FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

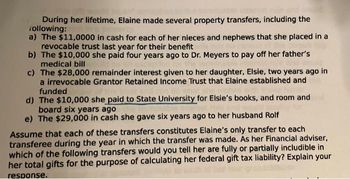

Transcribed Image Text:During her lifetime, Elaine made several property transfers, including the

following:

a) The $11,0000 in cash for each of her nieces and nephews that she placed in a

revocable trust last year for their benefit

b) The $10,000 she paid four years ago to Dr. Meyers to pay off her father's

medical bill

c) The $28,000 remainder interest given to her daughter, Elsie, two years ago in

a irrevocable Grantor Retained Income Trust that Elaine established and

funded

d) The $10,000 she paid to State University for Elsie's books, and room and

board six years ago

e) The $29,000 in cash she gave six years ago to her husband Rolf

Assume that each of these transfers constitutes Elaine's only transfer to each

transferee during the year in which the transfer was made. As her Financial adviser,

which of the following transfers would you tell her are fully or partially includible in

her total gifts for the purpose of calculating her federal gift tax liability? Explain your

response.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Several years ago, Georgia transferred $500,000 of real estate into an irrevocable trust for her son, Lee. The trustee was directed to retain income until Lee's 21st birthday and then pay him the corpus of the trust. Georgia retained the power to require the trustee to pay income to Lee at any time and the right to the assets if Lee predeceased her. What amount of the trust, if any, will be included in Georgia's estate if she dies this year when the value of the real estate in trust is $700,000? Amount to be included in Georgia's estatearrow_forwardDiego is a single individual who owns a life insurance policy worth $1.54 million that will be worth $8 million upon his death. This year Diego transferred the policy and all incidents of ownership to an irrevocable trust that pays income annually to Diego's two children for 15 years and then distributes the corpus to the children in equal shares. Assume that Diego has made only one prior taxable gift of $12 million in January of 2018. (Refer to Exhibit 25-1 and Exhibit 25-2.) Required: a. Calculate the amount of gift tax due (if any) on the transfer of the insurance policy. b. Diego died unexpectedly this year after transferring the policy. At the time of death, Diego's probate estate was $25 million, to be divided in equal shares between Diego's two children. Calculate the amount of cumulative taxable transfers for estate tax purposes. Note: For all requirements, enter your answers in dollars and not in millions of dollars. a. Amount of gift tax b. Amount of cumulative taxable…arrow_forwardHarold and Maude were married and lived in a common-law state. Maude died in 2018 with a taxable estate of $26.00 million and left it all to Harold. Maude's executor filed a timely estate tax return claiming the marital deduction for the property left to Harold including a valid portability election. Harold died this year, leaving the entire $26.00 million to their three children. (Refer to Exhibit 25- 1 and Exhibit 25-2.) Calculate how much estate tax is due from Harold's estate under the following two alternatives. a. Assume that neither Harold nor Maude had made any taxable gifts prior to this year. b. Assume that Harold and Maude each made a $1 million taxable gift in 2011 and offset the gift tax at that time with the applicable credit. Estate tax if no taxable gifts were made Estate tax if taxable gifts were made $ 5,928,000 $ 0arrow_forward

- Mr. Jackson died on June 19 when the total FMV of his property was $23 million and his debts totaled $2.789 million. His executor paid $23,000 funeral expenses and $172,000 accounting and legal fees to settle the estate. Mr. Jackson bequeathed $500,000 to the First Lutheran Church of Milwaukee and $1 million to Western Wisconsin College. He bequeathed his art collection (FMV $6.4 million) to his wife and the residual of his estate to his three children. Assume that Mr. Jackson made a substantial gift in 2011 and used $5 million of his lifetime transfer tax exclusion to reduce the amount on which gift tax was owed to zero, compute the estate tax payable on Mr. Jackson’s estate. a. $2,766,400 b. $2,366,400 c. $2,966,400 d. $3,482,000arrow_forwardnarrow_forwardThe terms of a will currently undergoing probate are: “A gift to my brother Chris of $40,000 cash; to my son Eric, $75,000 from my Redstone Savings Bank account; and to my daughter Lauryn, all of my remaining property.” At the time of death, the balance in the savings account was $60,000, and there was additional cash (after payment of funeral expenses and all claims against the estate) of $95,000. The gift to Chris is aarrow_forward

