FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

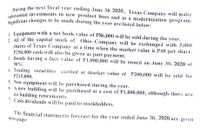

Transcribed Image Text:Significant changes to be made during the year are listed below:

substantial investments in new product lines and in a modernization program,

During the next fiscal year ending June 30, 2020, Texas Company will nake

Sienificant changes to be made during the year are listed below:

L Equipment with a net book value of P86,000 will be sold during the year.

2 All of the capital stock of Ohio Company will be exchanged with 5,000

shares of Texas Company at a time when the market value is P40 per share.

P250,000 cash will also be given as part payment.

3. Bonds having a face value of P1,000,000 will be issued on June 30, 2020 at

98%.

4. Trading securities carried at market value of P200,000 will be sold for

P215,000.

5. New equipment will be purchased during the year.

6. A new building will be purchased at a cost of P1,000,000, although there are

no building retirements.

1. Cash dividends wil! be paid to stockholders.

The financial statements forecast for the vear ended June 30, 2020 are given

next page:

Transcribed Image Text:Income Siatement

For the Year Ended June 30, 2020

Net sales

Cost of gonds sold (including depreciation

of P191,500,

Operating expenses (including depreciation

P2,430,500

P1,073,000

of P100,000)

Interest expense

Gain on sale of equipment

Gain on sale of trading securities

Unrealized holding gain on trading securities

500,000

7,500

(26,000)

(15,000)

(44,000)

356,000

P1,851,500

P 579,000

Income tax

Total

Net income

Texas Company

Balance Sheets

June 30

Assets

2020

2019

P442,000

325,000

Cash

P532,000

275,000

Trading Securities(market)

Accounts receivable

Inventories

80,500

141,500

168,500

450,000

43,000

86,000

Investment in Associates (cost)

Land

43,000

321,500

Buildings (net)

Equipment (net)

Total assets

1,095,000

352,000

P3,057,000

242,500

P1,540,500

Liabilities & Equity

P 93,500

P107,500

50,000

Accounts payable

Short-term bank loans payable

Accrued operating expenses

Income tax payable

Bonds payable (net)

Common stock, P10 par value

Additional paid in capital

Retained earnings

Total liabilities & equity

50,000

20,500

143,000

980,000

41,500

156,500

550,000

500,000

400,000

250,000

820,000

P3,057,000

435,000

P1,540,500

REQUIRED:

a forccast cash flow statement for the vear ended June 30,

** 1ow supporting schedules or T-accounts for many missing amounts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 3. Superserv Inc. intends to acquire new equipment for $10 million and has an estimated life of 5 years and a salvage value of $800K. The new equipment is expected to allow additional annual sales of $5 million over the next 5 years. The associated additional annual operating costs are expected to be $2.5 million, while the interest on debt issued to finance the project is $1.5 million. In addition, working capital will increase by $1.2 million at the outset. The project's cost of capital is 10%. The firm's tax rate is 40%. The annual depreciation charge on the new machine is $2 million. What is the project's NPV? ($-1.438m)< This is the answer however I need to know how to obtain this answer with a financial calculator, please do not use excelarrow_forwardMuffins masonry incs balance sheet list next fixed assets as $ 14 million. The fixed assets could currently be sold for 19 million dollars. muffins current balance sheet shows current liabilities of 5.5 million dollars and networking capital of 4.5 million dollars. if all the current accounts were liquidated today the company would receive 7.25 million dollars cash after paying the 5.5 million incurrent liabilities. what is the book value of muffins missionaries assets today and market value of these assets? Enter answers in millions of dollars rounded to 2 decimal places Book value. Market value. Current assets: Fixed assets: Total:arrow_forwardDerry Corporation is expected to have an EBIT of $3,100,000 next year. Depreciation, the increase in net working capital, and capital spending are expected to be $245,000, $150,000, and $250,000, respectively. All are expected to grow at 15 percent per year for four years. The company currently has $19,500,000 in debt and 860,000 shares outstanding. After Year 5, the adjusted cash flow from assets is expected to grow at 3.4 percent, indefinitely. The company's WACC is 9.7 percent and the tax rate is 23 percent. What is the price per share of the company's stock? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Share pricearrow_forward

