remain in service for five years and have a residual value of $20,000. The computer will process 50,000 documents the first year, decreasing annually by 5,000 during each of the next four years (that is 45,000 documents in 2021, 40,000 documents is 2022, and so on). In trying to decide which depreciation method to use, the company president has requested a depreciation schedule for each of three depreciation methods (straight-line, units-of-production, and double-diminishing-balance). Before completing the straight-line depreciation schedule, calculate the straight-line depreciation rate. First, select the labels for the formula and then compute the rate. (Round the rate to two decimal places.) Date January 3, 2020 December 31, 2020 December…arrow_forward

- Star Construction Corporation has a contract to construct a building for $10,950,000. The building is controlled by the customer throughout the term of the contract. Total costs to complete the building were originally estimated at $8,850,000. Construction commenced on 4 February 20×5. Actual costs were in line with estimated costs for 20×5 and 20×6. In 20×7, actual costs exceeded estimated costs by $150,000. Total construction costs incurred in each year were as follows: 20X5: $2,700,00020X6: $4,500,00020X7: $1,800,000 Progress billings based on the amount of work completed were collected each year. Star Construction uses the percentage-of-completion method. The percentage-of-completion is based on costs incurred compared with estimated total costs of the project. Company also billed the client and collected the following payments Year Billings Payments Received 20X5: $2,300,000 $2,100,000 20X6: $4,900,000 $4,700,000 20X7: $3,750,000 $4,150,000…arrow_forwardXYZ Co. completed construction of a new silver mine in 2020. The cost of direct materials for the construction was $2,500,000 and direct labour was $2,300,000. In addition, the company allocated $280,000 of general overhead costs to the project. To finance the project, the company obtained a loan of $2,700,000 from its bank. The loan funds were drawn on February 24, 2020 and the mine was completed on November 24, 2020. The interest rate on the loan was 9% p.a. During construction, excess funds from the loan were invested and earned interest income of $24,000. The remainder of the funds needed for construction was drawn from internal cash reserves in the company. The company has also publicly made a commitment to clean up the site of the mine when the extraction operation is complete. It is estimated that the mining of this particular seam will be completed in 13 years, at which time restoration costs of $150,000 will be incurred. The appropriate discount rate for this type of…arrow_forwardCaramel Spa Company sells prefabricated pools that cost $80,000 to customers for $144,000. The sales price includes an installation fee, which is valued at $20,000. The fair value of the pool is $128,000. The installation is considered a seperate performance obligation and is expected to take 3 months to complete. The transaction price allocated to the pool and the installation isarrow_forward

- Ayayai Inc., a manufacturer of steel school lockers, plans to purchase a new punch press for use in its manufacturing process. After contacting the appropriate vendors, the purchasing department received differing terms and options from each vendor. The Engineering Department has determined that each vendor's punch press is substantially identical and each has a useful life of 20 years. In addition, Engineering has estimated that required year-end maintenance costs will be $1,020 per year for the first 5 years, $2,020 per year for the next 10 years, and $3,020 per year for the last 5 years. Following is each vendor's sales package. Vendor A: $51,520 cash at time of delivery and 10 year-end payments of $19.750 each. Vendor A offers all its customers the right to purchase at the time of sale a separate 20-year maintenance service contract, under which Vendor A will perform all year-end maintenance at a one-time initial cost of $10,170. Vendor B: Forty semiannual payments of $9,780 each,…arrow_forwardLerner College, a not-for-profit liberal arts college, charges the total cost of running its research library to its three academic programs: the humanities, the social sciences, and the sciences. Rent and utilities for the library space costs $30,000 per month. Salaries for the library’s employees total $275,000 per year, plus an additional 24% for benefits. The depreciation on the library's office equipment is $32,000 each year. Other library expenses – including supplies, books, subscriptions – are equal to $14,000 per month. The total cost of running the research library is allocated to each of the three academic programs based on the number of students in each of the three programs. The humanities program has 440 students; the social sciences program has 390 students; the sciences program has 260 students. The teaching staff for the social sciences program earns $650,000 per year in salaries and benefits. In addition, the social sciences program consumes $9,500 of supplies each…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education