FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

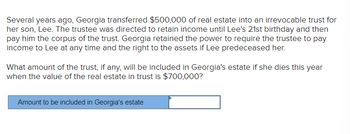

Transcribed Image Text:Several years ago, Georgia transferred $500,000 of real estate into an irrevocable trust for

her son, Lee. The trustee was directed to retain income until Lee's 21st birthday and then

pay him the corpus of the trust. Georgia retained the power to require the trustee to pay

income to Lee at any time and the right to the assets if Lee predeceased her.

What amount of the trust, if any, will be included in Georgia's estate if she dies this year

when the value of the real estate in trust is $700,000?

Amount to be included in Georgia's estate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In 2017, Sandra gifted stock to her son, Eddy. Sandra originally purchased the stock for $45,000. At the date of gift, the stock had a fair market value of $32,000. In 2023, Eddy sold the stock for $27,000. What is Eddy's basis for determining his gain or loss on the sale of the stock?arrow_forwardLast year Robert transferred a life insurance policy worth $470,000 to an irrevocable trust with directions to distribute the corpus of the trust to a grandson, Danny, upon graduation from college, or to Danny's estate upon death. Robert paid $41,000 of gift tax on the transfer of the policy. Early this year, Robert died, and the insurance company paid $4.2 million to the trust. What amount, if any, is included in Robert's gross estate? Note: Enter your answers in dollars, not millions of dollars. Amount to be included in Robert's gross estatearrow_forwardV1arrow_forward

- Cora, 79, has an estate that includes her personal residence valued at $120,000 and $18,000 in a bank account that is solely in her name. She would like to arrange her estate so that she maintains exclusive control of the assets during her lifetime, but at her death the assets will pass to her friend, Mabel, outside of probate. Based on Cora's goals and situation, which of the following are correct statements about will substitutes that she could use? She should put her bank account in tenancy in common with Mabel. She should title her personal residence in joint tenancy with her friend, Mabel. She should execute a will that names her friend, Mabel, as the legatee of the bank account and the devisee of the personal residence. She should place the bank funds in a payable on death (POD) account with Mabel as beneficiary. She should change the title on her personal residence to indicate a life estate reserved for her lifetime and a remainder to her friend, Mabel. A)IV and V…arrow_forwardIn 2021, Alejandro made a gift of $4,000,000 to each of his three sons in 2021. He has made no previous gifts. What is the amount of his taxable gifts and the gift tax?arrow_forwardAn individual died on June 30, 2020. On that date, they owned marketable securities worth $100,000 and an adjusted cost base (ACB) of $40,000; and an unmatured registered retirement savings plan (RRSP) of $250,000. Up to the date of death, they received interest income of $8,000 and salary income of $35,000. By the terms of the will the securities were given to the son and the RRSP to the spouse. How much would be reported in the deceased’s income for 2020?arrow_forward

- For tax year 2020: George and Nancy were husband and wife. At the time of George's death, they owned the following: land as tenants by the entirety worth $500,000 (purchased by George) and stock as equal tenants in common worth $30,000 (purchased by Nancy). George owned an insurance policy on his life (maturity value of $800,000) with Nancy as the designated beneficiary. George's will passes all his property to Nancy. How much marital deduction is allowed George's estate?arrow_forwardIf you were to become an executor of my estate, how would you value my prized Pete Rose rookie card in mint condition? Would you sell it? Would you give it to my heirs?arrow_forwardPenny and Mary Hardaway are married and live in Tennessee, a common-law state. For the holidays in 2023 , Mary gave cash gifts of $40,500 to each of her two sons, and Penny gave $40,600to his daughter. What is the amount of Mary's taxable gifts if Penny and Mary opt to gift-split? Multiple Choice $40,500 $70,500 $9,800 $6,500 None of the choices are correct.arrow_forward

- Your 80-year-old uncle has an estate valued at over $10 million and asked for your advice regarding how to make sure that each of his heirs receive certain assets and that estate taxes are minimized. What steps would you recommend? Be sure to address such issues as wills, trusts, gifting, and probate.arrow_forwardIn 2019, Joshua gave $12,500 worth of Microsoft stock to his son. In 2020, the Microsoft shares were worth $22,500. What was the gift tax in 2019? The gift tax exemption in 2019 was the same as in 2020. Gift taxarrow_forwardWalter owns a whole-life insurance policy worth $55,800 that directs the insurance company to pay the beneficiary $251,000 on Walter's death. Walter pays the annual premiums and has the power to designate the beneficiary of the policy (it is currently his son, James). Required: What value of the policy, if any, will be included in Walter's estate upon his death? Value of policyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education