FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

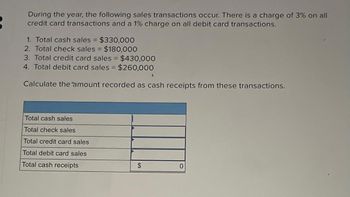

Transcribed Image Text:During the year, the following sales transactions occur. There is a charge of 3% on all

credit card transactions and a 1% charge on all debit card transactions.

1. Total cash sales = $330,000

2. Total check sales = $180,000

3. Total credit card sales = $430,000

4. Total debit card sales = $260,000

Calculate the amount recorded as cash receipts from these transactions.

Total cash sales

Total check sales

Total credit card sales

Total debit card sales

Total cash receipts

$

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company had the following sales transactions: 1. Total debit card sales = $280,000. 2. Total credit card sales = $410,000. 3. Total cash sales = $840,000. 4. Total check sales = $160,000. There is a charge of 3% on all credit card transactions. There is no charge on debit card transactions. Calculate total sales revenue recorded for the year. Sales revenuearrow_forwardA customer in a bank has made a balance withdrawal transaction in the last 30 days. In the last 28 days, the customer routinely made cash withdrawals of $100000. In the last two days, this customer made a withdrawal amounting to$7500000 and $5000000. Based on the transaction data, which value is the most appropriate to describe the central tendency of the distribution of customer cash withdrawal data? a) $510000 b) $100000 c) $275000 d) $426000arrow_forwardBeginning accounts receivable were $135,600 and ending accounts receivable were $128,640. All sales were on credit and totaled $1,682,480. Determine how much cash was collected from customers.?arrow_forward

- During the year, the following sales transactions occur. There is a charge of 3% on all credit card transactions and a 1% charge on all debit card transactions. Total cash sales = $380,000 Total check sales = $230,000 Total credit card sales = $480,000 Total debit card sales = $210,000 calculate the amount recorded as cash receipts from these transactionsarrow_forwardJumbotron Inc. collects its receivables in 15 days and pays its payables in 20 days. All sales and purchases are on credit. All months have 30 days. December purchases were $7,000, January purchases were $8,700, February purchase were $6,600 and March purchases were $6,000. What were Jumbotron's total cash disbursements in February? (To the nearest $) ● ● $7,667 $8,000 $1,867 $6,533 $5,600arrow_forwardMN.3.arrow_forward

- Logan Sales provides the following information: Net credit sales: $770,000 Beginning net accounts receivable: $45,000.00 Ending net accounts receivable: $22,000 Calculate the accounts receivable turnover ratio. (Round your answer to the nearest whole number.) A. 23 times B. 35 times C. 33 times D. 17 timesarrow_forwardDuring its first year of operations, Fertig Company had credit sales of $3,000,000, of which $400,000 remained uncollected at year- end. The credit manager estimates that $18,000 of these receivables will become uncollectible. The accounts receivable turnover is 10 times and average collection period is 36.5 days. Assume that average net accounts receivable were $300.000. Explain what these measures tell us. BI V T, TI E LE E H I 99 H E à ला 11 A A OWord(s)arrow_forwardUse the following information about a company's receivable transactions to determine relevant balances. * Account balances at 1/1/x2 Accounts receivable $100,000 Allowance for doubtful accounts 7,000 Allowance for sales returns 2,000 During the year, 20x2, the company had the following transactions related to receivables: • Credit sales revenue of $350,000 recorded. • Cash collections from accounts of $370,000. • Customer account write-offs in the amount of $10,000 • Customer returns of credit sales in the amount of $3,500. • Bad debt expense of $5,000 recorded at the end of the period. • The company estimates sales returns at 2% of credit sales revenue for the period. Determine the net realizeable value of receivables at the end of the year as disclosed on the balance sheet.arrow_forward

- Fred's Factory has credit sales of $747,500 and an average accounts receivable balance of $57,500. Fred factors his receivables throughout the year with his local bank at a 2% discount. What is the effective annual rate of this arrangement? Multiple Choice 27.88% 29.24% 28.67% 28.03% 30.04%arrow_forwardJ. Whitlock Co. had $1,000 of credit cards sales. The net cash receipts were deposited immediately into Whitlock's bank account less a 5% fee. The entry to record this sales transaction would include a debit to:arrow_forwardBank Alfatih earned an annual profit amounting to USD1,500,000 through a Mudharaba Mutlaqah deposit account. The profit sharing ratio between the bank and the depositors of the Mudharaba deposit account is (40:60) respectively. The table below contains data on the deposit types that are available, average balance needed, and the weights that are used. Deposit Types Average balance Weights 1 month 300,000 0.5 3 months and less 400,000 0.8 6 months and less 600,000 1 12 months and less 800,000 1.25 Total 2,100,000 Calculate the total depositors’ share from the annual profit. Calculate the weighted average balance for each type of deposits.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education