- Suppose an industrial building can be purchased for $2,500,000 and is expected to yield cash flows of $180,000 in each of the next five years. (Note: assume payments are made at end of year.) If the building can be sold at the end of the fifth year for $2,800,000, calculate the IRR for this investment over the five-year holding period. A) 0.09%. B) 4.57%. C) 9.20%. Page 4 of 6 D) 10.37%arrow_forwardDerry Corporation is expected to have an EBIT of $2,950,000 next year. Depreciation, the increase in net working capital, and capital spending are expected to be $230,000, $135,000, and $235,000, respectively. All are expected to grow at 18 percent per year for four years. The company currently has $18,000,000 in debt and 845,000 shares outstanding. After Year 5, the adjusted cash flow from assets is expected to grow at 3.1 percent, indefinitely. The company’s WACC is 9.4 percent and the tax rate is 25 percent. What is the price per share of the company's stock?arrow_forwardA company enters into a project that will be unwound at the end of year 5, and it is expected that roughly 15% of the sales related to this project will be “on account” where the payments are made a year later, and where at the end of the project, all payments are received at EOY 5 (i.e. not received one year later). Show what the “Working Capital” investments are related to each period, based on these sales and how it was calculated:arrow_forward

- Please correctly with stepsarrow_forwardPaige Company is contemplating the acquisition of a machine that costs $50,000 and promises to reduce annual cash operating costs by $11,000 over each of the next six years. Which of the following is a proper way to evaluate this investment if the company desires a 12% return on all investments? Select one: a. $50,000 versus -$11,000 × 6. b. $50,000 versus -$66,000 × 0.507. c. $50,000 versus -$66,000 × 4.111. d. $50,000 versus -$11,000 × 4.111. e. $50,000 × 0.893 versus -$11,000 × 4.111.arrow_forwardLichen Plc owns a machine that has a carrying value amount of $85,000 at the year-end of 31 March 2023. Its market value is $78,000 and costs of disposal are estimated at $2,500. A new machine would cost $150,000. Lichen Plc expects it to produce net cash flows of $30,000 per annum for the next three years. The cost of capital of Lichen Plc is 8%. Required: What is the impairment loss on the machine to be recognised in the financial statements at 31 March 2023 (Enter your answer to the nearest whole $).arrow_forward

- Riordan Manufacturing is considering an investment in new equipment that will produce equal annual cash flows of $52,000 for 8 years and has a net present value of $94,182. The initial investment is $247,000, the useful life is 8 years, and the equipment's salvage value after 8 years is $26,000. What is the equipment's profitability index? Round your answer to two decimal places. 6.56 1.38 4.75 1.81arrow_forwardOne year ago, JK Mfg. deposited $20,839 in an investment account for the purpose of buying new equipment four years from today. Today, it is adding another $22872 to this account. The company plans on making a final deposit of $20,217 to the account one year from today. How much will be available when it is ready to buy the equipment, assuming the company earns 10.91% APR on its invest funds?arrow_forwardThe Podrasky Corporation is considering a $250 million expansion (capital expenditure) program next year. The company currently has $400 million in net fixed assets on its books. Next year, the company expects to earn $70 million after interest and taxes. The company also expects to maintain its present level of dividends, which is $20 million. If the expansion program is accepted, the company expects its inventory and accounts receivable each to increase by approximately $25 million next year. Long-term debt retirement obligations total $9 million for next year, and depreciation is expected to be $75 million. The company does not expect to sell any fixed assets next year. The company maintains a cash balance of $5 million, which is sufficient for its present operations. If the expansion is accepted, the company feels it should increase its year-end cash balance to $7 million because of the increased level of activities. For planning purposes, assume no other cash flow changes for next…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education