FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

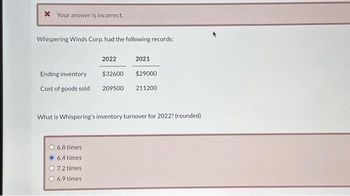

Transcribed Image Text:* Your answer is incorrect.

Whispering Winds Corp. had the following records:

Ending inventory

Cost of goods sold

6.8 times

6.4 times

2021

What is Whispering's inventory turnover for 2022?(rounded)

O 7.2 times

6.9 times:

2022

$32600

$29000

209500 211200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- SOLVE BOTH QUESTIONSarrow_forwardSuppose this information is available for PepsiCo, Inc. for 2020, 2021, and 2022. (c) (in millions) Beginning inventory Ending inventory Cost of goods sold Sales revenue (a) Inventory turnover ratio Your answer is correct. Inventory turnover ratio 2020 Days in inventory $116,000 317,500 895,000 1,120,000 1,595,500 1,195,000 eTextbook and Medial Calculate the inventory turnover for 2020, 2021, and 2022. (Round answers to 1 decimal places, e.g. 15.2.) Gross profit rate 2020 2021 2020 $317,500 2020 410,500 Calculate the inventory turnover for 2020, 2021, and 2022. (Round answers to 1 decimal places, e.g. 15.2.) 4.1 times 4.1 times 2020 2022 89 days $410,500 476,500 1,297,500 1,894,000 Calculate the days in inventory for 2020, 2021, and 2022. (Round answers to 1 decimal places, e.g. 15.2.) 2021 % 2021 3.1 times. 2021 3.1 Calculate the gross profit rate for 2020, 2021, and 2022. (Round answers to 1 decimal places, e.g. 15.2 %) 2021 times 117 days 2022 2022 2022 2022 125 2.9 2.9 times times…arrow_forwardCaterpillar Inc (CAT) has the following excerpts from their financial statements December 31, 2021 December 31, 2020 Inventory (in $ Millions) 14,038 11,402 Net Income(in $ Millions) 6,489 2,998 Inventories are principally determined using the last-in, first-out (LIFO) method. The value of inventories on the LIFO basis. If the FIFO (first-in, first-out) method had been in use, inventories would have been $3,258 million and $2,921 million higher than reported at December 31, 2021 and 2020, respectively. Assume corporate tax rate of 21%. If CAT had used FIFO method instead of LIFO method What inventory (in $ Millions) would CAT report for 2021? What net income (profit) would CAT report in 2021? What is the cumulative amount of income tax savings that CAT generated through end of 2021 by using LIFO instead of FIFO? What…arrow_forward

- Solve incorrect answersarrow_forwardComplete the missing piece of information involving the changes in inventory, and their relationship to goods available for sale, for the two years shown: 2021 2022 Beginning inventory 10,000 7,000 Purchases 25,000 3,000 Goods available for sale 35,000 ? Ending inventory 7,000 ? Cost of goods sold ? 8,500arrow_forwardSuppose this information is available for PepsiCo, Inc. for 2020, 2021, and 2022. (in millions) Beginning inventory Ending inventory Cost of goods sold Sales revenue (a) 2020 Inventory turnover $1,700 2,200 15,015 38,600 2021 $2,200 $2,500 2,500 2022 45,100 2020 17,860 17,595 2,600 Calculate the inventory turnover for 2020, 2021, and 2022. (Round inventory turnover to 1 decimal place, e.g. 5.1.) 45,000 times 2021 times 2022 timesarrow_forward

- Presented below is information related to Kingbird, Inc. End-of-Year Inventory Price Date (End-of-Year Prices) Index December 31, 2017 $ 1,200,000 100 December 31, 2018 1,522,500 105 December 31, 2019 1,562,000 110 December 31, 2020 1,813,500 117 Compute the ending inventory for Kingbird, Inc. for 2017 through 2020 using the dollar-value LIFO method. Ending Inventory 2017 2018 2019 2020 $ %24 %24arrow_forwardPresented below is information related to Sheffield Company. December 31, 2022 December 31, 2023 December 31, 2024 December 31, 2025 December 31, 2026 December 31, 2027 2022 2023 2024 2025 Date 2026 2027 Ending Inventory (End-of-Year Prices) $ $82,100 117,104 114,835 129,516 154,985 183,168 Compute the ending inventory for Sheffield Company for 2022 through 2027 using the dollar-value LIFO method. Price Index Ending Inventory 100 104 119 129 139 144arrow_forwardNonearrow_forward

- Current Attempt in Progress Marigold Inc. uses a perpetual inventory system. At January 1, 2025, inventory was $368,080 at both cost and net realizable value. At December 31, 2025, the inventory was $491,920 at cost and $455,800 at net realizable value. Prepare the entry under (a) the cost-of-goods-sold method and (b) the loss method. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation (a) (b) e Textbook and Media List of Accounts Save for Later Debit Credit Attempts: 1 of 3 used Submit Answerarrow_forwardSagararrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education