- The Bell Family Trust (Bell Trust) was established by Mr. Bell for the purposes of the education and wellbeing of his family. In the last financial year Emma (aged 37) as Trustee made distributions from the trust account to herself, John (aged 20) and Edward (aged 17) under her discretion as trustee. Emma reports to you, her tax advisor, the following information: Distributions Emma $145,000 John $105,000 Edward $80,000 Retained in trust $10,000 Additional information: Emma works as a Social Media consultant and also had $150,000 in salary and $12,500 in work related expenses. John is a fulltime university student with no other income. Edward attends a private boarding school. $75,000 of his trust distribution pays his school fees. Explain the tax obligations for Emma, John, Edward and the undistributed income retained in the trust account?arrow_forwardMany years ago James and Sergio purchased property for $945,000. Although they are listed as equal co-owners, Sergio was able to provide only $420,000 of the purchase price. James treated the additional $52,500 of his contribution to the purchase price as a gift to Sergio. Required: If the property is worth $1,134,000 at Sergio's death, what amount would be included in Sergio's estate if the title to the property was tenants in common? What if the title was joint tenancy with right of survivorship? (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) Amount to be included in Sergio's estate if: Title to the property was tenants in common Title to the property were joint tenancy with right of survivorshiparrow_forwardWhen Jacob Kohler died unmarried in 2015, he left an estate valued at 7,900,000. His trust directed distribution as follows: $19,000 to the local hospital, $150,000 to his alma mater, and the remainder to his 3 children. Death-related costs and expenses were $15,100 for funeral, $30,000 paid to attorneys, $6,500 paid to accountants, and $35,000 paid to the trustee of his living trust. In addition, debts of $115,000. Calculate the federal estate tax due on his estate.arrow_forward

- Cora, 79, has an estate that includes her personal residence valued at $120,000 and $18,000 in a bank account that is solely in her name. She would like to arrange her estate so that she maintains exclusive control of the assets during her lifetime, but at her death the assets will pass to her friend, Mabel, outside of probate. Based on Cora's goals and situation, which of the following are correct statements about will substitutes that she could use? She should put her bank account in tenancy in common with Mabel. She should title her personal residence in joint tenancy with her friend, Mabel. She should execute a will that names her friend, Mabel, as the legatee of the bank account and the devisee of the personal residence. She should place the bank funds in a payable on death (POD) account with Mabel as beneficiary. She should change the title on her personal residence to indicate a life estate reserved for her lifetime and a remainder to her friend, Mabel. A)IV and V…arrow_forwardBob died with a gross estate of $4,500,000, half of which is attributable to the value of stock in Graystone Inc., a closely held corporation. Bob owns 80% of Graystone Inc. He had no debts, and his estate administrative expenses were $50,000, of which $10,000 constitutes the personal representative's statutory fee. His will named his wife, Pearl, as the sole beneficiary of his estate and as his personal representative. Bob made no lifetime taxable gifts. Which of the following postmortem techniques are available and advisable for Bob's estate or its sole beneficiary, Pearl? Election of Section 6166 payment of estate taxes Use of the alternate valuation date Waiver by Pearl of the right to her statutory fee as personal representative Election of a Section 303 stock redemption A) III and IV B) II only C) I and II D) I, III, and IVarrow_forwardThis year Carla received corporate stock worth $35,000 as a gift from her grandfather. Her grandfather originally had purchased the stock in 2012 at a cost of $20,000. No gift taxes were paid on the transfer. Three months after receiving the stock. Carla sold it for $32,000. What are the amount and character of gain or loss recognized by Carla on this transaction?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education